Getting Your Remodeling Business Ready to Produce More Work

Growth in consumer spending on remodeling during 2018, and beyond, is expected to skyrocket. This means that remodelers will have the opportunity to grow their businesses, and if done well; will make a lot of money. But is your business ready for the work? If you are already working too hard for too many hours will increasing volume just end up with you in divorce court and or on blood pressure medicine? Below I offer a vision, and some suggestions, for what you can do to be ready. If you already allowed yourself to get in too deep, then perhaps my suggestions can help you create a plan to get things running better than you had ever imagined.

Growth in consumer spending on remodeling during 2018, and beyond, is expected to skyrocket. This means that remodelers will have the opportunity to grow their businesses, and if done well; will make a lot of money. But is your business ready for the work? If you are already working too hard for too many hours will increasing volume just end up with you in divorce court and or on blood pressure medicine? Below I offer a vision, and some suggestions, for what you can do to be ready. If you already allowed yourself to get in too deep, then perhaps my suggestions can help you create a plan to get things running better than you had ever imagined.

It all starts with estimating.

Estimating might as well be the center of the universe for remodeling contractors. Using a defined process and key information, your production team can conquer that universe. If you grow your business without an advanced estimating system you risk dropping into a financial black hole. Your estimating should not only help provide a profitable selling price, it should also create, document, and organize the information your production team needs to build independently, without constantly bothering you or your salespeople. Done well, it should also help you predict your cash flow needs, and therefore your payment schedules. This way every job finances itself using your clients' money to pay bills on time, not yours. Successful estimating will also help your production team identify and schedule all the resources needed to complete the project weeks, or even months, before they are actually needed at the job site.

A real estimating system includes job costing.

First, an estimate is not  what you give to a prospective client. That is called a price. The estimate is really the contractor's best guess on what the project will cost their business to complete before overhead and profit are added. That's right, it’s just a guess. To continuously improve the accuracy of that guess, particularly as your business is exposed to new products and construction methods, or brings on new untested employees, job costing will be the only way to reduce the risks of estimating. Imagine going six months or a whole year before realizing you were using inaccurate information. Imagine the benefits of offering profit sharing if your team brings jobs in on budget. But, what if your budgets are never adequate and there are no profits to share, and when your employees ask why you can't tell them?

what you give to a prospective client. That is called a price. The estimate is really the contractor's best guess on what the project will cost their business to complete before overhead and profit are added. That's right, it’s just a guess. To continuously improve the accuracy of that guess, particularly as your business is exposed to new products and construction methods, or brings on new untested employees, job costing will be the only way to reduce the risks of estimating. Imagine going six months or a whole year before realizing you were using inaccurate information. Imagine the benefits of offering profit sharing if your team brings jobs in on budget. But, what if your budgets are never adequate and there are no profits to share, and when your employees ask why you can't tell them?

This all requires a well set up financial system.

Even if you are a good estimator and you never miss any of the sticks and bricks, if you do not know which labor rate and markup to use you may be buying jobs instead of selling them. Without a well thought out list of estimating and matching time card work categories (sometimes referred to as phases), you will never know how well your team did compared to your estimated labor assumptions in specific areas. Also, without the right time card categories, how will you know and or confirm how many non-billable hours of pay you will need to add to, and cover, inside the burden labor rate you assume and charge for their billable hours?

Even if you are a good estimator and you never miss any of the sticks and bricks, if you do not know which labor rate and markup to use you may be buying jobs instead of selling them. Without a well thought out list of estimating and matching time card work categories (sometimes referred to as phases), you will never know how well your team did compared to your estimated labor assumptions in specific areas. Also, without the right time card categories, how will you know and or confirm how many non-billable hours of pay you will need to add to, and cover, inside the burden labor rate you assume and charge for their billable hours?

There are plenty of things to work on as you grow a remodeling business. However, if you don't get the estimating of your jobs right growing your business will just help you lose money faster.

Small business owners usually cringe at the thought of tax season. They are busy enough with their daily operations that they don’t want to spend all of the time and energy getting ready to file on time. They also may dread of thought of paying more in taxes than they feel they should. While small business owners cannot avoid taxes altogether (even though they wish they could), they can take some steps now to avoid the hassles that typically come at tax time.

Small business owners usually cringe at the thought of tax season. They are busy enough with their daily operations that they don’t want to spend all of the time and energy getting ready to file on time. They also may dread of thought of paying more in taxes than they feel they should. While small business owners cannot avoid taxes altogether (even though they wish they could), they can take some steps now to avoid the hassles that typically come at tax time. Even if you are diligent about keeping receipts, a

Even if you are diligent about keeping receipts, a  Categorizing expenses

Categorizing expenses Are you pretending to be a remodeling business owner but in reality you are actually just a "job owner"? The questions below are tough and may make you feel real bad about yourself depending on how you answer them. But that’s not why I assembled them. Don’t kid yourself. If you are not cut out to be a business owner recognize that reality now. Don’t wait until you lose you all your money, your home and maybe even your family. If being in business is not your calling keep in mind the industry is desperate for good employees. Real remodeling business owners offer good jobs with great pay and benefits. Answering these questions might just be the best thing you do for yourself this year.

Are you pretending to be a remodeling business owner but in reality you are actually just a "job owner"? The questions below are tough and may make you feel real bad about yourself depending on how you answer them. But that’s not why I assembled them. Don’t kid yourself. If you are not cut out to be a business owner recognize that reality now. Don’t wait until you lose you all your money, your home and maybe even your family. If being in business is not your calling keep in mind the industry is desperate for good employees. Real remodeling business owners offer good jobs with great pay and benefits. Answering these questions might just be the best thing you do for yourself this year. Are you one of those business owners who doesn't know the difference between markup and margin, or worse you think they mean the same thing (WAG)?

Are you one of those business owners who doesn't know the difference between markup and margin, or worse you think they mean the same thing (WAG)?

OK, I’m sick and tired of the foo-foo fluffy BS answers some magazines and bloggers put out there to answer how contractors can raise their markup. All the BS answers I see offered by others never call these contractors out on their ignorance. Without knowing what markup they actually need to use how would a contractor who is “slowly raising” his markup know when he has finally hit the right markup? It drives me crazy! If you are ready for the no BS answers read on…

OK, I’m sick and tired of the foo-foo fluffy BS answers some magazines and bloggers put out there to answer how contractors can raise their markup. All the BS answers I see offered by others never call these contractors out on their ignorance. Without knowing what markup they actually need to use how would a contractor who is “slowly raising” his markup know when he has finally hit the right markup? It drives me crazy! If you are ready for the no BS answers read on…

Over 10 million Americans are independent contractors, according to the most recent estimates by the U.S. Department of Labor. Whether that means you do freelance work or have started your own company and hope to employ many people yourself one day, most independent contractors have one thing in common: they are learning as they go.

Over 10 million Americans are independent contractors, according to the most recent estimates by the U.S. Department of Labor. Whether that means you do freelance work or have started your own company and hope to employ many people yourself one day, most independent contractors have one thing in common: they are learning as they go. From office supplies to packing materials, the biggest waste of time and energy is buying things you knew you would need at the last minute and paying full retail price. If you’re a retailer, seek out wholesale options and buy in bulk for the maximum discount. Look into a Costco membership for any and all office supplies. Office furniture can also be found at the local thrift store, furniture rental company or hotel furniture liquidators for pennies on the dollar.

From office supplies to packing materials, the biggest waste of time and energy is buying things you knew you would need at the last minute and paying full retail price. If you’re a retailer, seek out wholesale options and buy in bulk for the maximum discount. Look into a Costco membership for any and all office supplies. Office furniture can also be found at the local thrift store, furniture rental company or hotel furniture liquidators for pennies on the dollar. But not even a lack of cash flow can stop you these days. With the popularity of crowdfunding, job placement services and Craigslist, there are outlets everywhere for the hard working, resourceful, independent contractor. Leave no stone unturned and check to see if you qualify for any

But not even a lack of cash flow can stop you these days. With the popularity of crowdfunding, job placement services and Craigslist, there are outlets everywhere for the hard working, resourceful, independent contractor. Leave no stone unturned and check to see if you qualify for any  Guest Blogger: Stacy Eden is a Phoenix, Arizona native with a passion for art, power tools, and historical significance. She draws inspiration from classic cars, ancient mythological sculptures and jewelry designers such as Delfina Delettrez, Shaun Leane, and Dior Jewellery creative director Victoire de Castellane.

