Getting Your Remodeling Business Ready to Produce More Work

Growth in consumer spending on remodeling during 2018, and beyond, is expected to skyrocket. This means that remodelers will have the opportunity to grow their businesses, and if done well; will make a lot of money. But is your business ready for the work? If you are already working too hard for too many hours will increasing volume just end up with you in divorce court and or on blood pressure medicine? Below I offer a vision, and some suggestions, for what you can do to be ready. If you already allowed yourself to get in too deep, then perhaps my suggestions can help you create a plan to get things running better than you had ever imagined.

Growth in consumer spending on remodeling during 2018, and beyond, is expected to skyrocket. This means that remodelers will have the opportunity to grow their businesses, and if done well; will make a lot of money. But is your business ready for the work? If you are already working too hard for too many hours will increasing volume just end up with you in divorce court and or on blood pressure medicine? Below I offer a vision, and some suggestions, for what you can do to be ready. If you already allowed yourself to get in too deep, then perhaps my suggestions can help you create a plan to get things running better than you had ever imagined.

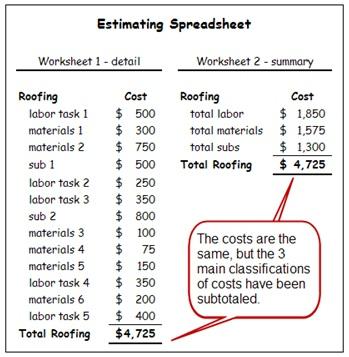

It all starts with estimating.

Estimating might as well be the center of the universe for remodeling contractors. Using a defined process and key information, your production team can conquer that universe. If you grow your business without an advanced estimating system you risk dropping into a financial black hole. Your estimating should not only help provide a profitable selling price, it should also create, document, and organize the information your production team needs to build independently, without constantly bothering you or your salespeople. Done well, it should also help you predict your cash flow needs, and therefore your payment schedules. This way every job finances itself using your clients' money to pay bills on time, not yours. Successful estimating will also help your production team identify and schedule all the resources needed to complete the project weeks, or even months, before they are actually needed at the job site.

A real estimating system includes job costing.

First, an estimate is not  what you give to a prospective client. That is called a price. The estimate is really the contractor's best guess on what the project will cost their business to complete before overhead and profit are added. That's right, it’s just a guess. To continuously improve the accuracy of that guess, particularly as your business is exposed to new products and construction methods, or brings on new untested employees, job costing will be the only way to reduce the risks of estimating. Imagine going six months or a whole year before realizing you were using inaccurate information. Imagine the benefits of offering profit sharing if your team brings jobs in on budget. But, what if your budgets are never adequate and there are no profits to share, and when your employees ask why you can't tell them?

what you give to a prospective client. That is called a price. The estimate is really the contractor's best guess on what the project will cost their business to complete before overhead and profit are added. That's right, it’s just a guess. To continuously improve the accuracy of that guess, particularly as your business is exposed to new products and construction methods, or brings on new untested employees, job costing will be the only way to reduce the risks of estimating. Imagine going six months or a whole year before realizing you were using inaccurate information. Imagine the benefits of offering profit sharing if your team brings jobs in on budget. But, what if your budgets are never adequate and there are no profits to share, and when your employees ask why you can't tell them?

This all requires a well set up financial system.

Even if you are a good estimator and you never miss any of the sticks and bricks, if you do not know which labor rate and markup to use you may be buying jobs instead of selling them. Without a well thought out list of estimating and matching time card work categories (sometimes referred to as phases), you will never know how well your team did compared to your estimated labor assumptions in specific areas. Also, without the right time card categories, how will you know and or confirm how many non-billable hours of pay you will need to add to, and cover, inside the burden labor rate you assume and charge for their billable hours?

Even if you are a good estimator and you never miss any of the sticks and bricks, if you do not know which labor rate and markup to use you may be buying jobs instead of selling them. Without a well thought out list of estimating and matching time card work categories (sometimes referred to as phases), you will never know how well your team did compared to your estimated labor assumptions in specific areas. Also, without the right time card categories, how will you know and or confirm how many non-billable hours of pay you will need to add to, and cover, inside the burden labor rate you assume and charge for their billable hours?

There are plenty of things to work on as you grow a remodeling business. However, if you don't get the estimating of your jobs right growing your business will just help you lose money faster.

Builders, remodelers and lumber dealers often get in trouble with lumber framing packages by overlooking the obvious…the volatile lumber market. Most contractors and lumber dealers do not have the luxury of pricing a job today, signing it tomorrow and buying the required materials the next day. By the time a job is priced, signed and the lumber gets delivered to the jobsite 30, 60 or even 90 or more days may have passed and lumber prices may have changed as much as 20%. At the Estimating Workshops I did this concern comes up quite often and attendees often share how their profits are affected as a result.

Builders, remodelers and lumber dealers often get in trouble with lumber framing packages by overlooking the obvious…the volatile lumber market. Most contractors and lumber dealers do not have the luxury of pricing a job today, signing it tomorrow and buying the required materials the next day. By the time a job is priced, signed and the lumber gets delivered to the jobsite 30, 60 or even 90 or more days may have passed and lumber prices may have changed as much as 20%. At the Estimating Workshops I did this concern comes up quite often and attendees often share how their profits are affected as a result. He says some weeks do not change at all. However he also points out that 70% of the time they do change by an average 2.5% each week or 10% per month. Based on those realities a contractor who estimates a framing package using today’s lumber costs at $10,000 may end actually paying over $13,000 for that same package 90 days later. For those of you who understand how margins and markups work, not only will the contractor have lost the $3300 due to price increases, but also the gross profit margin on that difference. At a 50% markup that’s another $1650 of gross profit that could have been included in the sell price to help cover overhead and profit.

He says some weeks do not change at all. However he also points out that 70% of the time they do change by an average 2.5% each week or 10% per month. Based on those realities a contractor who estimates a framing package using today’s lumber costs at $10,000 may end actually paying over $13,000 for that same package 90 days later. For those of you who understand how margins and markups work, not only will the contractor have lost the $3300 due to price increases, but also the gross profit margin on that difference. At a 50% markup that’s another $1650 of gross profit that could have been included in the sell price to help cover overhead and profit.

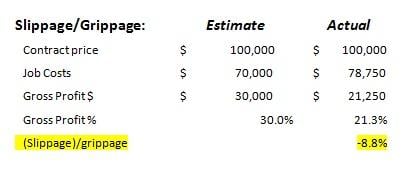

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

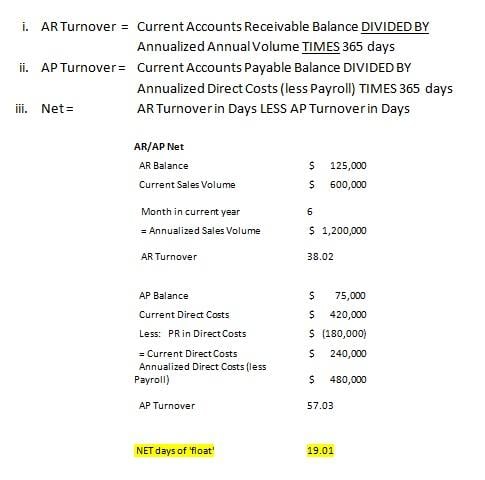

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems: Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems: