Owning a business can be uniquely rewarding, but rewards do not come without risk. Perhaps the most dreaded of those risks is a lawsuit. While some contractors who get sued keep that worry in the back of their minds, others avoid thinking about legal issues altogether, or worse; they assume it can’t happen to them. But contractor law suits do happen. Often. While you can’t guarantee that you won’t be sued, you can prepare yourself by having a plan of action in the event of a lawsuit.

Here are the steps contractors should take if they get sued:

- Take notes about service of process. Each jurisdiction has rules governing service of process (how you were informed of the law suit). Take note on how you were served so that you or your lawyer can determine whether there are grounds to challenge service.

- DO NOT ignore the Complaint! Do not throw the Complaint in a drawer and try to forget about it. Failing to respond to a Complaint could result in default judgment against you or your company. The sooner you act, the more control you have over the situation.

- Review the Complaint. Read the Complaint to gather some basic information about the suit. Who filed the suit? Is the plaintiff suing your company, you, or both? Why has the plaintiff filed suit? How much money is the plaintiff demanding?

Contact a lawyer. Do not attempt to engage the plaintiff on your own. Contact an attorney experienced in construction law. Your attorney will help you analyze and understand your risks. If the amount in controversy is small, your attorney can advise you on how to best represent yourself. After consulting an attorney, you will be able to make an informed decision about how to proceed with the lawsuit.

Contact a lawyer. Do not attempt to engage the plaintiff on your own. Contact an attorney experienced in construction law. Your attorney will help you analyze and understand your risks. If the amount in controversy is small, your attorney can advise you on how to best represent yourself. After consulting an attorney, you will be able to make an informed decision about how to proceed with the lawsuit.- Contact your insurance company. If you think that you may have insurance coverage for the plaintiff’s claims, contact your insurance company immediately, since most insurance companies require prompt notification of the claim. Your attorney can also assist you in reviewing your policy and obtaining coverage.

- Collect and preserve documents: Collect all documents, photographs, correspondence, etc. (electronic or paper) related to the case so that you can review them with your lawyer. Do not delete or destroy anything. Hiding information from your lawyer can only hurt your case. You could also face severe sanctions from the court for destroying or withholding information during the case.

- Be careful who you speak to. Your conversations with your attorney are generally privileged. However, anything you say to a third party could make its way to the other side.

- Consider whether you can settle the case right now. The vast majority of lawsuits end in a settlement. Settling the case at an early stage can save a lot of cost and

You can’t guarantee that you won’t ever be sued but you can prepare yourself by having an action plan in the event of a lawsuit.

Note: This article is for informational purposes only and is not intended to serve as a substitute for consultation with a legal professional.

Guest Blogger: Renee Schwerdt, Esq., Owner/Attorney at Plumb & True Legal Consulting and Representation. Renee is an attorney and the owner of Plumb & True Legal, a law firm that serves contractors, architects, vendors and others in the construction industry. Her new blog, Level Up, is available here.

Guest Blogger: Renee Schwerdt, Esq., Owner/Attorney at Plumb & True Legal Consulting and Representation. Renee is an attorney and the owner of Plumb & True Legal, a law firm that serves contractors, architects, vendors and others in the construction industry. Her new blog, Level Up, is available here.

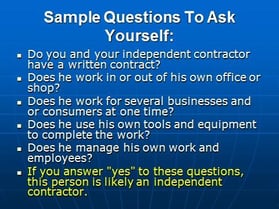

The government has recently been cracking down on improper classification of workers as subcontractors. Understanding the difference, at least in the eyes of the government, can help a remodeler avoid challenges as well as the fines and penalties that come with misclassification. I recently became aware of an additional consideration as a result of reading an article in Remodeling magazine titled

The government has recently been cracking down on improper classification of workers as subcontractors. Understanding the difference, at least in the eyes of the government, can help a remodeler avoid challenges as well as the fines and penalties that come with misclassification. I recently became aware of an additional consideration as a result of reading an article in Remodeling magazine titled  When a customer experiences what Perry speaks to its not likely the contractor performing the work will ever get future business or referrals from the disappointed customer. Remember, quality is not just determined by the final outcome. Quality is also determined by the experience the consumer has as the product is being delivered.

