How to Update Your State Unemployment Rate in QuickBooks for 2015

For those of you running payroll through QuickBooks, it’s important to be sure that you start creating paychecks in 2015 using the correct state unemployment rate. Although QuickBooks is capable of correcting miscalculated numbers if you accidentally neglect to update the rate prior to running payroll in the new year, it’s cleaner to be sure it’s correct right from the start.

Why is this important?

Because this rate is specific to your company rather than being a state-wide rate, QuickBooks is unable to automatically correct this rate via a payroll download. That’s why you need to make the adjustment manually.

You should soon (or may have already) received notification from your state department of labor. In some states, this form can be somewhat confusing since there are multiple figures. Often, clients aren’t sure which rate to use or where to enter it in QuickBooks.

Where to enter in QuickBook

- Click Lists ⇒ Payroll Item List.

- Scroll down the list to find and select your state unemployment item. QuickBooks usually names it using the 2-letter state abbreviation followed by Unemployment Company (as in ME – Unemployment Company).

- Double-click to edit and click Next twice to bring you to the Company tax rates screen.

- If you make the change prior to 1/1/15, you will see your 2014 rates by quarter and will need to enter the new rate in the box at the bottom called Year 2015 For 1/1 – 3/31. If you wait until after 1/1/15 (but before creating any 2015 paychecks), you will be able to enter the rate into the fields for the four quarters.

- Click Next until you get to the screen with Finish on it. Click Finish and you’re done.

What to enter in QuickBooks

Use the rate you received from the state. Be careful since states that have multiple taxes that are “grouped” may report the individual taxes and then the total amount. If QuickBooks calculates the taxes separately, you must enter the tax rate for unemployment without accidentally entering a rate that reflects a combined rate for unemployment and something else.

Example: In Maine we have an additional Competitive Skills Scholarship Fund (CSSF) tax that is reported and paid along with unemployment. The rate update form in Maine provides the information broken out as follows:

- 2015 Final Unemployment Contribution Rate

- 2015 CSSF Assessment Rate

- Total Combined Assessment Rate for 2015

Because QuickBooks already tracks the CSSF rate separately, if your company were in Maine, you would need to enter the 2015 Final Unemployment Contribution Rate, not the Total Combined Assessment Rate.

For example, for 2015 my rates are as follows:

- 2015 Final Unemployment Contribution Rate = 1.54%

- 2015 CSSF Assessment Rate = .06%

- Total Combined Assessment Rate for 2015 = 1.60%

I will be using the 1.54% rate.

I hope that helps!

Examples of nonproductive time for carpenters

Examples of nonproductive time for carpenters

I was discussing the cost of labor the other day with a client, and he told me he really had a handle on what his costs were. “No kidding? That’s great,” I said. I then quizzed him on what factors he’d included, and was impressed that he’d gotten so many: wages; company-paid payroll taxes; Worker’s Comp; liability insurance; vehicles, cell phones, and small tools used by production workers; health insurance; retirement. “And what about non-productive time?” I asked. Puzzled, he asked me what I meant.

I was discussing the cost of labor the other day with a client, and he told me he really had a handle on what his costs were. “No kidding? That’s great,” I said. I then quizzed him on what factors he’d included, and was impressed that he’d gotten so many: wages; company-paid payroll taxes; Worker’s Comp; liability insurance; vehicles, cell phones, and small tools used by production workers; health insurance; retirement. “And what about non-productive time?” I asked. Puzzled, he asked me what I meant. Let’s do the math.

Let’s do the math.

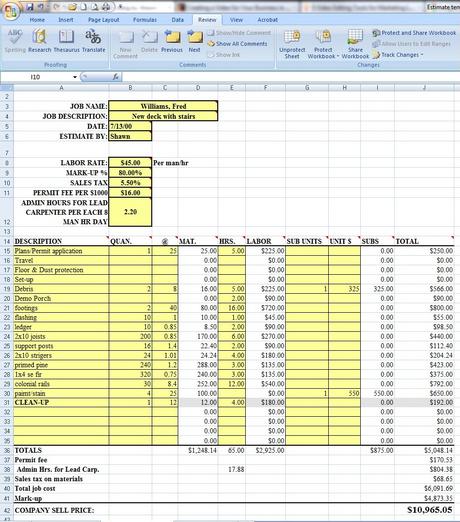

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate?

