3 Simple Steps To Covering A Carpenter's Non Productive Time

If your business pays a carpenter or other hourly employee for non productive time you better know how to build it into your labor charges so your customers are paying for it, not your profits. The theory for how to do it is actually very simple.

What is nonproductive time?

Nonproductive time is the hours you must pay an employee for, when he or she is not producing income for the business. Basically it’s what is typically referred to as non-billable time. Non productive time can fall into a variety of categories for a construction company. Here is a brief list of common examples:

Examples of nonproductive time for carpenters

Examples of nonproductive time for carpenters

- Attending weekly meetings

- Shop, tool and vehicle maintenance

- Commuting to/from projects

- Attending educational events and training

- Vacations, Holidays, Sick Days

- Attending company social functions

How to include nonproductive time in your labor rates in 3 steps

In order to pay an employee for his or her nonproductive time a contractor must charge enough for that employee’s annual billable hours to also cover the non-billable hours. To figure out how much to charge follow these simple steps.

- Add up the total annual cost to the business to compensate and support the employee. In addition to hourly wages, here is a partial list to help you out. Add any others specific to your business.

- Employer paid taxes and Social Security

- Vehicle expenses

- Vehicle replacement

- Workmen’s Comp

- Liability Insurance

- Medical benefits

- Education and Training

- Employee raises during the year

- 401K or similar

- Add up the total annual non-billable hours for that employee and subtract them from total paid hours to determine that employee’s total available billable hours.

- Divide the total annual cost to compensate and support the employee by the total annual billable hours for that employee.

The resulting number is what you need to charge for each billable hour so it will, over the course of a year, bring in the money needed to pay that employee for all billable and non-billable hours.

Below is an example to help show how the math works

The example assumes an annual cost of $60,000 to compensate and support the employee. It also assumes the employee will be paid for 2080 hours but can only be billed out for 1900 hours.

$60,000.00 ÷ 1900 billable hours = $31.58/Hr billable hourly rate

To prove the example above works simply multiply the billable rate by the number of billable hours to prove it will produce the total amount of money you will need to cover the cost of the employee for the entire year.

1900 Billable hours X $31.58/Hr = $60,002.00

It’s that simple! Kinda...

Figuring out what to charge to cover your carpenter’s nonproductive time is simple to do, but here are a few caveats to keep in mind so you don’t come up short on the money you need.

- If the employee doesn’t work all of the assumed billable hours you will not collect enough money. So, if you have an employee who is constantly sick or is unreliable, realize that even though you may not be paying the employee for the missed time, that missed time is not contributing to the dollars you need to cover the total annual cost of the assumed non-productive time.

- And, if in your billable hourly rate you included the costs of items required to support the employee, you will also come up short on the money you need to pay for those items as well.

Need help figuring out your Labor Costs?

Attend this workshop to find out how to calucalate and include burdened labor costs into your estimates

Get 6 credits towards your MA CSL renewal too!

"Estimating, Pricing and Producing Successful Projects"

February 7th, 2014 at Brockway Smith Company in Andover MA

February 11th, 2014 at Brockway Smith Company in Hatfield MA

February 12th, 2014 at Sterritt Lumber in Watertown MA

Rather work one-on-one?

Call or Email Shawn today.

Bits

Bits Cost to repair and maintain tools and equipment

Cost to repair and maintain tools and equipment

I was discussing the cost of labor the other day with a client, and he told me he really had a handle on what his costs were. “No kidding? That’s great,” I said. I then quizzed him on what factors he’d included, and was impressed that he’d gotten so many: wages; company-paid payroll taxes; Worker’s Comp; liability insurance; vehicles, cell phones, and small tools used by production workers; health insurance; retirement. “And what about non-productive time?” I asked. Puzzled, he asked me what I meant.

I was discussing the cost of labor the other day with a client, and he told me he really had a handle on what his costs were. “No kidding? That’s great,” I said. I then quizzed him on what factors he’d included, and was impressed that he’d gotten so many: wages; company-paid payroll taxes; Worker’s Comp; liability insurance; vehicles, cell phones, and small tools used by production workers; health insurance; retirement. “And what about non-productive time?” I asked. Puzzled, he asked me what I meant. Let’s do the math.

Let’s do the math.

When you’re young and in perfect health, it seems stupid to waste money on insurance. There are so many more important (and fun) things to buy: trucks, tools, additional personnel; the list is endless. I remember when I fell off my roof, my life didn’t flash before my eyes, but I did have a very clear sequence of thoughts.

When you’re young and in perfect health, it seems stupid to waste money on insurance. There are so many more important (and fun) things to buy: trucks, tools, additional personnel; the list is endless. I remember when I fell off my roof, my life didn’t flash before my eyes, but I did have a very clear sequence of thoughts.

