Think Twice Before You Use Subs or 1099’s Who Can’t Speak English; Here’s 2 Simple Reasons Why

The government has recently been cracking down on improper classification of workers as subcontractors. Understanding the difference, at least in the eyes of the government, can help a remodeler avoid challenges as well as the fines and penalties that come with misclassification. I recently became aware of an additional consideration as a result of reading an article in Remodeling magazine titled “Se Habla Ingles + No = No Deal? Get Real!” After reading the article, but particularly the reader comments, that new consideration jumped out at me. Using subcontractors and or 1099 workers who do not speak English can put your remodeling business at risk in at least two costly ways.

The government has recently been cracking down on improper classification of workers as subcontractors. Understanding the difference, at least in the eyes of the government, can help a remodeler avoid challenges as well as the fines and penalties that come with misclassification. I recently became aware of an additional consideration as a result of reading an article in Remodeling magazine titled “Se Habla Ingles + No = No Deal? Get Real!” After reading the article, but particularly the reader comments, that new consideration jumped out at me. Using subcontractors and or 1099 workers who do not speak English can put your remodeling business at risk in at least two costly ways.

Two simple ways the language barrier can put your remodeling or construction business at risk

#1: Customer service can be compromised leading to loss of repeat work and referrals.

Let’s face facts here; if a worker cannot speak English there will definitely be communication challenges. This is clearly demonstrated by the comment left at the article I mentioned above. The comment was by Perry, an actual consumer who personally experienced the challenges and disappointments caused both by the workers who could not adequately understand English as well as the business that hired them:

“It's difficult to quantify or fully explain in this comment the magnitude of problems we've had on our current job, but approximately half the problems can be traced directly back to a communication problem with the workers at the site. I witnessed our job supervisor explaining what was needed (in as good a Spanish as he could muster), the worker acknowledging his understanding, and hours later when the completed work is inspected, it's clear the worker did not understand exactly what was needed. This has happened repeatedly, with some of the mistakes far more costly than others.”

When a customer experiences what Perry speaks to its not likely the contractor performing the work will ever get future business or referrals from the disappointed customer. Remember, quality is not just determined by the final outcome. Quality is also determined by the experience the consumer has as the product is being delivered.

When a customer experiences what Perry speaks to its not likely the contractor performing the work will ever get future business or referrals from the disappointed customer. Remember, quality is not just determined by the final outcome. Quality is also determined by the experience the consumer has as the product is being delivered.

#2: Risk of the government deciding they are employees

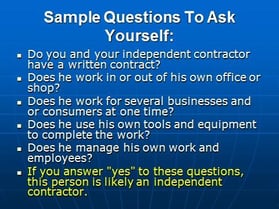

Contractors should be using fixed scope contracts with subcontractors. Subcontractor agreements should detail the work to be completed, the expected outcome, when it has to be completed and include a fixed price for the services performed. If a subcontractor and or his/her workers cannot read a written work order due to a language barrier someone outside the subcontractor’s business will have to explain what is to be done and how it is to be done to the subcontractor. And in the absence of the subcontractor at the jobsite someone will need to explain and direct that sub’s employees. This type of relationship with a sub and or the sub’s employees demonstrates control by the business that hired the subcontractor.

The IRS will consider a worker to be an employee unless independent contractor status is clearly indicated by the relationship between the worker and a remodeling business. The way the IRS sees it an employee is a worker who performs services at the direction of an employer. Subcontractors are considered to be in business for themselves and work under their own direction. So simply stated anyone who performs services for a remodeler is an employee if the remodeler can and or does control what will be done and how it will be done. Explaining things to a worker and orally directing how and in what order to perform their work therefore makes the worker an employee.

The fines and penalties for misclassification can ruin your business

As I pointed out in a previous blog post the determination by the government of misclassification of workers can be caused by many reasons. Plus when it happens the government assumes you to be guilty until you prove your innocence. If you cannot create a written subcontractor agreement, in the  language of the subs you work with which details the scope of work they are to perform independently, you and or your business will be forced to orally direct the work of the subs. Once you do that the government no longer classifies them as subs, but rather as employees. That is therefore misclassification. According to an article at workcompcentral, in Tennessee a company by the name of Aguilar Carpentry was caught misclassifying workers and was fined $73,000. In another article posted to WTNH.com a CT contractor was fined $20,240 for misclassification. Those fine amounts would put most remodelers out of business.

language of the subs you work with which details the scope of work they are to perform independently, you and or your business will be forced to orally direct the work of the subs. Once you do that the government no longer classifies them as subs, but rather as employees. That is therefore misclassification. According to an article at workcompcentral, in Tennessee a company by the name of Aguilar Carpentry was caught misclassifying workers and was fined $73,000. In another article posted to WTNH.com a CT contractor was fined $20,240 for misclassification. Those fine amounts would put most remodelers out of business.

