3 Financial Strategies for a More Scalable Construction Business

As 2017 dawns, the outlook for the construction industry is optimistic. Despite setbacks experienced during the Great Recession, the industry is set to add 790,400 jobs over the decade of 2014 to 2024, accounting for the majority of new jobs in the goods-producing sector. Real output will grow 2.8 percent annually during this period. In 2017, total U.S. construction starts will increase 5 percent, reaching $713 billion, anticipates Dodge Data & Analytics.

As 2017 dawns, the outlook for the construction industry is optimistic. Despite setbacks experienced during the Great Recession, the industry is set to add 790,400 jobs over the decade of 2014 to 2024, accounting for the majority of new jobs in the goods-producing sector. Real output will grow 2.8 percent annually during this period. In 2017, total U.S. construction starts will increase 5 percent, reaching $713 billion, anticipates Dodge Data & Analytics.

For contractors, this is great news, but it also presents the challenge of scaling up to meet growing demand. Scaling up requires not only hiring more workers and buying more material, but also adjusting your financial strategy to cover your increased overhead expenses without hurting your cash flow and profits. Here are three financial strategies for successfully scaling up in 2017.

Scale up Revenue while Scaling Down Costs and Expenses

A scalable remodeling business model is designed to allow you to increase revenue while holding both job costs and overhead expenses down. To be scalable, your financial plan should aim for gross profit margins of 40 percent or more (minimum of a 1.67 markup).

To achieve this level of gross profit margin, one fundamental strategy is increasing your revenue. The key to increasing your revenue is improving your marketing and sales. One of the most efficient ways to improve your marketing is by improving your positioning through a better unique selling proposition (USP): a brief statement that summarizes what you offer customers that your competition doesn’t.

To achieve this level of gross profit margin, one fundamental strategy is increasing your revenue. The key to increasing your revenue is improving your marketing and sales. One of the most efficient ways to improve your marketing is by improving your positioning through a better unique selling proposition (USP): a brief statement that summarizes what you offer customers that your competition doesn’t.

To refine your USP, narrow down your ideal target market. For instance, is there a certain neighborhood or a certain type of building that would be more profitable to specialize in? Research what your target market is most seeking in a construction contractor. For example, are they price shoppers or are quality or service bigger priorities for them? Craft your USP to emphasize what your target market most values and make sure all your marketing material reflects your new USP.

Along with increasing your revenue, the other half of keeping a high profit margin is keeping expenses low. Many construction businesses fail because they can’t cover the cost of overhead. Finding ways to reduce the money you must pay for running your business is key to minimizing your expenses. Taking the time to research different organizational charts, industry best practices, project management methods, business management software and employee compensation strategies based on performance. Investing in these areas now can help your business reduce overhead through efficiency of operations as well as economy of scale as the business grows.

Maintain Efficiency through Automation

Another effective strategy to lower job costs is automation. Automation can help you lower the costs of materials by helping you plan more precisely to avoid unnecessary waste. J.E. Dunn has partnered with Autodesk and Microsoft to develop Lens, a cloud-based software tool that combines 3-D virtual modeling with instantly-calculated cost estimates for each component of your building project.

Another effective strategy to lower job costs is automation. Automation can help you lower the costs of materials by helping you plan more precisely to avoid unnecessary waste. J.E. Dunn has partnered with Autodesk and Microsoft to develop Lens, a cloud-based software tool that combines 3-D virtual modeling with instantly-calculated cost estimates for each component of your building project.

Although not common yet in residential remodeling, another way automation can help cut materials costs and waste is by using 3-D printing. 3-D printing allows you to select from a wider range of cost-efficient materials, while speeding up the building process. Last year, Chinese company Huashang Tengda was able to assemble a 3-D-printed house in just 45 days. Remember, many said nail guns would never catch on!

Keep Costs and Expenses Down with Outsourcing

Outsourcing is another proven way to cut labor costs both in the field as well as the office. Many successful large companies outside our industry have used outsourcing effectively to streamline their labor expenses. For instance, Google relies heavily on revenue from pay-per-click advertisers who pay to have their results featured in search engine rankings. Maintaining its advertising revenue requires a large sales support team, which Google has outsourced. Amway is another company that outsources its sales, relying on a distributor model to promote direct sales. In our industry many contractors already outsource activities such as design, engineering, building permit procurement, sales, lead intake and prequalification, RRP demo, specialty trades and even general carpentry.

Outsourcing is another proven way to cut labor costs both in the field as well as the office. Many successful large companies outside our industry have used outsourcing effectively to streamline their labor expenses. For instance, Google relies heavily on revenue from pay-per-click advertisers who pay to have their results featured in search engine rankings. Maintaining its advertising revenue requires a large sales support team, which Google has outsourced. Amway is another company that outsources its sales, relying on a distributor model to promote direct sales. In our industry many contractors already outsource activities such as design, engineering, building permit procurement, sales, lead intake and prequalification, RRP demo, specialty trades and even general carpentry.