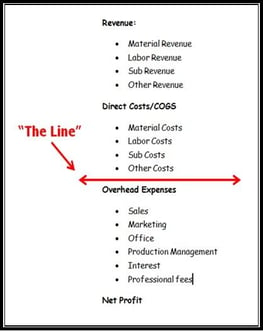

Guest Blogger: Stacy Eden is a Phoenix, Arizona native with a passion for art, power tools, and historical significance. She draws inspiration from classic cars, ancient mythological sculptures and jewelry designers such as Delfina Delettrez, Shaun Leane, and Dior Jewellery creative director Victoire de Castellane. Many remodelers determine their pricing structure by copying what other businesses do rather than figure out what markup their business actually needs to use. Comparing or copying markups or margins is pointless and very risky without knowing how they were determined. The decision about what costs or expenses go above or below the gross profit line can be different at different remodeling companies. Therefore the markup each company will need to use to cover overhead costs and planned net profit will be different. Let me explain and clarify.

Many remodelers determine their pricing structure by copying what other businesses do rather than figure out what markup their business actually needs to use. Comparing or copying markups or margins is pointless and very risky without knowing how they were determined. The decision about what costs or expenses go above or below the gross profit line can be different at different remodeling companies. Therefore the markup each company will need to use to cover overhead costs and planned net profit will be different. Let me explain and clarify. First, here are the terms you need to know

First, here are the terms you need to know It also important to know that fewer than 20% of remodelers actually know the true costs of being in business. That means that 80% or more are using what has been referred to as the WAG or “Wild Ass Guess” method when it comes to deciding what markup they use to price the projects they sell. I call that

It also important to know that fewer than 20% of remodelers actually know the true costs of being in business. That means that 80% or more are using what has been referred to as the WAG or “Wild Ass Guess” method when it comes to deciding what markup they use to price the projects they sell. I call that  So, what about you and your business?

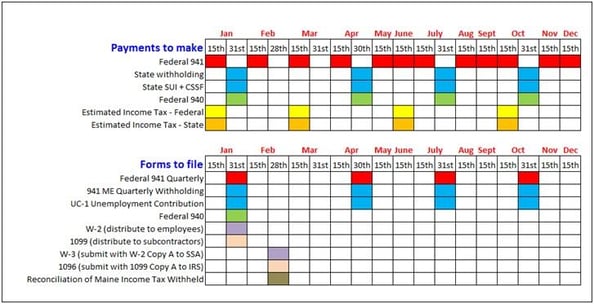

So, what about you and your business? Payroll is complicated enough without having to worry about when to make payments and when to file which form to which government entity. I have many clients who are comfortable creating paychecks, but are nervous about missing payroll tax payments or filing forms late. A client recently asked if I couldn’t find a simple way to have reminders that would prompt him to do whatever had to be done. To help I created a simple “in your face” payroll reminder.

Payroll is complicated enough without having to worry about when to make payments and when to file which form to which government entity. I have many clients who are comfortable creating paychecks, but are nervous about missing payroll tax payments or filing forms late. A client recently asked if I couldn’t find a simple way to have reminders that would prompt him to do whatever had to be done. To help I created a simple “in your face” payroll reminder.

How to get it on your desktop

How to get it on your desktop

I came across a great question asked by a group member while participating on LinkedIn. I replied to the question on LinkedIn, but also thought it would make for great info to share with other contractors who might be asking the same question.

I came across a great question asked by a group member while participating on LinkedIn. I replied to the question on LinkedIn, but also thought it would make for great info to share with other contractors who might be asking the same question. Also consider, as a business owner you may personally be measuring your profitability including the costs of any investments for a one year period. As a result may not see a profit in the bank at the end of the year. However the money spent on those investments is still considered profit for business and tax purposes. This is the case because when filing your taxes the government sees these investment type purchases as assets paid for with profits. To get tax deductions for these assets you are allowed to depreciate the assets over time to reduce their value and take tax deductions for them over several years or more. Essentially, for tax purposes, the government measures your profit by combining the money you earned and still have; along with the assets you bought using any profits, as your total taxable net profit. Also, any money your business paid out to you the owner as profit distributions over the year will be considered part of your business’ total taxable net income.