Still unsure about your relationship with sub? Here are three possible options

For a quick answer perhaps just take the quiz Remodeling Magazine recently offered titled: "Take the Quiz: Are You Misclassifying Your Subcontractor?" Answer the questions honestly and then see if the government would call them subs or employees.

If you want help from the IRS and you have a lot of time to wait you can use IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. The completed form can be filed with the IRS by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status. Unfortunately it can take at least six months to get a determination. Additionally, often times because determining factors used by the government are not always objective, the determination may not binding.

If you want help from the IRS and you have a lot of time to wait you can use IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. The completed form can be filed with the IRS by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status. Unfortunately it can take at least six months to get a determination. Additionally, often times because determining factors used by the government are not always objective, the determination may not binding.

The majority of remodeling contractors who participate in the remodeling industry are holding the industry back from becoming much more professional and successful. Remodelers forever complain about what they perceive the government and even consumers do to them to make running a business and earning a profit difficult. However in many ways remodelers are their own worse enemies, creating problems for themselves and the industry by both their actions as well as their lack of action. Below are just five things I wish all remodelers and the industry would change, but won’t.

The majority of remodeling contractors who participate in the remodeling industry are holding the industry back from becoming much more professional and successful. Remodelers forever complain about what they perceive the government and even consumers do to them to make running a business and earning a profit difficult. However in many ways remodelers are their own worse enemies, creating problems for themselves and the industry by both their actions as well as their lack of action. Below are just five things I wish all remodelers and the industry would change, but won’t.

There are probably more than one million remodeling businesses in the United States if you include those without payroll. Sadly, I bet fewer than 20% operate completely legal. That’s probably why so many remodelers find some way to rationalize why they tolerate other illegal businesses; “People who live in glass houses shouldn’t throw stones”. Here is just a partial checklist you can use to self-assess: RRP, OSHA, permits, using 1099 workers, taking cash, proper licensing… Need I go on?

There are probably more than one million remodeling businesses in the United States if you include those without payroll. Sadly, I bet fewer than 20% operate completely legal. That’s probably why so many remodelers find some way to rationalize why they tolerate other illegal businesses; “People who live in glass houses shouldn’t throw stones”. Here is just a partial checklist you can use to self-assess: RRP, OSHA, permits, using 1099 workers, taking cash, proper licensing… Need I go on?  As a remodeling contractor seeks to grow his or her business past a million dollars it’s important to bring someone on to help with getting the work done. Without doing so the business owner can quickly become overwhelmed wearing too many hats. At this stage in business it’s important to decide whether you want to hire a Production Supervisor or a Production Manager. Before making the decision be clear on the difference between the two and how you should decide.

As a remodeling contractor seeks to grow his or her business past a million dollars it’s important to bring someone on to help with getting the work done. Without doing so the business owner can quickly become overwhelmed wearing too many hats. At this stage in business it’s important to decide whether you want to hire a Production Supervisor or a Production Manager. Before making the decision be clear on the difference between the two and how you should decide. When subcontractors become involved in the work they too will be supervised by the Production Supervisor. They will be required to contact the supervisor for project information, onsite decisions and to discuss solutions when challenges and or discrepancies occur at the jobsite.

When subcontractors become involved in the work they too will be supervised by the Production Supervisor. They will be required to contact the supervisor for project information, onsite decisions and to discuss solutions when challenges and or discrepancies occur at the jobsite. If the home owner has questions, wants to make changes, and or is upset about something, again those things are typically handled right at the jobsite. The Lead Carpenter can reach out to the Production Manager for things outside of his expertise or authority.

If the home owner has questions, wants to make changes, and or is upset about something, again those things are typically handled right at the jobsite. The Lead Carpenter can reach out to the Production Manager for things outside of his expertise or authority.

Ignoring for the moment the fine points of litigation, which Liability insurance company should you notify? Your current carrier? The one who had your policy at the time of the construction? Or both of those, plus every policy you’ve had during the past five years?