When a customer experiences what Perry speaks to its not likely the contractor performing the work will ever get future business or referrals from the disappointed customer. Remember, quality is not just determined by the final outcome. Quality is also determined by the experience the consumer has as the product is being delivered.

language of the subs you work with which details the scope of work they are to perform independently, you and or your business will be forced to orally direct the work of the subs. Once you do that the government no longer classifies them as subs, but rather as employees. That is therefore misclassification. According to an article at workcompcentral, in Tennessee a company by the name of Aguilar Carpentry was caught misclassifying workers and was fined $73,000. In another article posted to WTNH.com a CT contractor was fined $20,240 for misclassification. Those fine amounts would put most remodelers out of business.

language of the subs you work with which details the scope of work they are to perform independently, you and or your business will be forced to orally direct the work of the subs. Once you do that the government no longer classifies them as subs, but rather as employees. That is therefore misclassification. According to an article at workcompcentral, in Tennessee a company by the name of Aguilar Carpentry was caught misclassifying workers and was fined $73,000. In another article posted to WTNH.com a CT contractor was fined $20,240 for misclassification. Those fine amounts would put most remodelers out of business.

Many contractors are using what are refer to as 1099 workers to avoid employee and payroll related administrative responsibilities and financial costs. Some use this tactic to reduce their costs to help win bids and or make more money. If you never get caught you may feel or believe it was worth it. On the other hand if you get caught, whether you knew what you were doing was illegal or you really believed what you were doing was OK, the financial and litigation related costs can kill your business. The chance of this happening has dramatically increased in certain areas of the country because Washington is offering money to states to help them do so. Read on to find out about what is already happening in Virginia.

Many contractors are using what are refer to as 1099 workers to avoid employee and payroll related administrative responsibilities and financial costs. Some use this tactic to reduce their costs to help win bids and or make more money. If you never get caught you may feel or believe it was worth it. On the other hand if you get caught, whether you knew what you were doing was illegal or you really believed what you were doing was OK, the financial and litigation related costs can kill your business. The chance of this happening has dramatically increased in certain areas of the country because Washington is offering money to states to help them do so. Read on to find out about what is already happening in Virginia. That means you have to pay up on any fines, at their full rate (anywhere from $7K to 70K per violation) right away. Then you have to decide if you are willing to wait for your legal case to make it through a legal system sponsored by the same entity that is accusing your business.

That means you have to pay up on any fines, at their full rate (anywhere from $7K to 70K per violation) right away. Then you have to decide if you are willing to wait for your legal case to make it through a legal system sponsored by the same entity that is accusing your business.

Lots of small businesses, including many contractors, outsource accounting services like payroll and tax preparation. This is a smart move; tools like QuickBooks and

Lots of small businesses, including many contractors, outsource accounting services like payroll and tax preparation. This is a smart move; tools like QuickBooks and

It would appear that in the original interview ProSales had with Lowes about the story the fact that Lowes was selling 2x4’s that did not meet the standard accepted size of 1 ½” x 3 ½” was a detail left out of the interview. I say this with a high level of confidence because I find ProSales to be consistently accurate and the magazine editor, Craig Webb, does a great job vetting the information being published.

It would appear that in the original interview ProSales had with Lowes about the story the fact that Lowes was selling 2x4’s that did not meet the standard accepted size of 1 ½” x 3 ½” was a detail left out of the interview. I say this with a high level of confidence because I find ProSales to be consistently accurate and the magazine editor, Craig Webb, does a great job vetting the information being published.  The concern I am expressing is if these rules apply to retailers will they also apply to contractors? If they do, or eventually will, contractors in California and the rest of the country may also run into challenges not only with the government, but also with their customers. Perhaps trade associations such as NAHB and NARI should proactively seek out the answer to this question to help guide and protect their members and the rest of the construction industry. The RRP Rule came about because our industry didn’t proactively deal with the hazards of lead during construction on its own before the government stepped in and dictated regulations many do not agree with.

The concern I am expressing is if these rules apply to retailers will they also apply to contractors? If they do, or eventually will, contractors in California and the rest of the country may also run into challenges not only with the government, but also with their customers. Perhaps trade associations such as NAHB and NARI should proactively seek out the answer to this question to help guide and protect their members and the rest of the construction industry. The RRP Rule came about because our industry didn’t proactively deal with the hazards of lead during construction on its own before the government stepped in and dictated regulations many do not agree with.

“Schemes like this to avoid paying premium undermine the purpose of workers’ comp insurance – to protect workers who are injured on the job – and will result in unwanted attention from our investigators.”

“Schemes like this to avoid paying premium undermine the purpose of workers’ comp insurance – to protect workers who are injured on the job – and will result in unwanted attention from our investigators.” How would you look at that? I know one contractor who had that happen to him. When I asked him about it he told me he was definitely scared about going to prison so he spent big money to hire a good lawyer to try to keep him out of prison. He said the lawyer was successful but he was definitely sweating it right up until the final verdict. He didn’t get any jail time but did have to pay a lot of money in fines. He also told me that when everything was said and done, and based on all the money he saved over the years by cheating, the fine and lawyer fees were far less than the money he saved. He told me he felt it was worth the risk.

