How to Have a Hassle-Free Tax Season: 3 Tips for Small Business Owners

Small business owners usually cringe at the thought of tax season. They are busy enough with their daily operations that they don’t want to spend all of the time and energy getting ready to file on time. They also may dread of thought of paying more in taxes than they feel they should. While small business owners cannot avoid taxes altogether (even though they wish they could), they can take some steps now to avoid the hassles that typically come at tax time.

Small business owners usually cringe at the thought of tax season. They are busy enough with their daily operations that they don’t want to spend all of the time and energy getting ready to file on time. They also may dread of thought of paying more in taxes than they feel they should. While small business owners cannot avoid taxes altogether (even though they wish they could), they can take some steps now to avoid the hassles that typically come at tax time.

Consult Last Year’s Return

One of the best moves small business owners can make now to prepare for the upcoming tax season is to review last year’s return carefully. You may realize that you missed some deductions or expenses that you want to be sure to take advantage of this year. Or, you may realize that you underestimated this year’s taxes and need to start saving now.

On the other hand, if looking at last year’s return makes you feel completely overwhelmed, it’s time to invest in W-2 software and/or 1099 software tax software or hire an accountant or tax lawyer who specializes in small business taxes. Sometimes it’s better to admit defeat and utilize the tools and resources available to you and leave the hassle to someone else. It’s also important to note that it’s not advisable to wait to consult with a tax attorney or hire an accountant. These professionals become swamped after the first of the year and may not be able to schedule an appointment with you if you wait too long to reach out for help.

Have Your Records in Order

Even if you are diligent about keeping receipts, a tax organizer or tax diary is a must. It’s also critical that small business owners keep their expense logs separate from their tax organizers, especially because high-quality tax organizers cover all of the questions the IRS will want answers to regarding travel, entertainment, and expenses should you be audited. Small business owners who keep tax organizers are better protected if they are audited because the burden of proof rests on the IRS when they have all of their expenses and taxes in order and logged properly.

Even if you are diligent about keeping receipts, a tax organizer or tax diary is a must. It’s also critical that small business owners keep their expense logs separate from their tax organizers, especially because high-quality tax organizers cover all of the questions the IRS will want answers to regarding travel, entertainment, and expenses should you be audited. Small business owners who keep tax organizers are better protected if they are audited because the burden of proof rests on the IRS when they have all of their expenses and taxes in order and logged properly.

Be Diligent about Deductions and Expenses

While you are keeping your records in order, you need to be diligent about it. Taking legitimate deductions is one of the best ways to lower your tax liability, but without the proper documentation, it is difficult to take the deductions and arm yourself should auditors come calling. It’s also a good idea to decide now whether you are taking the home office deduction or not; if you have a dedicated space in your home where you conduct business and nothing else, you are entitled to the home office deduction. You’ll also have to decide whether you are going to calculate this deduction using the standard method of calculating square feet and adding up costs for rent or a mortgage and utilities before multiplying by the percentage of the home that you use as an office or the new method of taking a deduction of $5 per square foot of office space.

Categorizing expenses as equipment instead of supplies can cause a lot of headaches when it comes time to file your taxes. Keep in mind that supplies are things that you use during the year and replenish frequently, such as printer paper, pens, staples, file folders, and printer ink. On the other hand, equipment typically includes items that are more expensive and that last longer than a year. Equipment usually includes computers, software, furniture, and servers. You also should decide now whether you are going to write off the whole cost of new equipment this year or take depreciation over several years.

Categorizing expenses as equipment instead of supplies can cause a lot of headaches when it comes time to file your taxes. Keep in mind that supplies are things that you use during the year and replenish frequently, such as printer paper, pens, staples, file folders, and printer ink. On the other hand, equipment typically includes items that are more expensive and that last longer than a year. Equipment usually includes computers, software, furniture, and servers. You also should decide now whether you are going to write off the whole cost of new equipment this year or take depreciation over several years.

As a small business owner, you have the power to make your tax season hassle free if you learn from past years and take advantage of available tools and resources, have complete records in place, and correctly categorize deductions and expenses.

