3 Reasons Contractors Don't Share Financial Info With Employees

I recently read an interesting article about how much a business owner should tell their spouse about their company finances. Two different opinions were shared and explored. I’m on the side of sharing the info myself, but certainly not everything in detail.

That article got me to thinking about why so few construction and remodeling business owners share financial information with their employees. First, I’ll offer a few great reasons to do it. I hope the benefits will motivate more business owners to do so. Then, I’ll offer my thoughts on why business owners avoid doing so.

3 reasons to share your business financial information with employees:

Construction business owners who keep all the financial information about their businesses to themselves are definitively missing out on several potential benefits. Simply put, by sharing financial information you can accomplish at least three things that will help lower your financial anxiety and help you make and or keep more money:

You can get the opinions and advice of others so you can be more confident in your numbers and using them to make sound business decisions. Getting insight from others can also help you avoid costly mistakes.

You can get the opinions and advice of others so you can be more confident in your numbers and using them to make sound business decisions. Getting insight from others can also help you avoid costly mistakes.- By involving the right employees with the creation and interpretation of business financials you can share the workload required to create them. This can make getting your financial reports much more timely and therefore improve their accuracy.

- By mentoring employees on how to use financial reports you can help them learn to think like a business owner so they too can make sound business decisions. This is an important and required step if you ever want to remove yourself from the day to day management of your business and or offer a profit sharing plan to employees.

So then why do so few owners share their financial information?

Let me also offer three common reasons why many construction business owners can’t or won’t share business related financial information with their employees:

- The most common reason is because the business doesn’t have a real financial system that properly separates and tracks costs and expenses. For these business owners their financial system is really no more than a checkbook showing money coming in and going out. Without the ability to identify and separate your actual job costs from overhead expenses there is no way your business can get a meaningful profit and loss report. These business owners don’t share the information because there really is nothing of value worth sharing. Eventually, once a year for most of these business owners, their accountant gives them the good or bad news when their tax returns are ready to be filed.

Often financial information is held back because the business owner is embarrassed that he or she doesn't understand the business finances well enough to explain them or answer questions about them. This is not good. Imagine what a great employee will think about his boss and or the business if he discovers the owner is guessing at the financial health and well being of the company. Think about it. If you were an inspired and career motivated employee would you want to invest in your career at a business that is in the dark about predicting and measuring profits?

Often financial information is held back because the business owner is embarrassed that he or she doesn't understand the business finances well enough to explain them or answer questions about them. This is not good. Imagine what a great employee will think about his boss and or the business if he discovers the owner is guessing at the financial health and well being of the company. Think about it. If you were an inspired and career motivated employee would you want to invest in your career at a business that is in the dark about predicting and measuring profits?- During my years of experience providing financial consulting for construction business owners I have had many owners share with me their concern that if they educate employees about and share company financial information with them it will only serve to help them get ready to leave and start their own businesses. This could be true. On the other hand I found by educating my employees most of them figured out they didn’t want all the stress and financial responsibilities that came with being a business owner. However, those who did leave and started their own businesses where in a much better position to be financially successful. As a business owner I found personal satisfaction in helping make that possible.

Some words of advice

If this articles speaks to what is happening at your business it’s up to you to do something about it. I definitely recommend you do not consider growing your business in any way, or sharing the information with employees, until you and your business can produce and interpret accurate business financial reports. To help you see if doing so might be worth it try this self quiz to see if a properly setup financial system can help you and your employees improve business profits and reduce financial anxiety.

