To Be Successful In 2013 Create a Business Plan And Do An Estimate

For me, when I still owned my remodeling business, getting ready for business growth meant I would first need to do two things; make a plan and create a budget.

Create your plan

Create your plan

First was to create a plan for what I wanted to do and how I would do it. I considered what projects I would specialize in, who I would work for, where I wanted to work, and how I would market my business so the right people would find me. I determined how many employees I would need as the business grew and what skills they would need now and later so I could delegate some of my current responsibilities and include the money needed to do so in my selling prices. After determining the how, I needed to predict how much.

A business budget is kind of like a project estimate

The first budget I created was very simple. By looking at the end of year profit and loss report, the financial history of my business from the previous year, I was able to list the majority of the expense categories I would need to consider to predict the costs of my new plan. For anything I wasn’t sure about, I would call my accountant or another remodeler I knew at my NARI Chapter for advice. Just like a remodeling project estimate, I listed the related expenses and then got current prices for each of them.

The Numbers Game

Creating that first budget for my plan to grow the business seemed very overwhelming. After all, I had never done one before. Looking back, the hardest part about doing it was actually sitting down to do it.

Once I had become clear on the financial definitions and formulas used, the budget actually went together fairly easily. I admit it was very time consuming that first time. However, because I kept notes on how I had determined certain expenses and where I got the information, the second budget I did was a breeze. I did not have to completely recreate or try to remember the entire thought process.

Once I had become clear on the financial definitions and formulas used, the budget actually went together fairly easily. I admit it was very time consuming that first time. However, because I kept notes on how I had determined certain expenses and where I got the information, the second budget I did was a breeze. I did not have to completely recreate or try to remember the entire thought process.

Planning and budgeting assumptions

As a result of living through the experience, I developed four simple assumptions, in addition to keeping notes, which helped organize the way I looked at the process. They should be completed in the following order as well.

- Commit to making a real profit, establish how much, and think of it as an expense that must be paid. You only need a budget if you plan to make a profit.

- Be clear on how you will define and separate direct and indirect costs. Once you identify which is which, recast your current accounting software's account list. This requires moving misplaced accounts and costs to their proper locations as either cost of goods sold or overhead expenses.

- Look at the big picture. Consider your annual budget as just one project, like a whole house project that takes a year to complete. Use your profit and loss report for the previous year as a start to estimate the coming year’s budget. Then start making adjustments for each account to reflect any price changes and or your new plans for the coming year.

- Be sure all of your direct costs will somehow show up in your individual project estimates. Pay particular attention to labor costs, equipment purchases and repair, and general miscellaneous supplies. Make sure the hourly labor cost you use is burdened over and above the wage you pay employees to include all labor-related expenses and benefits. If you own and repair your equipment, and or you use assorted hardware and supplies that do not end up as line items in your estimate, establish a percentage to add to your estimated direct costs so you will cover and include these costs before you add your markup.

Using this simple process year after year, I came to learn how important it was to my business’ success that I planned ahead for what I wanted to accomplish. With a plan in hand, and a budget for what it would cost, I had the confidence and motivation I needed to make success a planned reality. I also had full confidence in asking for the real price I needed to sell each project.

Collect the money needed to finance all of a milestone’s tasks before you start it (don’t be Wimpy on this!)

Collect the money needed to finance all of a milestone’s tasks before you start it (don’t be Wimpy on this!)

There is way too much to learn about accounting and financing to cover or explain in this short blog article. I suppose that is why it is actually a career for some people. That’s why there are accountants, business consultants and financial advisors. For a business owner though, understanding and overseeing the process are the bare minimums. The ultimate success and profitability of your company is typically not left to someone else; it’s the owner’s responsibility. In order to identify what business owners need to do, I find have found it helpful to show my

There is way too much to learn about accounting and financing to cover or explain in this short blog article. I suppose that is why it is actually a career for some people. That’s why there are accountants, business consultants and financial advisors. For a business owner though, understanding and overseeing the process are the bare minimums. The ultimate success and profitability of your company is typically not left to someone else; it’s the owner’s responsibility. In order to identify what business owners need to do, I find have found it helpful to show my

Take this self quiz to see if a properly set up financial system would benefit you and your business:

Take this self quiz to see if a properly set up financial system would benefit you and your business:

The books in the list I offer below fall into the top five books I think remodelers should read if they want to grow a successful business and reduce the total time it takes to do so. More importantly, these books can help remodelers avoid the frustrations, wasted time and wasted money that come with the trial and error approach of going it alone as a business owner. Even if you still can’t build the business you want on your own after reading these books, you will definitely know what help you will need to get there

The books in the list I offer below fall into the top five books I think remodelers should read if they want to grow a successful business and reduce the total time it takes to do so. More importantly, these books can help remodelers avoid the frustrations, wasted time and wasted money that come with the trial and error approach of going it alone as a business owner. Even if you still can’t build the business you want on your own after reading these books, you will definitely know what help you will need to get there

A Few Ways You Might Be Affected:

A Few Ways You Might Be Affected: There nothing worse than the feeling of working really hard to earn a profit only to find out that you could have reduced your total tax burden (and the amount of profit you get to keep) by taking advantage of simple and completely legal tax strategies. A big lesson for me when I owned my remodeling business was making sure I had the right accountant and financial advice. Saving money on an accountant’s fees might just cost you far more in taxes than the money you might save if you have chosen your accountant based on price rather than value, strategic advice and timely services.

There nothing worse than the feeling of working really hard to earn a profit only to find out that you could have reduced your total tax burden (and the amount of profit you get to keep) by taking advantage of simple and completely legal tax strategies. A big lesson for me when I owned my remodeling business was making sure I had the right accountant and financial advice. Saving money on an accountant’s fees might just cost you far more in taxes than the money you might save if you have chosen your accountant based on price rather than value, strategic advice and timely services.

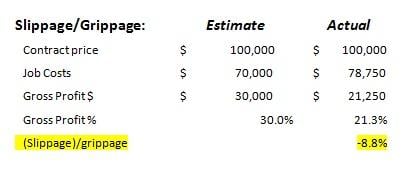

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

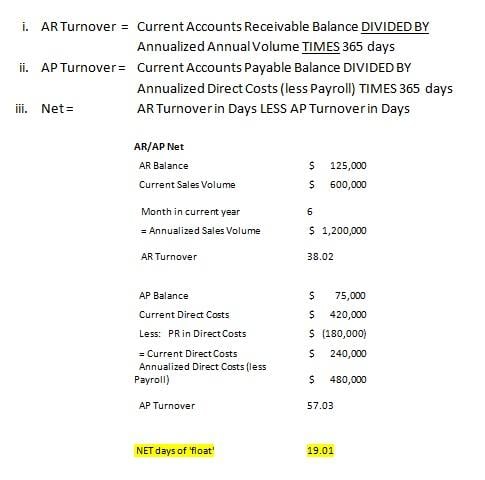

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due. Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

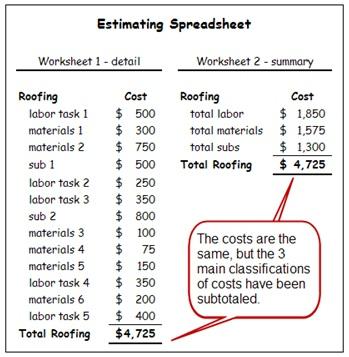

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems: Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above.

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above.