Guest Blogger: Julie Morris

Are you pretending to be a remodeling business owner but in reality you are actually just a "job owner"? The questions below are tough and may make you feel real bad about yourself depending on how you answer them. But that’s not why I assembled them. Don’t kid yourself. If you are not cut out to be a business owner recognize that reality now. Don’t wait until you lose you all your money, your home and maybe even your family. If being in business is not your calling keep in mind the industry is desperate for good employees. Real remodeling business owners offer good jobs with great pay and benefits. Answering these questions might just be the best thing you do for yourself this year.

Are you pretending to be a remodeling business owner but in reality you are actually just a "job owner"? The questions below are tough and may make you feel real bad about yourself depending on how you answer them. But that’s not why I assembled them. Don’t kid yourself. If you are not cut out to be a business owner recognize that reality now. Don’t wait until you lose you all your money, your home and maybe even your family. If being in business is not your calling keep in mind the industry is desperate for good employees. Real remodeling business owners offer good jobs with great pay and benefits. Answering these questions might just be the best thing you do for yourself this year. Are you one of those business owners who doesn't know the difference between markup and margin, or worse you think they mean the same thing (WAG)?

Are you one of those business owners who doesn't know the difference between markup and margin, or worse you think they mean the same thing (WAG)?

Many contractors are using what are refer to as 1099 workers to avoid employee and payroll related administrative responsibilities and financial costs. Some use this tactic to reduce their costs to help win bids and or make more money. If you never get caught you may feel or believe it was worth it. On the other hand if you get caught, whether you knew what you were doing was illegal or you really believed what you were doing was OK, the financial and litigation related costs can kill your business. The chance of this happening has dramatically increased in certain areas of the country because Washington is offering money to states to help them do so. Read on to find out about what is already happening in Virginia.

Many contractors are using what are refer to as 1099 workers to avoid employee and payroll related administrative responsibilities and financial costs. Some use this tactic to reduce their costs to help win bids and or make more money. If you never get caught you may feel or believe it was worth it. On the other hand if you get caught, whether you knew what you were doing was illegal or you really believed what you were doing was OK, the financial and litigation related costs can kill your business. The chance of this happening has dramatically increased in certain areas of the country because Washington is offering money to states to help them do so. Read on to find out about what is already happening in Virginia. That means you have to pay up on any fines, at their full rate (anywhere from $7K to 70K per violation) right away. Then you have to decide if you are willing to wait for your legal case to make it through a legal system sponsored by the same entity that is accusing your business.

That means you have to pay up on any fines, at their full rate (anywhere from $7K to 70K per violation) right away. Then you have to decide if you are willing to wait for your legal case to make it through a legal system sponsored by the same entity that is accusing your business.

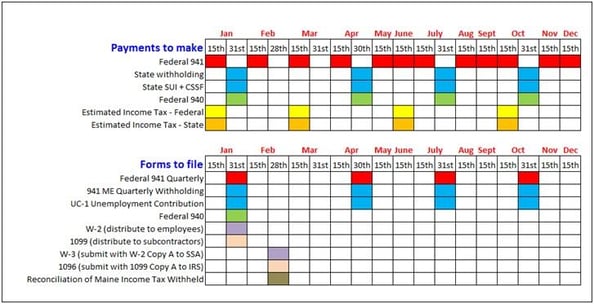

Payroll is complicated enough without having to worry about when to make payments and when to file which form to which government entity. I have many clients who are comfortable creating paychecks, but are nervous about missing payroll tax payments or filing forms late. A client recently asked if I couldn’t find a simple way to have reminders that would prompt him to do whatever had to be done. To help I created a simple “in your face” payroll reminder.

Payroll is complicated enough without having to worry about when to make payments and when to file which form to which government entity. I have many clients who are comfortable creating paychecks, but are nervous about missing payroll tax payments or filing forms late. A client recently asked if I couldn’t find a simple way to have reminders that would prompt him to do whatever had to be done. To help I created a simple “in your face” payroll reminder.

How to get it on your desktop

How to get it on your desktop