As these examples illustrate, you can outsource functions that are part of your core business if it is more efficient to delegate them to specialists than to maintain in-house talent. For instance, there is no need to pay for the expense of in-house 3-D drafting when you can easily outsource it. With the right plan and system you can also easily outsource routine peripheral functions such as bookkeeping and payroll.

Are you pretending to be a remodeling business owner but in reality you are actually just a "job owner"? The questions below are tough and may make you feel real bad about yourself depending on how you answer them. But that’s not why I assembled them. Don’t kid yourself. If you are not cut out to be a business owner recognize that reality now. Don’t wait until you lose you all your money, your home and maybe even your family. If being in business is not your calling keep in mind the industry is desperate for good employees. Real remodeling business owners offer good jobs with great pay and benefits. Answering these questions might just be the best thing you do for yourself this year.

Are you pretending to be a remodeling business owner but in reality you are actually just a "job owner"? The questions below are tough and may make you feel real bad about yourself depending on how you answer them. But that’s not why I assembled them. Don’t kid yourself. If you are not cut out to be a business owner recognize that reality now. Don’t wait until you lose you all your money, your home and maybe even your family. If being in business is not your calling keep in mind the industry is desperate for good employees. Real remodeling business owners offer good jobs with great pay and benefits. Answering these questions might just be the best thing you do for yourself this year. Are you one of those business owners who doesn't know the difference between markup and margin, or worse you think they mean the same thing (WAG)?

Are you one of those business owners who doesn't know the difference between markup and margin, or worse you think they mean the same thing (WAG)?

Over 10 million Americans are independent contractors, according to the most recent estimates by the U.S. Department of Labor. Whether that means you do freelance work or have started your own company and hope to employ many people yourself one day, most independent contractors have one thing in common: they are learning as they go.

Over 10 million Americans are independent contractors, according to the most recent estimates by the U.S. Department of Labor. Whether that means you do freelance work or have started your own company and hope to employ many people yourself one day, most independent contractors have one thing in common: they are learning as they go. From office supplies to packing materials, the biggest waste of time and energy is buying things you knew you would need at the last minute and paying full retail price. If you’re a retailer, seek out wholesale options and buy in bulk for the maximum discount. Look into a Costco membership for any and all office supplies. Office furniture can also be found at the local thrift store, furniture rental company or hotel furniture liquidators for pennies on the dollar.

From office supplies to packing materials, the biggest waste of time and energy is buying things you knew you would need at the last minute and paying full retail price. If you’re a retailer, seek out wholesale options and buy in bulk for the maximum discount. Look into a Costco membership for any and all office supplies. Office furniture can also be found at the local thrift store, furniture rental company or hotel furniture liquidators for pennies on the dollar. But not even a lack of cash flow can stop you these days. With the popularity of crowdfunding, job placement services and Craigslist, there are outlets everywhere for the hard working, resourceful, independent contractor. Leave no stone unturned and check to see if you qualify for any

But not even a lack of cash flow can stop you these days. With the popularity of crowdfunding, job placement services and Craigslist, there are outlets everywhere for the hard working, resourceful, independent contractor. Leave no stone unturned and check to see if you qualify for any  Guest Blogger: Stacy Eden is a Phoenix, Arizona native with a passion for art, power tools, and historical significance. She draws inspiration from classic cars, ancient mythological sculptures and jewelry designers such as Delfina Delettrez, Shaun Leane, and Dior Jewellery creative director Victoire de Castellane.

Guest Blogger: Stacy Eden is a Phoenix, Arizona native with a passion for art, power tools, and historical significance. She draws inspiration from classic cars, ancient mythological sculptures and jewelry designers such as Delfina Delettrez, Shaun Leane, and Dior Jewellery creative director Victoire de Castellane. Builders, remodelers and lumber dealers often get in trouble with lumber framing packages by overlooking the obvious…the volatile lumber market. Most contractors and lumber dealers do not have the luxury of pricing a job today, signing it tomorrow and buying the required materials the next day. By the time a job is priced, signed and the lumber gets delivered to the jobsite 30, 60 or even 90 or more days may have passed and lumber prices may have changed as much as 20%. At the Estimating Workshops I did this concern comes up quite often and attendees often share how their profits are affected as a result.

