Comparing Contractor Markups Can Be Pointless and Very Risky

Many remodelers determine their pricing structure by copying what other businesses do rather than figure out what markup their business actually needs to use. Comparing or copying markups or margins is pointless and very risky without knowing how they were determined. The decision about what costs or expenses go above or below the gross profit line can be different at different remodeling companies. Therefore the markup each company will need to use to cover overhead costs and planned net profit will be different. Let me explain and clarify.

Many remodelers determine their pricing structure by copying what other businesses do rather than figure out what markup their business actually needs to use. Comparing or copying markups or margins is pointless and very risky without knowing how they were determined. The decision about what costs or expenses go above or below the gross profit line can be different at different remodeling companies. Therefore the markup each company will need to use to cover overhead costs and planned net profit will be different. Let me explain and clarify.

First, here are the terms you need to know

First, here are the terms you need to know

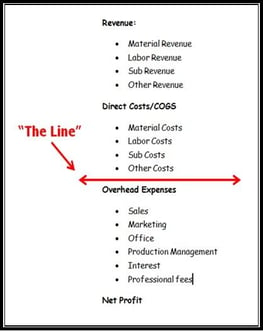

Above the line = direct project costs (materials, labor -including burdens, subs and equipment costs)

Below the line = overhead related expenses

Indirect costs = overhead expenses plus net profit added together

Here is the simple mathematical formula for determining your markup

The businesses’ total indirect costs divided by the expected direct costs for an anticipated volume of work equals the required markup % to add to estimated direct costs.

This assumes profit is a required expense of doing business!

Let’s do an example:

The setup:

Assuming a remodeler is running a $900,000.00 a year business with the following above and below the line expenses:

$300,000.00 (Of indirect cost: overhead + net profit) ÷ $600,000.00 (Of direct cost: materials, labor and subs) = 50% markup

Proving the math works:

So, $600,000.00 of estimate direct job costs marked up by 50% = $900,000.00 (Provides a sell price that includes $300,000.00 of gross profit to cover the indirect costs of overhead and net profit)

One contractor can put something like vehicle expenses or worker’s compensation insurance related to field staff above the line. Another might put the same items below the line. These two contractors may get to the same exact selling price but will be using different markups to get there.

Other important considerations to be aware of

It also important to know that fewer than 20% of remodelers actually know the true costs of being in business. That means that 80% or more are using what has been referred to as the WAG or “Wild Ass Guess” method when it comes to deciding what markup they use to price the projects they sell. I call that “Contractor Roulette”

It also important to know that fewer than 20% of remodelers actually know the true costs of being in business. That means that 80% or more are using what has been referred to as the WAG or “Wild Ass Guess” method when it comes to deciding what markup they use to price the projects they sell. I call that “Contractor Roulette”

If that isn’t shocking enough for you keep in mind that about 9 out of 10 remodelers go out of business within ten years. Your chances of copying a successful remodeler’s markup are therefore about one out of ten. And the odds of copying the wrong markup get even greater if you don't know how, or even if, that remodeler actually calculated his required markup or did the WAG.

So here’s the bottom line regarding markup

You need to do the math or you won't know whether you are buying or selling jobs! Your ultimate success hinges on knowing the true costs of being in business and how to profitably price the work you sell.

So, what about you and your business?

So, what about you and your business?

The choice is yours. You can get the help you need to figure out what you need to charge for your work so you can be successful. Or, you can continue using the Wild Ass Guess Method and go to bed every night wondering if and when you will join the 90% who go out of business.

Other related articles:

Self Quiz To See If A Properly Setup Financial System Can Help You:

10 Causes of Construction Business Owner Financial Anxiety

Don't Put Your Business at Risk by Guessing At What Markup to Use

Don’t Confuse Bad Cash Flow with Under-Pricing

The Five Biggest Financial Mistakes Contractors Make