Tips For Contractors On Ball Park Pricing and Charging For Estimates

Any contractor who has been in business for any length of time has probably had to deal with Ball Park pricing and charging for estimates. Home owners always seem to want one but not the other. Rather than risk letting a Ball Park price make them look bad, savvy contractors can use the request for one to help cause the other to happen. If interested in how to do this, read on.

Let’s start with Ball Park Pricing

How many times in your career has a homeowners asked you for a “Ball Park” price for their project. And, how many times did your Ball Park price end up being nowhere close to the actual price of the project?

How many times in your career has a homeowners asked you for a “Ball Park” price for their project. And, how many times did your Ball Park price end up being nowhere close to the actual price of the project?

I find the whole idea of Ball Park pricing comical. I’m not saying it doesn’t have value in some selling scenarios. I am saying however that when contractors offer a Ball Park price more times than not they strike out rather than hit a home run.

So, when I was selling remodeling and a prospect asked me for a ball park number, I would respond by asking them which ball park they preferred; Fenway Park or Yankee Stadium. That usually stopped them right there in their tracks and helped them think about what they just asked for. And, by asking that question, I was able to get them into a much more meaningful conversation about their project. Let’s face it; a "ball park number" really doesn't have much value unless there are some specifications to help give it any relevance.

Try asking them about which Ball Park they are looking for. Feel free to substitute the parks you use. I think you will find doing so to be a great conversation starter.

Then there’s the whole idea about charging for estimates

As contractors we know estimates are not free. Somehow the cost of creating an estimate must be recouped by the contractor.

Some contractors may say they don’t charge for estimating. If that is true they are working for free and the cost of estimating is not included in the price quoted to the prospect. I don’t know about you, but in my opinion if you do estimates for free you are undervaluing your worth and might also be putting your professionalism in doubt. If you are not charging for estimates, and you also are not accumulating enough money to someday retire, working for free might be a good part of why. And, contractors who do so are making things challenging for those who do charge by helping consumers think they should get estimates for free.

On the other hand many contractors who tell their prospects they do not charge for estimates are actually not charging for the estimate in advance, they recoup the cost of estimating through their markup; but only if they sell the job.

It’s OK if they don't want to pay, but why get offended?

So why do prospects get offended when you tell them you charge for estimates? Did they expect you to work for free? Do they work for free at their jobs? I doubt it.

So why do prospects get offended when you tell them you charge for estimates? Did they expect you to work for free? Do they work for free at their jobs? I doubt it.

When I was selling remodeling and homeowners asked if I would do free estimates I would say yes and give them an estimate right then and there. I would say something like “I estimate the bathroom project will cost somewhere between $15 and 25, 000”. Then I would just wait. When they asked why such a big range I would simply ask them why they thought I had to give such a big range. It usually led to meaningful conversations about the fact that an estimate is really just a guess and may not have any relevance to the true cost of what they would actually want to buy. And, as a result, having this conversation helped them discover the need for plans and or specification so I could give them a fixed price in place of the “estimate”.

After all, that’s what most remodeling consumers really want; a fixed price for what they actually want.

One option you can try if the Home Owner can’t understand why you charge for estimates

Next time a homeowner wants a free estimate, or is upset about charging for one, why not suggest bartering?

"If I spend the time to collect all the info about your project, seek pricing from my vendors, meet with my subs to get accurate pricing for their work, and then assemble an accurate cost and proposal; how about we do a trade? Maybe while I'm doing that stuff you could either babysit my kids or cut my lawn? What to do think Mr. Home Owner, would that be a fair trade?"

A point of clarification which should already be obvious

A point of clarification which should already be obvious

If you choose to go down the “Which Ball Park” or “Let’s barter” path make sure you do it in a respectful manner and your purpose for using this analogy is appreciated by your prospect.

How you say it can make the difference between being the contractor of choice and being shown the door!

Need help with estimating?

Checkout this Estimating Workshop for Contractors

Try to get your clients to make their selections during the design phase.

Try to get your clients to make their selections during the design phase.

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate?

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate? This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell.