Bits

Bits Cost to repair and maintain tools and equipment

Cost to repair and maintain tools and equipment

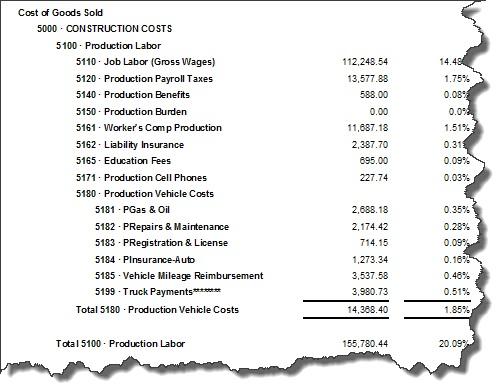

I was discussing the cost of labor the other day with a client, and he told me he really had a handle on what his costs were. “No kidding? That’s great,” I said. I then quizzed him on what factors he’d included, and was impressed that he’d gotten so many: wages; company-paid payroll taxes; Worker’s Comp; liability insurance; vehicles, cell phones, and small tools used by production workers; health insurance; retirement. “And what about non-productive time?” I asked. Puzzled, he asked me what I meant.

I was discussing the cost of labor the other day with a client, and he told me he really had a handle on what his costs were. “No kidding? That’s great,” I said. I then quizzed him on what factors he’d included, and was impressed that he’d gotten so many: wages; company-paid payroll taxes; Worker’s Comp; liability insurance; vehicles, cell phones, and small tools used by production workers; health insurance; retirement. “And what about non-productive time?” I asked. Puzzled, he asked me what I meant. Let’s do the math.

Let’s do the math.

When you’re young and in perfect health, it seems stupid to waste money on insurance. There are so many more important (and fun) things to buy: trucks, tools, additional personnel; the list is endless. I remember when I fell off my roof, my life didn’t flash before my eyes, but I did have a very clear sequence of thoughts.

When you’re young and in perfect health, it seems stupid to waste money on insurance. There are so many more important (and fun) things to buy: trucks, tools, additional personnel; the list is endless. I remember when I fell off my roof, my life didn’t flash before my eyes, but I did have a very clear sequence of thoughts.

Learn more about your Balance Sheet, the often under-utilized and misunderstood financial report that can spell success or failure

Learn more about your Balance Sheet, the often under-utilized and misunderstood financial report that can spell success or failure

The key to getting this right and meaningful is to decide beforehand what questions you want answered. So if you want to know what your gross profit is, for example, then you need to set up your Chart of Accounts to show it to you. If you want to figure out how much your production workers are costing you, then be sure to capture all the burdens along with the wages. If you want to find out which marketing methods are working best, then you’ll need to have two categories of information: (1) you’ll have to have your financials set up so you can see costs by marketing source, and (2) you’ll have to have a lead tracking system that will identify which leads are coming in from which source.

The key to getting this right and meaningful is to decide beforehand what questions you want answered. So if you want to know what your gross profit is, for example, then you need to set up your Chart of Accounts to show it to you. If you want to figure out how much your production workers are costing you, then be sure to capture all the burdens along with the wages. If you want to find out which marketing methods are working best, then you’ll need to have two categories of information: (1) you’ll have to have your financials set up so you can see costs by marketing source, and (2) you’ll have to have a lead tracking system that will identify which leads are coming in from which source.

When a prospect asks you if you will match someone else’s price for the same job you figure if the other guy can do it for that price so can you, so you say yes.

When a prospect asks you if you will match someone else’s price for the same job you figure if the other guy can do it for that price so can you, so you say yes. If you believe in the idea of relative success, where you convince yourself you are doing pretty well if you compare your results to other contractors who are doing far worse than you, then maybe you can be happy staying where you are regarding financial management at your business. On the other hand, if you want to measure your success against truly successful contractors, perhaps use

If you believe in the idea of relative success, where you convince yourself you are doing pretty well if you compare your results to other contractors who are doing far worse than you, then maybe you can be happy staying where you are regarding financial management at your business. On the other hand, if you want to measure your success against truly successful contractors, perhaps use  If you have been playing Contractor Roulette here is a simple three-step plan to help you end your gambling habit:

If you have been playing Contractor Roulette here is a simple three-step plan to help you end your gambling habit:

your production manager?

your production manager? If you’re setting out to just “drive around” you don’t need a destination. But if you need to get somewhere, it’s important to know where the destination is relative to where you are. So if I want to drive from New York to California, I should be heading west, not south. It’s the same with your financials. If you don’t have a clear view of the destination (answers to your questions), getting there is left to chance. You must identify what you want to find out.