Ignoring for the moment the fine points of litigation, which Liability insurance company should you notify? Your current carrier? The one who had your policy at the time of the construction? Or both of those, plus every policy you’ve had during the past five years? Because Liability policies usually state specifically that they cover damage occurring during the policy period only, you’ll need to ask when the damage actually “occurred.” At the time of original construction — during the time the cracks allegedly appeared and continued to worsen — or on the day the actual collapse took place?

Because Liability policies usually state specifically that they cover damage occurring during the policy period only, you’ll need to ask when the damage actually “occurred.” At the time of original construction — during the time the cracks allegedly appeared and continued to worsen — or on the day the actual collapse took place?

If this claim is made during the current policy period, your insurance company will pay it. However, suppose the claim isn’t made for several weeks, and by the time it arrives, your current coverage has expired and you’re into a new policy period? In this case, the “claims-made” policy will pay the claim, since it was made during the new period.

If this claim is made during the current policy period, your insurance company will pay it. However, suppose the claim isn’t made for several weeks, and by the time it arrives, your current coverage has expired and you’re into a new policy period? In this case, the “claims-made” policy will pay the claim, since it was made during the new period.

Bonuses are compensation for employees for work performed; they are paid in addition to salary or wages. Often business owners give out bonuses without any structured plan or objective method for determining the amount or even how the bonus can actually be earned. Although typically given out around Christmas time, bonuses can be given out any time of the year.

Bonuses are compensation for employees for work performed; they are paid in addition to salary or wages. Often business owners give out bonuses without any structured plan or objective method for determining the amount or even how the bonus can actually be earned. Although typically given out around Christmas time, bonuses can be given out any time of the year.  Profit Sharing is an arrangement between an employer and an employee in which the employer shares part of its profits with the employee. The key difference between a bonus and profit sharing is that there must be profit before any is shared with the employee.

Profit Sharing is an arrangement between an employer and an employee in which the employer shares part of its profits with the employee. The key difference between a bonus and profit sharing is that there must be profit before any is shared with the employee.  Keep in mind that depending on how a bonus or profit sharing is distributed the employer may incur additional costs over and above the dollar amount given to the individual employee. Depending on the employment relationship the company has with the employee, the business may incur the expense of payroll related taxes, liability insurance and/or workers compensation insurance on the dollars paid to employees. Its best to consult with your accountant regarding the total cost of offering a bonus or profit sharing plan before discussing with or offering either to employees.

Keep in mind that depending on how a bonus or profit sharing is distributed the employer may incur additional costs over and above the dollar amount given to the individual employee. Depending on the employment relationship the company has with the employee, the business may incur the expense of payroll related taxes, liability insurance and/or workers compensation insurance on the dollars paid to employees. Its best to consult with your accountant regarding the total cost of offering a bonus or profit sharing plan before discussing with or offering either to employees.

Help them get mentally prepared: Let them know what to expect they will live through while the construction is under way. Tell them about things that might affect them like the noise, the dust, shutting off their water, change orders and the decisions that come with final selections and unanticipated challenges. Just as a doctor would do with patients regarding medications, a good remodeler will warn clients that it is likely there might be side effects experienced during the remodeling process. By doing so clients can recognize the warning signs so they will be able to mentally and physically adjust. Also, my experience was that by discussing these realities in advance, the fatigue might not set in as early, or at least would not be as significant, as early, as it might be if my team had not warned them.

Help them get mentally prepared: Let them know what to expect they will live through while the construction is under way. Tell them about things that might affect them like the noise, the dust, shutting off their water, change orders and the decisions that come with final selections and unanticipated challenges. Just as a doctor would do with patients regarding medications, a good remodeler will warn clients that it is likely there might be side effects experienced during the remodeling process. By doing so clients can recognize the warning signs so they will be able to mentally and physically adjust. Also, my experience was that by discussing these realities in advance, the fatigue might not set in as early, or at least would not be as significant, as early, as it might be if my team had not warned them. Help them get physically prepared: Living through the remodeling process can be much easier with some preparation. For example, remind customers they will not be able to cook while you remodel their kitchen. Suggest they consider cooking and freezing easy to microwave meals and or collect take out menus before you start their kitchen renovation. Some remodelers have told me they actually provide their clients recipe books and or a collection of local restaurant menus to help with this. If you are renovating their only bathroom as part of a project, ask how they plan to deal without a toilet for a few days or more. They may not have even thought about such realities. Maybe you or they can even set up temporary spaces to tide them over until they get their homes and their lives back.