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate? This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell.

This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell. First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use

First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use  If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

At a recent Remodeler Summit event I participated in for

At a recent Remodeler Summit event I participated in for

At a tour of

At a tour of

Both examples above can help contractors earn more money in less time. Both examples offer ways contractors can get more work done without having to add any additional talents or skills to their crews. Both examples also eliminate or reduce the need to find and bring in sub contractors to do work the contractor’s own crews either don’t have the talents for or might not be cost effective at doing.

Both examples above can help contractors earn more money in less time. Both examples offer ways contractors can get more work done without having to add any additional talents or skills to their crews. Both examples also eliminate or reduce the need to find and bring in sub contractors to do work the contractor’s own crews either don’t have the talents for or might not be cost effective at doing.

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above.

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above. Labor cost is one of the most difficult costs to predict in an estimate. Basically, this cost is determined by calculating the hours required to complete a task or project and then factoring those estimated hours by what it costs your business per hour to compensate and support your field employees. The cost per hour to compensate and support your field employees is commonly called burdened labor costs or your burdened hourly rate.

Labor cost is one of the most difficult costs to predict in an estimate. Basically, this cost is determined by calculating the hours required to complete a task or project and then factoring those estimated hours by what it costs your business per hour to compensate and support your field employees. The cost per hour to compensate and support your field employees is commonly called burdened labor costs or your burdened hourly rate.

The hard cost of labor includes not only the hourly wage of the employee, but also all employer-paid taxes, Social Security, insurance, vehicle expenses, and any employee benefits. Workmen’s Compensation, liability insurance, auto insurance, paid holidays, vacations, medical benefits, education, employee meetings, cell phones, pagers, and every other labor-related expense must be factored into your hourly rates.

The hard cost of labor includes not only the hourly wage of the employee, but also all employer-paid taxes, Social Security, insurance, vehicle expenses, and any employee benefits. Workmen’s Compensation, liability insurance, auto insurance, paid holidays, vacations, medical benefits, education, employee meetings, cell phones, pagers, and every other labor-related expense must be factored into your hourly rates.  Knowing what to charge clients for the work you do is often the difference between long term success and eventual failure for the business. Many contractors look at estimating simply as a way to determine the cost of a project. In the traditional design-bid model of project delivery, this simplistic approach may work, assuming your sell price generates enough gross profit to cover your overhead and profit requirements. However, if you’re doing design/build, and your current estimating system is limited to only producing the number you charge clients for a project, you may be missing out on many other possible benefits.

Knowing what to charge clients for the work you do is often the difference between long term success and eventual failure for the business. Many contractors look at estimating simply as a way to determine the cost of a project. In the traditional design-bid model of project delivery, this simplistic approach may work, assuming your sell price generates enough gross profit to cover your overhead and profit requirements. However, if you’re doing design/build, and your current estimating system is limited to only producing the number you charge clients for a project, you may be missing out on many other possible benefits. If you think of Design/Build as a way of doing business, your estimating system must become a tool that facilitates how you do business, not just a way to get to the price. Here are several ways a Design/Builder or a remodeler can maximize the potential of the method and system used to do estimating:

If you think of Design/Build as a way of doing business, your estimating system must become a tool that facilitates how you do business, not just a way to get to the price. Here are several ways a Design/Builder or a remodeler can maximize the potential of the method and system used to do estimating:

Many expect Workers Compensation rates to increase significantly this year. The MA Workers Comp Rating and Inspection Bureau has recently applied for an average rate increase of 19.3%. According to the Insurance Journal, Commissioner Joseph Murphy will be holding a public meeting on March 30th on this request.

Many expect Workers Compensation rates to increase significantly this year. The MA Workers Comp Rating and Inspection Bureau has recently applied for an average rate increase of 19.3%. According to the Insurance Journal, Commissioner Joseph Murphy will be holding a public meeting on March 30th on this request.