How would you look at that? I know one contractor who had that happen to him. When I asked him about it he told me he was definitely scared about going to prison so he spent big money to hire a good lawyer to try to keep him out of prison. He said the lawyer was successful but he was definitely sweating it right up until the final verdict. He didn’t get any jail time but did have to pay a lot of money in fines. He also told me that when everything was said and done, and based on all the money he saved over the years by cheating, the fine and lawyer fees were far less than the money he saved. He told me he felt it was worth the risk. Many remodeling contractors may be operating their businesses illegally without even knowing it. In addition to construction supervisor licensing, most states now have some type of licensing or registration requirements for contractors who offer and or perform home improvement work. Home improvement contractor licensing and regulations govern how contractors conduct business, not how they build or renovate at the job site. Fines and penalties for lack of compliance can be substantial, including losing your right to conduct business. The specific details of home improvement contractor laws and regulations are different from state to state, so it’s a good idea to make sure you’re aware of and understand requirements where you work.

Many remodeling contractors may be operating their businesses illegally without even knowing it. In addition to construction supervisor licensing, most states now have some type of licensing or registration requirements for contractors who offer and or perform home improvement work. Home improvement contractor licensing and regulations govern how contractors conduct business, not how they build or renovate at the job site. Fines and penalties for lack of compliance can be substantial, including losing your right to conduct business. The specific details of home improvement contractor laws and regulations are different from state to state, so it’s a good idea to make sure you’re aware of and understand requirements where you work.

Over the years, I have heard from many contractors — some of them with very big companies — about how they handle drafting their business contracts. Many times, these documents consist of a collection of "stuff some guys I know have in their contracts" cobbled together. It doesn't even occur to these business owners that laws vary by state, or that they might need an expert to customize contracts to fit their own business's unique needs. By not having a professional create legal documents that fit a clear sales procedure and overall company goals, they are putting their company at serious risk. I know because we learned the hard way, too.

Over the years, I have heard from many contractors — some of them with very big companies — about how they handle drafting their business contracts. Many times, these documents consist of a collection of "stuff some guys I know have in their contracts" cobbled together. It doesn't even occur to these business owners that laws vary by state, or that they might need an expert to customize contracts to fit their own business's unique needs. By not having a professional create legal documents that fit a clear sales procedure and overall company goals, they are putting their company at serious risk. I know because we learned the hard way, too.  In 1998, we incorporated as Myers Constructs, Inc., because we had taken on a huge and complicated renovations project. We knew we needed serious business structures in place to protect us, so in 2001 we asked Dana Priesing, an attorney who is now our office manager, to read our contracts to look for problems. (She had us sign a contract before she did so!) Dana interviewed Tamara to better understand how she sells, and how our customers buy, and then gave us a few recommendations right off the bat:

In 1998, we incorporated as Myers Constructs, Inc., because we had taken on a huge and complicated renovations project. We knew we needed serious business structures in place to protect us, so in 2001 we asked Dana Priesing, an attorney who is now our office manager, to read our contracts to look for problems. (She had us sign a contract before she did so!) Dana interviewed Tamara to better understand how she sells, and how our customers buy, and then gave us a few recommendations right off the bat:

Unless they have been under a rock somewhere, most professional remodelers are now aware of the

Unless they have been under a rock somewhere, most professional remodelers are now aware of the  He sets a great example for our industry. We are professionals and as an industry we need to stand up for what is right. By what he is doing, and assuming he is successful, he will be establishing a precedence that consumers cannot lie with impunity about their experiences with a professional contractor. I think it’s great that this woman will now have a taste of what it’s like to be financially challenged to defend herself, a position many contractors find themselves in when consumers sue contractors.

He sets a great example for our industry. We are professionals and as an industry we need to stand up for what is right. By what he is doing, and assuming he is successful, he will be establishing a precedence that consumers cannot lie with impunity about their experiences with a professional contractor. I think it’s great that this woman will now have a taste of what it’s like to be financially challenged to defend herself, a position many contractors find themselves in when consumers sue contractors. According to Perez the pending court case has left her reeling and potentially facing thousands of dollars in legal bills to defend herself. She has definitely come to realize the consequences of her actions because Dietz had the guts to stand up for his rights. Had he not done so she would have established and or helped to maintain a precedence of “let’s bad mouth that contractor so we can blackmail him for the money we owe him”. She took a calculated risk that Dietz would back down. If Dietz wins the calculation of risks for homeowners who use such tactics will change going forward.

According to Perez the pending court case has left her reeling and potentially facing thousands of dollars in legal bills to defend herself. She has definitely come to realize the consequences of her actions because Dietz had the guts to stand up for his rights. Had he not done so she would have established and or helped to maintain a precedence of “let’s bad mouth that contractor so we can blackmail him for the money we owe him”. She took a calculated risk that Dietz would back down. If Dietz wins the calculation of risks for homeowners who use such tactics will change going forward.