Guest Blogger: Paul Lesieur is a 203K consultant/contractor and writer within our industry. If you are interested in learning more about the 203K opportunity you can go to his websites www.203kloanmn.com and 203kcontractor. There you can also find some links to the HUD website where you can learn more.

Success Guide For Contractors Seeking To Do 203K Loan Work

To do a successful quote for a 203K loan you must write a detailed line item bid, you should do this anyway but what works best is to break out your costs.

To do a successful quote for a 203K loan you must write a detailed line item bid, you should do this anyway but what works best is to break out your costs.

Here are some examples of how to write specs into your bid:

- 1000SF of 3 tab asphalt roofing @ $1.26SF for materials is $1260 and $1.86SF for labor is $1860 to total $3120.00.

- Or remove old washer and dryer and install owner’s new appliances for 2 @ $120ea labor to install for $240.00.

- Remove 80SF of sidewalk and replace with 80SF of new concrete sidewalk @ $20.00 a SF = $1600.00

The better you detail the better chance you get the job and make money. On the Streamline 203K your bid is checked by the lender who likes to see details. The bank will not accept a bid that says simply "Paint house $5000" or "Reroof house $8000". When I am the 203K consultant and get this kind of bid from a contractor I disallow it.

Successfully Pricing and Getting Paid When Involved With A Full 203K Loan Project

A full 203K loan uses the services of a 203K consultant. The consultant writes up a scope of repairs which always includes the minimum health and safety requirements of the FHA. After the minimum standards are called out the homeowner can add anything they want as long as their loan is approved for that amount. NEVER do your bid before the consultant does the work write up, you will probably end up doing it again when the appraiser gets done. The consultant does a scope with prices attached and then you bid using his mandatory items and the homeowners’ desired items.

You the contractor then bid the job.

Pricing is what the market will bear. I have thrown out bids that were too low, and occasionally items that were too high. So charge what you need to be profitable and assume everything is negotiable just like any other job.

Your first draw can be called whenever you feel you want some money.

The consultant then inspects and approves your completed work. If you are installing vinyl windows at $1000 each and I get there and five are installed I will allow payment for five windows or $5000. The five windows you say you will do after lunch don't count and the fact they are sitting in the living room means nothing to the bank. These draws (up to 5 are allowed) cost the homeowner $150 to $250 each, so we try to use them to the best effect. If you run out of money consultants will do more draws but the consultant will get a check from you the contractor when he visits.

The consultant then inspects and approves your completed work. If you are installing vinyl windows at $1000 each and I get there and five are installed I will allow payment for five windows or $5000. The five windows you say you will do after lunch don't count and the fact they are sitting in the living room means nothing to the bank. These draws (up to 5 are allowed) cost the homeowner $150 to $250 each, so we try to use them to the best effect. If you run out of money consultants will do more draws but the consultant will get a check from you the contractor when he visits.

You will get paid!

No payments are disbursed unless you show proof of permits.

No payments are disbursed unless you show proof of permits.- On a streamline 203k which is under $35,000 you will get 30 to 50% down and the rest after the project is complete. The Streamline 203K allows for 2 payments.

- The Full 203K which can go up to $365,000 or higher allows no down payments. This means you need to be strong enough to operate until the first draw.

- All draws are subject to a 10% holdback which is released 30 or 35 days after the last draw.

- It takes on average 7 to 10 days to get a check which is mailed to the homeowner with your name and theirs on it.

Change orders

Change orders are allowed and are most often used for upgrades by the homeowner or hidden conditions. If you mis-measured you’re out of luck, HUD does not pay for your mistakes. Get detailed or stay away from these jobs.

This type of work goes best when you are part of a team that knows what they are doing and as a 203K consultant I find you can't always count on that being the case. Educate your buyer by being the answer person for their 203K.

Problems?

Problems that come up most often are inexperienced 203K consultants and inexperienced lenders new to selling 203K loans.

Also, homeowners who are first time home buyers who don't understand the difference between a $40,000 quote and one for $19,000 for what they think is the same scope of repairs. Educate your subs and clients and you will have fewer issues.

Regardless of the issues I have not had any problem large enough to make me want to leave this program. There is billions of dollars of work out there to fall under the 203K loan program and for any contractor willing to adapt a good opportunity is waiting.

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate?

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate? This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell.

This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell. First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use

First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use  If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year. A HUD/FHA 203k loan is an insured loan where one loan payment covers the purchase and remodel costs. The 203K has been around for years and is by owner occupants to purchase, repair, and renovate a home. Or, it can be used to refinance if you are looking to do a remodel on your existing home.

A HUD/FHA 203k loan is an insured loan where one loan payment covers the purchase and remodel costs. The 203K has been around for years and is by owner occupants to purchase, repair, and renovate a home. Or, it can be used to refinance if you are looking to do a remodel on your existing home. There are two types of 203K loans

There are two types of 203K loans This is a great loan with a lot of upside for contractors. The money is escrowed and it’s insured so you don't have to worry about a homeowner gambling it away at the bingo hall Friday night.