Builders, remodelers and lumber dealers often get in trouble with lumber framing packages by overlooking the obvious…the volatile lumber market. Most contractors and lumber dealers do not have the luxury of pricing a job today, signing it tomorrow and buying the required materials the next day. By the time a job is priced, signed and the lumber gets delivered to the jobsite 30, 60 or even 90 or more days may have passed and lumber prices may have changed as much as 20%. At the Estimating Workshops I did this concern comes up quite often and attendees often share how their profits are affected as a result. He says some weeks do not change at all. However he also points out that 70% of the time they do change by an average 2.5% each week or 10% per month. Based on those realities a contractor who estimates a framing package using today’s lumber costs at $10,000 may end actually paying over $13,000 for that same package 90 days later. For those of you who understand how margins and markups work, not only will the contractor have lost the $3300 due to price increases, but also the gross profit margin on that difference. At a 50% markup that’s another $1650 of gross profit that could have been included in the sell price to help cover overhead and profit.

He says some weeks do not change at all. However he also points out that 70% of the time they do change by an average 2.5% each week or 10% per month. Based on those realities a contractor who estimates a framing package using today’s lumber costs at $10,000 may end actually paying over $13,000 for that same package 90 days later. For those of you who understand how margins and markups work, not only will the contractor have lost the $3300 due to price increases, but also the gross profit margin on that difference. At a 50% markup that’s another $1650 of gross profit that could have been included in the sell price to help cover overhead and profit.

When creating a project’s payment schedule use project milestones to determine when payments will become due. If when doing your estimate you list your tasks and related costs for each task in critical path order, you can then add up the marked up cost of each milestone’s tasks to make sure the amount collected for each payment will adequately finance each phase of the project. Then, add a little extra money to create a cushion of safety (front loading).

When creating a project’s payment schedule use project milestones to determine when payments will become due. If when doing your estimate you list your tasks and related costs for each task in critical path order, you can then add up the marked up cost of each milestone’s tasks to make sure the amount collected for each payment will adequately finance each phase of the project. Then, add a little extra money to create a cushion of safety (front loading). Also make it company policy that your contractor’s warranty starts at substantial completion of the project. Clarify however that no warranty work will be completed until the final project balance has been paid in full.

Also make it company policy that your contractor’s warranty starts at substantial completion of the project. Clarify however that no warranty work will be completed until the final project balance has been paid in full.

When you’re young and in perfect health, it seems stupid to waste money on insurance. There are so many more important (and fun) things to buy: trucks, tools, additional personnel; the list is endless. I remember when I fell off my roof, my life didn’t flash before my eyes, but I did have a very clear sequence of thoughts.

When you’re young and in perfect health, it seems stupid to waste money on insurance. There are so many more important (and fun) things to buy: trucks, tools, additional personnel; the list is endless. I remember when I fell off my roof, my life didn’t flash before my eyes, but I did have a very clear sequence of thoughts.

Learn more about your Balance Sheet, the often under-utilized and misunderstood financial report that can spell success or failure

Learn more about your Balance Sheet, the often under-utilized and misunderstood financial report that can spell success or failure

Collect the money needed to finance all of a milestone’s tasks before you start it (don’t be Wimpy on this!)

Collect the money needed to finance all of a milestone’s tasks before you start it (don’t be Wimpy on this!)

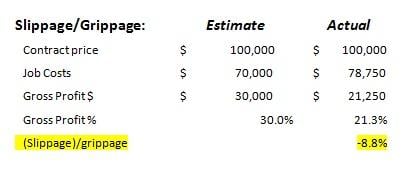

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

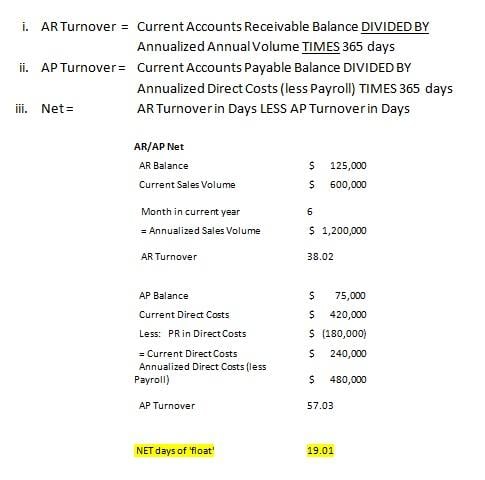

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due. Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Paying the bills for yesterday’s project using the deposit money from a job you haven’t started yet may seem to solve the cash flow problem; however it only temporarily puts off the eventual reality that you are buying jobs instead of selling them. Due to the recession many contractors discovered this reality when the new job deposits dried up and there was no money in the bank to pay the bills for work already completed.

Paying the bills for yesterday’s project using the deposit money from a job you haven’t started yet may seem to solve the cash flow problem; however it only temporarily puts off the eventual reality that you are buying jobs instead of selling them. Due to the recession many contractors discovered this reality when the new job deposits dried up and there was no money in the bank to pay the bills for work already completed.