Guest Blogger: Melanie Hodgdon is a Certified QuickBooks ProAdvisor who has been providing financial analysis and QuickBooks training for contractors since 1994. She’s the author of A Simple Guide to Turning a Profit as a Contractor. Melanie and Shawn often coordinate their efforts when helping remodelers develop financial systems for their businesses so they serve the contractor, not just their accountant.

Benefits of Rethinking Your Estimating and Job Costing Approach

What functions should an estimate serve on a fixed/contract price job?

Pricing

The cost of the job determines the price of the job, so knowing the costs allows you to generate a sale price.

Job Costing

The estimate can function like a budget for both time and costs.

In order to price and job cost accurately, the estimate needs a lot of detail. If you (oops!) forget to include windows or a toilet, your only choices are (a) go back to the customer, admit your mistake, and hope he accepts the revised price or (b) eat the cost.

Also, sharing a highly detailed estimate with the project’s lead carpenter can help limit questions from the field back to the office.

But the same high level of detail that can save you when pricing and producing the job can get in your way if you attempt to job cost at that same level of detail. As a QuickBooks ProAdvisor working with literally hundreds of contractors, I have seen two common categories of errors:

Job costing at too high a level of detail can be a problem

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

- Your project manager and bookkeeper will waste time coding out every little line item on a vendor’s bill.

- The more opportunity for choice, the more likelihood of misclassifying things. Highly detailed job cost reports actually have a greater chance of being inaccurate on a category-by-category basis.

- Your job cost reports will be so lengthy and complex that you’ll lose the forest for the trees.

Job costing using apples and oranges?

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

- They create a disconnect between the categories used for estimating (apples) and those use for job costing (oranges), making it virtually impossible to compare common estimated and actual categories

- They create an ever-increasing list of job-specific categories inside QuickBooks with single-use history

How to do it right

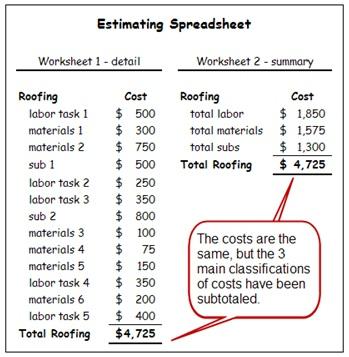

Instead, estimate at a high level of detail but create a way to subtotal these into categories that you use consistently, will be relatively simple to code, and will produce reports that allow you to perform a side-by-side comparison of estimated and actual costs.

For those using a customized spreadsheet for estimating, the process might look like this:

The summarized categories with costs can then be entered in your accounting software and job costed using the same categories. Doing this will keep your cost categories consistent and provide apples to apples comparison.