This is a great loan with a lot of upside for contractors. The money is escrowed and it’s insured so you don't have to worry about a homeowner gambling it away at the bingo hall Friday night.

At a recent Remodeler Summit event I participated in for

At a recent Remodeler Summit event I participated in for

At a tour of

At a tour of

Both examples above can help contractors earn more money in less time. Both examples offer ways contractors can get more work done without having to add any additional talents or skills to their crews. Both examples also eliminate or reduce the need to find and bring in sub contractors to do work the contractor’s own crews either don’t have the talents for or might not be cost effective at doing.

Both examples above can help contractors earn more money in less time. Both examples offer ways contractors can get more work done without having to add any additional talents or skills to their crews. Both examples also eliminate or reduce the need to find and bring in sub contractors to do work the contractor’s own crews either don’t have the talents for or might not be cost effective at doing.

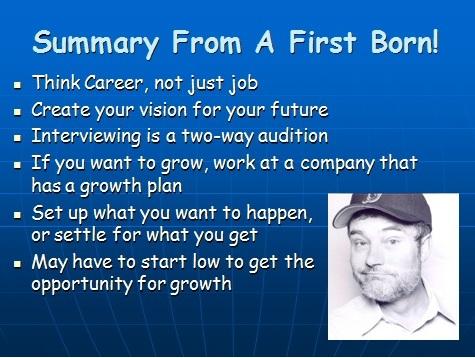

Below is a list of some of the considerations an aspiring carpenter might want to use when searching and interviewing for a new job and career opportunity. As part of my presentation I’ll be reviewing and discussing this list at the seminar. My hope is that by discussing these considerations attendees can determine whether they are working at the right company already, whether they should consider looking for a new company to work for, and how to evaluate the businesses they interview with.

Below is a list of some of the considerations an aspiring carpenter might want to use when searching and interviewing for a new job and career opportunity. As part of my presentation I’ll be reviewing and discussing this list at the seminar. My hope is that by discussing these considerations attendees can determine whether they are working at the right company already, whether they should consider looking for a new company to work for, and how to evaluate the businesses they interview with. Does the business have a financial budget for the year?

Does the business have a financial budget for the year? Does the business have an organizational chart you can look at?

Does the business have an organizational chart you can look at? Does the business plan to advance employees as it grows or hire to fill future positions?

Does the business plan to advance employees as it grows or hire to fill future positions? What are the goals of the owner; Practice vs. growing business?

What are the goals of the owner; Practice vs. growing business?

Make Your Opinion Known

Make Your Opinion Known

Several years ago I helped one of my remodeler coaching clients plan out how to offer and perform snow removal services. He called me because he realized there were a lot of things he should consider before just sending his guys out with there with shovels and axes. Below is a list of considerations from my coaching session notes created during my discussions with him. By sharing my notes my hope is that you will find them helpful, you will price the work for profit, you and your employees will be safer while performing the work, you can use the opportunity to create new customers and you will generate future work from those that hire you.

Several years ago I helped one of my remodeler coaching clients plan out how to offer and perform snow removal services. He called me because he realized there were a lot of things he should consider before just sending his guys out with there with shovels and axes. Below is a list of considerations from my coaching session notes created during my discussions with him. By sharing my notes my hope is that you will find them helpful, you will price the work for profit, you and your employees will be safer while performing the work, you can use the opportunity to create new customers and you will generate future work from those that hire you. Discussed properly equipping his employees to avoid risk and health problems. Confirmed he has fall protection equipment needed to meet OSHA requirements and employees know how to use it. Should try to do as much of the work as they can from the ground.

Discussed properly equipping his employees to avoid risk and health problems. Confirmed he has fall protection equipment needed to meet OSHA requirements and employees know how to use it. Should try to do as much of the work as they can from the ground. Look at the work as a good way to meet new clients. Because there might be more demand than he can service, be selective about who he will work for, make sure they fit within his target customer/location niche.

Look at the work as a good way to meet new clients. Because there might be more demand than he can service, be selective about who he will work for, make sure they fit within his target customer/location niche. Discourage use of Red Bull, maybe even coffee. Suggested hot chocolate and donuts.

Discourage use of Red Bull, maybe even coffee. Suggested hot chocolate and donuts.

Create your plan

Create your plan  Once I had become clear on the

Once I had become clear on the

Take this self quiz to see if a properly set up financial system would benefit you and your business:

Take this self quiz to see if a properly set up financial system would benefit you and your business:

The books in the list I offer below fall into the top five books I think remodelers should read if they want to grow a successful business and reduce the total time it takes to do so. More importantly, these books can help remodelers avoid the frustrations, wasted time and wasted money that come with the trial and error approach of going it alone as a business owner. Even if you still can’t build the business you want on your own after reading these books, you will definitely know what help you will need to get there

The books in the list I offer below fall into the top five books I think remodelers should read if they want to grow a successful business and reduce the total time it takes to do so. More importantly, these books can help remodelers avoid the frustrations, wasted time and wasted money that come with the trial and error approach of going it alone as a business owner. Even if you still can’t build the business you want on your own after reading these books, you will definitely know what help you will need to get there