Also consider, as a business owner you may personally be measuring your profitability including the costs of any investments for a one year period. As a result may not see a profit in the bank at the end of the year. However the money spent on those investments is still considered profit for business and tax purposes. This is the case because when filing your taxes the government sees these investment type purchases as assets paid for with profits. To get tax deductions for these assets you are allowed to depreciate the assets over time to reduce their value and take tax deductions for them over several years or more. Essentially, for tax purposes, the government measures your profit by combining the money you earned and still have; along with the assets you bought using any profits, as your total taxable net profit. Also, any money your business paid out to you the owner as profit distributions over the year will be considered part of your business’ total taxable net income. Again, great question to ask. I hope this article helps. Being a business owner means you have to understand how to manage and protect the profits you earn, but at the same time manage how you will be taxed on that same money. By not knowing or ignoring these considerations you can be working hard to make money while profits that could have stayed with you are going out the door to the government as taxes. That said there are a lot of great reasons to have a proactive accountant helping you and your business instead of a historian type accountant who only files your taxes for you when everything is already said and done for the year.

Again, great question to ask. I hope this article helps. Being a business owner means you have to understand how to manage and protect the profits you earn, but at the same time manage how you will be taxed on that same money. By not knowing or ignoring these considerations you can be working hard to make money while profits that could have stayed with you are going out the door to the government as taxes. That said there are a lot of great reasons to have a proactive accountant helping you and your business instead of a historian type accountant who only files your taxes for you when everything is already said and done for the year. Growing a remodeling business past $1Million a year of installed sales comes with new costs and expenses as the number of employees and overhead related activities naturally increase. Just like estimating the cost of a remodeling project, the business owner will need a practical plan for growing the business and an accurate estimate of the costs related to growing it. Then just like a remodeling project the business needs a way to measure how well things are actually going against the plan and budget.

Growing a remodeling business past $1Million a year of installed sales comes with new costs and expenses as the number of employees and overhead related activities naturally increase. Just like estimating the cost of a remodeling project, the business owner will need a practical plan for growing the business and an accurate estimate of the costs related to growing it. Then just like a remodeling project the business needs a way to measure how well things are actually going against the plan and budget.  As the business grows and more employees are added to share the workload the owner must be able to delegate tasks he or she probably did them self as they grew the business. These delegated activities might include things like product selection, product procurement, production management, and even the responsibility for doing the estimating.

As the business grows and more employees are added to share the workload the owner must be able to delegate tasks he or she probably did them self as they grew the business. These delegated activities might include things like product selection, product procurement, production management, and even the responsibility for doing the estimating.  Without an accurate financial system in place your business will, unfortunately, be like the majority of other remodeling businesses in our industry. Over 80% of remodelers have no idea of the true cost of being in business. These businesses use what is referred to as the WAG method, or "Wild Ass Guess Method” for estimating direct cost and even the markup percentage to use on estimated costs when pricing the jobs they sell. If that describes you and your business put the things I describe here in this article in place at your business before you seek to take-off past $1Million in remodeling. Growing your business should be rewarding and profitable. Entering the unknown without being properly prepared can be costly and may even lead to the demise of your remodeling business.

Without an accurate financial system in place your business will, unfortunately, be like the majority of other remodeling businesses in our industry. Over 80% of remodelers have no idea of the true cost of being in business. These businesses use what is referred to as the WAG method, or "Wild Ass Guess Method” for estimating direct cost and even the markup percentage to use on estimated costs when pricing the jobs they sell. If that describes you and your business put the things I describe here in this article in place at your business before you seek to take-off past $1Million in remodeling. Growing your business should be rewarding and profitable. Entering the unknown without being properly prepared can be costly and may even lead to the demise of your remodeling business.

Lots of small businesses, including many contractors, outsource accounting services like payroll and tax preparation. This is a smart move; tools like QuickBooks and

Lots of small businesses, including many contractors, outsource accounting services like payroll and tax preparation. This is a smart move; tools like QuickBooks and