If you’re setting out to just “drive around” you don’t need a destination. But if you need to get somewhere, it’s important to know where the destination is relative to where you are. So if I want to drive from New York to California, I should be heading west, not south. It’s the same with your financials. If you don’t have a clear view of the destination (answers to your questions), getting there is left to chance. You must identify what you want to find out. If you’re planning that trip from New York to California, the path you select will reflect your criteria, such as whether or not you are interested in the fastest route, the most scenic route, the cheapest route, etc. Accounting software varies in its user friendliness and flexibility. QuickBooks is highly flexible and very user friendly, which leads users to take inappropriate routes with a high degree of confidence! There are many ways to accomplish any given task. Making the right choice can be confusing, sort of like making the New York to California trip without the benefit of road signs (or GPS!). You must know the software.

If you’re planning that trip from New York to California, the path you select will reflect your criteria, such as whether or not you are interested in the fastest route, the most scenic route, the cheapest route, etc. Accounting software varies in its user friendliness and flexibility. QuickBooks is highly flexible and very user friendly, which leads users to take inappropriate routes with a high degree of confidence! There are many ways to accomplish any given task. Making the right choice can be confusing, sort of like making the New York to California trip without the benefit of road signs (or GPS!). You must know the software. Can you turn right on a red light in Iowa? Is the maximum speed limit in Kansas the same as that in Missouri? Is it mandatory to wear seat belts in Nevada? Do you have to turn on your lights if it’s raining in California? Just as you can get yourself into trouble while driving if you don’t know the law, you can get yourself in trouble in accounting if you don’t know the correct way to classify transactions. You must understand the basics of construction accounting.

Can you turn right on a red light in Iowa? Is the maximum speed limit in Kansas the same as that in Missouri? Is it mandatory to wear seat belts in Nevada? Do you have to turn on your lights if it’s raining in California? Just as you can get yourself into trouble while driving if you don’t know the law, you can get yourself in trouble in accounting if you don’t know the correct way to classify transactions. You must understand the basics of construction accounting. Help is available! There are good, experienced, qualified resources out there who can either start you out right or help you adjust your course. The key is to look for consultants and trainers with experience in your industry and in your software of choice. Find out how many businesses similar to yours they have worked with. A construction expert who has only worked with development companies with revenue in excess of $20M may not be appropriate for a startup remodeling company with forecast revenue of $600K. Get references. Request a no obligation 15 minute phone call to get a feel for whether they will be a good fit for your business and you.

Help is available! There are good, experienced, qualified resources out there who can either start you out right or help you adjust your course. The key is to look for consultants and trainers with experience in your industry and in your software of choice. Find out how many businesses similar to yours they have worked with. A construction expert who has only worked with development companies with revenue in excess of $20M may not be appropriate for a startup remodeling company with forecast revenue of $600K. Get references. Request a no obligation 15 minute phone call to get a feel for whether they will be a good fit for your business and you. Final Word

Final Word

Here are a few times when saying nothing might just be the best thing to say:

Here are a few times when saying nothing might just be the best thing to say:

A good number of contractors at one time or another find themselves in a financial hole. Rather than figure out how they got there, they just keep working, often assuming by working harder or longer hours they will eventually get out of the hole. Unfortunately many of them just dig a deeper hole and eventually the hole is so deep they can’t climb out so they stay in it. Sometimes the hole can even cave in all around them and bury them and their businesses. If you want to avoid the most common reasons contractors get into financial trouble

A good number of contractors at one time or another find themselves in a financial hole. Rather than figure out how they got there, they just keep working, often assuming by working harder or longer hours they will eventually get out of the hole. Unfortunately many of them just dig a deeper hole and eventually the hole is so deep they can’t climb out so they stay in it. Sometimes the hole can even cave in all around them and bury them and their businesses. If you want to avoid the most common reasons contractors get into financial trouble

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate?

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate? This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell.

This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell. First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use

First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use  If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

Why Profit Sharing and Open Book Management?

Why Profit Sharing and Open Book Management?