Five Keys To Getting Contractor Financial Reports That Speak To You

Guest Blogger: Melanie Hodgdon is a Certified QuickBooks ProAdvisor who has been providing financial analysis and QuickBooks training for contractors since 1994. She’s the co-author of A Simple Guide to Turning a Profit as a Contractor. Melanie and Shawn often coordinate their efforts when helping remodelers develop financial systems for their businesses so they serve the contractor, not just their accountant.

“How can I get meaningful financial reports for my construction business?”

There’s a big difference between a pile of materials and a well-designed building. Yes, everything required to create and use the building is contained within the pile, but until it’s been put together with the intention of producing something useful and well-thought-out, it’s pretty much useless.

The same thing applies to contractor financial reports

I have worked with literally hundreds of contractors’ financial databases, and many of them have got the majority of the information in there, all right. The problem is that, just like the pile of materials, the information isn’t organized in a way to let them easily draw conclusions. Just like the point of having a house is to provide shelter, the point of having financial reports is to make informed management decisions.

My clients, seminar attendees, and reader audience are probably sick of hearing this, but if reports don’t provide useful information at-a-glance, they aren’t doing you any good. Contractors can’t afford to have their bookkeeper or accountant adjust, explain, and interpret reports. Waiting for this kind of information puts them at the mercy of others. Instead, any contractor should be able to instantly access, review, and draw conclusions from standard reports any time he feels like it!

Begin with the end in mind

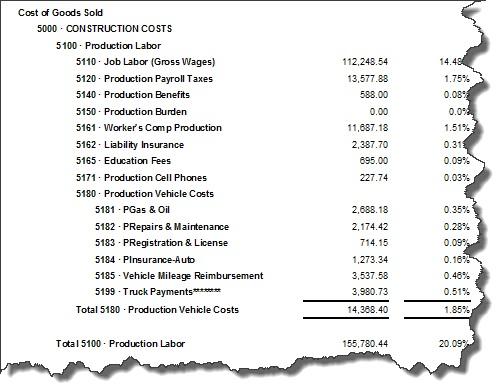

The key to getting this right and meaningful is to decide beforehand what questions you want answered. So if you want to know what your gross profit is, for example, then you need to set up your Chart of Accounts to show it to you. If you want to figure out how much your production workers are costing you, then be sure to capture all the burdens along with the wages. If you want to find out which marketing methods are working best, then you’ll need to have two categories of information: (1) you’ll have to have your financials set up so you can see costs by marketing source, and (2) you’ll have to have a lead tracking system that will identify which leads are coming in from which source.

The key to getting this right and meaningful is to decide beforehand what questions you want answered. So if you want to know what your gross profit is, for example, then you need to set up your Chart of Accounts to show it to you. If you want to figure out how much your production workers are costing you, then be sure to capture all the burdens along with the wages. If you want to find out which marketing methods are working best, then you’ll need to have two categories of information: (1) you’ll have to have your financials set up so you can see costs by marketing source, and (2) you’ll have to have a lead tracking system that will identify which leads are coming in from which source.

Even software that advertises itself as being set up specifically for contractors doesn’t necessarily classify costs in the most useful way for a particular company; relying on the software to control the content and level of detail of information means you may be giving up answers that are important to you.

Here are five keys to getting the financial reports contractors need:

- First and foremost, give accounts names that make sense to you. If you want to call your refuse disposal garbage, do it. Don’t be hung up on what your accountant thinks it should be called. Use names that are familiar, descriptive, and have meaning for you.

- Separate costs related to production from overhead by using different types of accounts; when you run your financial reports, they will be in different regions of the reports and you should be able to get key numbers (such as gross profit) without doing anything more.

- Use account numbers to control the order of the accounts. Without numbers, your reports may appear in alphabetical order, which may be far less revealing.

- Organize the accounts in clusters; use sub-accounts to provide detail when required. For example, you can have a main account for marketing, but use sub-accounts for web, home show, print, and other categories.

- Arrange accounts to show the biggest numbers higher up. For example, if you cluster your production-related accounts together, and 50% of your production costs are for subcontractors, then put the subcontractor account at the top of the production cost list. If you spend only 3% on permits, put that at the bottom.

Take control of your Chart of Accounts so that your financials will speak to you.

You don’t have to have an MBA to derive meaning from reports; the basics are pretty darned easy to understand. However, if your accounts have arcane names, are organized with an inappropriate level of detail, or are in the wrong location, your job will be made more difficult. It’s challenging enough being a contractor without making things harder than they have to be!