This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell. First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use

First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use  If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

Create your plan

Create your plan  Once I had become clear on the

Once I had become clear on the

There is way too much to learn about accounting and financing to cover or explain in this short blog article. I suppose that is why it is actually a career for some people. That’s why there are accountants, business consultants and financial advisors. For a business owner though, understanding and overseeing the process are the bare minimums. The ultimate success and profitability of your company is typically not left to someone else; it’s the owner’s responsibility. In order to identify what business owners need to do, I find have found it helpful to show my

There is way too much to learn about accounting and financing to cover or explain in this short blog article. I suppose that is why it is actually a career for some people. That’s why there are accountants, business consultants and financial advisors. For a business owner though, understanding and overseeing the process are the bare minimums. The ultimate success and profitability of your company is typically not left to someone else; it’s the owner’s responsibility. In order to identify what business owners need to do, I find have found it helpful to show my

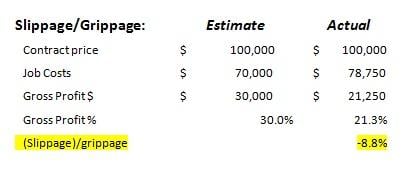

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

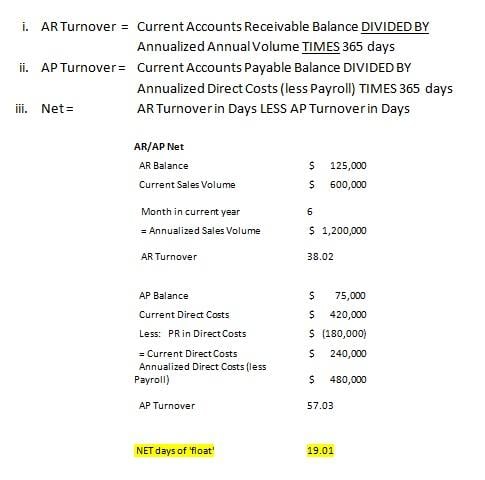

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

There are many reason construction businesses fail. A read of a 2007 report by the Joint Center for Housing Studies at Harvard University titled

There are many reason construction businesses fail. A read of a 2007 report by the Joint Center for Housing Studies at Harvard University titled  First, if you don’t put efficient business systems in place as a small business your likelihood of failure will be very high even if your business remains small in size. Also, even with modest growth, unless you put systems in place your business is more likely to fail. Also consider, without efficient systems, it will be you the business owner who will have to work harder and longer to get things done due to the lack of those systems. If that is the case then burn out and or the typical resulting health problems might lead to failure. But remember, that burnout happened because of a lack of systems.

First, if you don’t put efficient business systems in place as a small business your likelihood of failure will be very high even if your business remains small in size. Also, even with modest growth, unless you put systems in place your business is more likely to fail. Also consider, without efficient systems, it will be you the business owner who will have to work harder and longer to get things done due to the lack of those systems. If that is the case then burn out and or the typical resulting health problems might lead to failure. But remember, that burnout happened because of a lack of systems. First, unless you can determine the cost of being in business you won’t know what to charge for your services over and above the direct job costs of labor and materials. If you don’t know what to charge you literally won’t know whether you are buying or selling jobs. Plus, every contractor I have helped do a budget goes forward with confidence and success selling at the price they now know they need to get to be profitable.

First, unless you can determine the cost of being in business you won’t know what to charge for your services over and above the direct job costs of labor and materials. If you don’t know what to charge you literally won’t know whether you are buying or selling jobs. Plus, every contractor I have helped do a budget goes forward with confidence and success selling at the price they now know they need to get to be profitable.

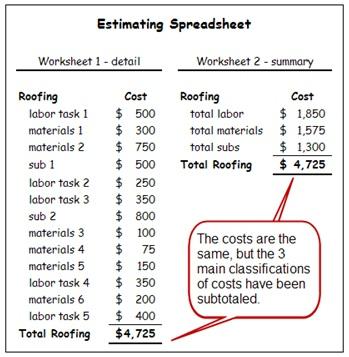

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems: Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above.

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above. Labor cost is one of the most difficult costs to predict in an estimate. Basically, this cost is determined by calculating the hours required to complete a task or project and then factoring those estimated hours by what it costs your business per hour to compensate and support your field employees. The cost per hour to compensate and support your field employees is commonly called burdened labor costs or your burdened hourly rate.

Labor cost is one of the most difficult costs to predict in an estimate. Basically, this cost is determined by calculating the hours required to complete a task or project and then factoring those estimated hours by what it costs your business per hour to compensate and support your field employees. The cost per hour to compensate and support your field employees is commonly called burdened labor costs or your burdened hourly rate.

The hard cost of labor includes not only the hourly wage of the employee, but also all employer-paid taxes, Social Security, insurance, vehicle expenses, and any employee benefits. Workmen’s Compensation, liability insurance, auto insurance, paid holidays, vacations, medical benefits, education, employee meetings, cell phones, pagers, and every other labor-related expense must be factored into your hourly rates.

The hard cost of labor includes not only the hourly wage of the employee, but also all employer-paid taxes, Social Security, insurance, vehicle expenses, and any employee benefits. Workmen’s Compensation, liability insurance, auto insurance, paid holidays, vacations, medical benefits, education, employee meetings, cell phones, pagers, and every other labor-related expense must be factored into your hourly rates.