Guest Blogger: Jason Dickerson is a freelance writer for Direct Marketing and Analysis who focuses on ways people can make their home's more energy efficient and green. When Jason isn't writing he enjoys mountain biking and spending time with his wife Marissa.

How Remodelers and Their Customers Can Both Make Money Being Green

So you have a client that has decided to remodel their home. Considering that they’ve decided to make a serious investment in their home, it’s easy to suggest that they should also think about investing in something that can pay them dividends.

The value of adding green energy infrastructure to a home is threefold. Not only will residents save money in the long run by decreasing the amount of energy they purchase from their retailer, they’ll be helping reduce America’s dependence on foreign energy, and they might even make money by selling the energy they don’t consume to others.

Here in Texas, there are plenty of energy retailers that offer special plans for homeowners with green energy technologies installed on their property. If your clients need to find out which retailers have the best offers, tell them to visit energyproviderstexas.com to explore their options.

What is green energy?

Green energy is a big buzzword in politics these days, but it’s rare that someone actually explains what it is. Green energy generally refers to energy produced through means that are not dependent on fossil fuels. Instead, renewable resources drive the production of energy. Some of the most recognizable forms of green energy are hydroelectric energy, wind energy and solar energy.

Hydroelectric energy

Hydroelectric energy is one of the most developed forms of green energy across the country. For generations, American engineers have been developing dams for many of our nation’s rivers. Once a river has been dammed, engineers can control how much water passes through at any given time. As that water flows, it rotates a series of turbines thus creating energy.

Hydroelectric energy is one of the most developed forms of green energy across the country. For generations, American engineers have been developing dams for many of our nation’s rivers. Once a river has been dammed, engineers can control how much water passes through at any given time. As that water flows, it rotates a series of turbines thus creating energy.

Unfortunately, if you don’t live close to a major water source, this form of green energy probably isn’t available to you, and it’s definitely not something a single homeowner can implement on their own property. That said, hydroelectric energy is collectively one of the largest sources of renewable energy in the country.

Wind energy

In order to turn wind into electricity, a new type of windmill has been developed. Often these windmills are installed in large groups referred to as wind farms. All throughout West Texas, there are thousands of new windmills that have been built over the past decade, and wind-generated power is becoming an increasingly substantial source of energy for the Texas grid.

In order to turn wind into electricity, a new type of windmill has been developed. Often these windmills are installed in large groups referred to as wind farms. All throughout West Texas, there are thousands of new windmills that have been built over the past decade, and wind-generated power is becoming an increasingly substantial source of energy for the Texas grid.

Individual homeowners can harness the wind to produce energy on a small scale, or if they’d rather not make that sort of an investment, many energy retailers offer products that are comprised of energy derived solely from wind farms in Texas. Either way, utilizing wind energy is one of the most effective ways for Texans to support green energy.

Solar energy

Harnessing the energy of the sun’s rays requires the use of solar panel technology. While solar panels were once extremely pricey, prices have come down as technology has advanced. Now, many people in sunny regions, including many areas of Texas, are installing their own personal solar arrays in order to capitalize on the most abundant energy resource in our solar system.

Harnessing the energy of the sun’s rays requires the use of solar panel technology. While solar panels were once extremely pricey, prices have come down as technology has advanced. Now, many people in sunny regions, including many areas of Texas, are installing their own personal solar arrays in order to capitalize on the most abundant energy resource in our solar system.

If one of your clients is interested in pursuing a green energy solution during the remodeling process, be sure to suggest they install their own solar array. Solar energy in particular can really pay off in the long run, especially when homeowners elect to sell the energy they do not use to other consumers on the grid.

If a client is interested in adding a solar array to their home, but isn’t sure if they can afford it, there are still options for them to consider. Some energy providers in Texas subsidize solar arrays, by offering to lease them to homeowners.

Green energy and remodeling go hand in hand

Considering how volatile the energy market has been in Texas over the past few years, it’s easy to make the case to many clients that green energy infrastructure is a worthwhile investment. Consider adding green energy installation to your skillset in order to capitalize on the current trends in the market!

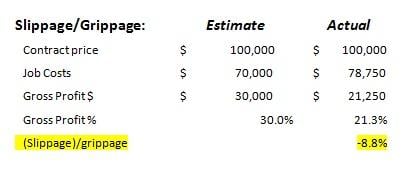

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

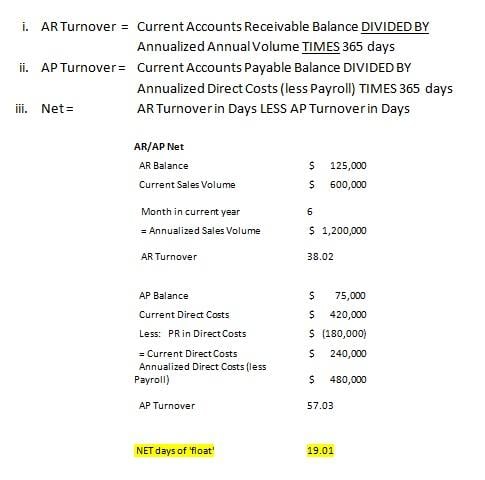

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due. Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.