Help them get physically prepared: Living through the remodeling process can be much easier with some preparation. For example, remind customers they will not be able to cook while you remodel their kitchen. Suggest they consider cooking and freezing easy to microwave meals and or collect take out menus before you start their kitchen renovation. Some remodelers have told me they actually provide their clients recipe books and or a collection of local restaurant menus to help with this. If you are renovating their only bathroom as part of a project, ask how they plan to deal without a toilet for a few days or more. They may not have even thought about such realities. Maybe you or they can even set up temporary spaces to tide them over until they get their homes and their lives back.

Hydroelectric energy is one of the most developed forms of green energy across the country. For generations, American engineers have been developing dams for many of our nation’s rivers. Once a river has been dammed, engineers can control how much water passes through at any given time. As that water flows, it rotates a series of turbines thus creating energy.

Hydroelectric energy is one of the most developed forms of green energy across the country. For generations, American engineers have been developing dams for many of our nation’s rivers. Once a river has been dammed, engineers can control how much water passes through at any given time. As that water flows, it rotates a series of turbines thus creating energy. In order to turn wind into electricity, a new type of windmill has been developed. Often these windmills are installed in large groups referred to as wind farms. All throughout West Texas, there are thousands of new windmills that have been built over the past decade, and wind-generated power is becoming an increasingly substantial source of energy for the Texas grid.

In order to turn wind into electricity, a new type of windmill has been developed. Often these windmills are installed in large groups referred to as wind farms. All throughout West Texas, there are thousands of new windmills that have been built over the past decade, and wind-generated power is becoming an increasingly substantial source of energy for the Texas grid. Harnessing the energy of the sun’s rays requires the use of solar panel technology. While solar panels were once extremely pricey, prices have come down as technology has advanced. Now, many people in sunny regions, including many areas of Texas, are installing their own personal solar arrays in order to capitalize on the most abundant energy resource in our solar system.

Harnessing the energy of the sun’s rays requires the use of solar panel technology. While solar panels were once extremely pricey, prices have come down as technology has advanced. Now, many people in sunny regions, including many areas of Texas, are installing their own personal solar arrays in order to capitalize on the most abundant energy resource in our solar system.

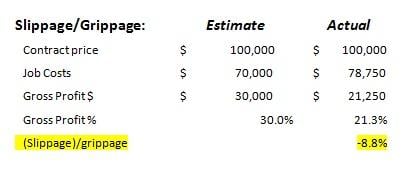

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

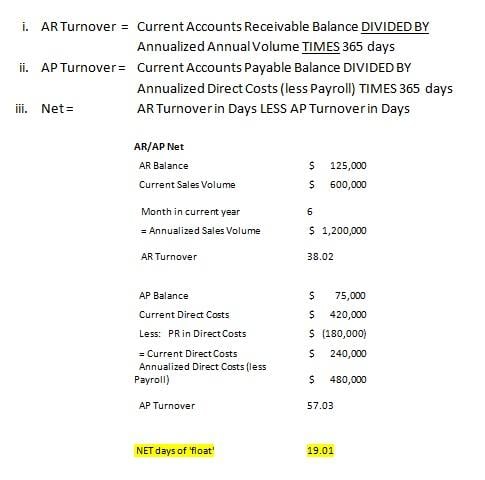

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

My suggestion to design/build firms is to have a decorator either on staff or one you’ve built a good relationship with available to you, that is willing to work in conjunction with the designer and/or contractor as far as the pretty aspect of such things as tile lay-out, mirror and sconce placement goes. This is where creating a team comes into play. When all parties are able to communicate clearly with one another and work together everyone wins. That’s the whole point - everyone does what they’re good at, has a good time and works together so more business is forth-coming.

My suggestion to design/build firms is to have a decorator either on staff or one you’ve built a good relationship with available to you, that is willing to work in conjunction with the designer and/or contractor as far as the pretty aspect of such things as tile lay-out, mirror and sconce placement goes. This is where creating a team comes into play. When all parties are able to communicate clearly with one another and work together everyone wins. That’s the whole point - everyone does what they’re good at, has a good time and works together so more business is forth-coming.