Learn more about your Balance Sheet, the often under-utilized and misunderstood financial report that can spell success or failure

Learn more about your Balance Sheet, the often under-utilized and misunderstood financial report that can spell success or failure

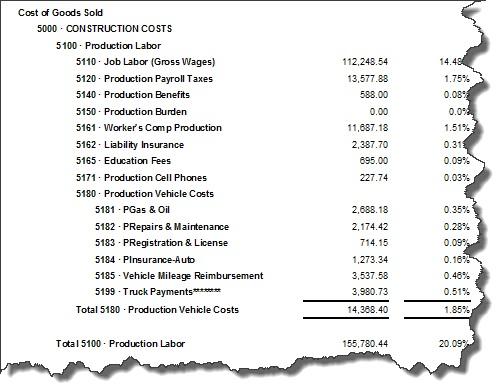

The key to getting this right and meaningful is to decide beforehand what questions you want answered. So if you want to know what your gross profit is, for example, then you need to set up your Chart of Accounts to show it to you. If you want to figure out how much your production workers are costing you, then be sure to capture all the burdens along with the wages. If you want to find out which marketing methods are working best, then you’ll need to have two categories of information: (1) you’ll have to have your financials set up so you can see costs by marketing source, and (2) you’ll have to have a lead tracking system that will identify which leads are coming in from which source.

The key to getting this right and meaningful is to decide beforehand what questions you want answered. So if you want to know what your gross profit is, for example, then you need to set up your Chart of Accounts to show it to you. If you want to figure out how much your production workers are costing you, then be sure to capture all the burdens along with the wages. If you want to find out which marketing methods are working best, then you’ll need to have two categories of information: (1) you’ll have to have your financials set up so you can see costs by marketing source, and (2) you’ll have to have a lead tracking system that will identify which leads are coming in from which source.

In my opinion when any business seeks to be competitive it typically becomes a commodity. By that I mean the buying public looks at that business and or it’s offering as being the same as their other choices. When consumers see a product or service as a commodity they ultimately make their choice between available options based on price. By trying to remain competitive contractors playing in this sandbox become bidders in a reverse auction where the loser is the one who wins.

In my opinion when any business seeks to be competitive it typically becomes a commodity. By that I mean the buying public looks at that business and or it’s offering as being the same as their other choices. When consumers see a product or service as a commodity they ultimately make their choice between available options based on price. By trying to remain competitive contractors playing in this sandbox become bidders in a reverse auction where the loser is the one who wins.  When I ask how they know they are the most expensive most contractors tell me their prospects are the source of their assumptions. For those using their prospects' feedback to determine their price point in the marketplace remember, buyers are liars. The 11th commandment states that you can lie to a sales person and still go to heaven!

When I ask how they know they are the most expensive most contractors tell me their prospects are the source of their assumptions. For those using their prospects' feedback to determine their price point in the marketplace remember, buyers are liars. The 11th commandment states that you can lie to a sales person and still go to heaven! Now, if a contractor has done market research, for his or her local market, this may be true. Savvy contractors, those who know what price they need to charge, will sell at higher prices up to the point that a majority of protects stop buying. I would consider this to be true market research. However, these business not only know how to determine the true costs of doing business, they also typically have professional marketing programs to help them get in front of specific prospects and they employ professionally trained salespeople who know how to sell.

Now, if a contractor has done market research, for his or her local market, this may be true. Savvy contractors, those who know what price they need to charge, will sell at higher prices up to the point that a majority of protects stop buying. I would consider this to be true market research. However, these business not only know how to determine the true costs of doing business, they also typically have professional marketing programs to help them get in front of specific prospects and they employ professionally trained salespeople who know how to sell.

When a prospect asks you if you will match someone else’s price for the same job you figure if the other guy can do it for that price so can you, so you say yes.

When a prospect asks you if you will match someone else’s price for the same job you figure if the other guy can do it for that price so can you, so you say yes. If you believe in the idea of relative success, where you convince yourself you are doing pretty well if you compare your results to other contractors who are doing far worse than you, then maybe you can be happy staying where you are regarding financial management at your business. On the other hand, if you want to measure your success against truly successful contractors, perhaps use

If you believe in the idea of relative success, where you convince yourself you are doing pretty well if you compare your results to other contractors who are doing far worse than you, then maybe you can be happy staying where you are regarding financial management at your business. On the other hand, if you want to measure your success against truly successful contractors, perhaps use  If you have been playing Contractor Roulette here is a simple three-step plan to help you end your gambling habit:

If you have been playing Contractor Roulette here is a simple three-step plan to help you end your gambling habit:

your production manager?

your production manager? If you’re setting out to just “drive around” you don’t need a destination. But if you need to get somewhere, it’s important to know where the destination is relative to where you are. So if I want to drive from New York to California, I should be heading west, not south. It’s the same with your financials. If you don’t have a clear view of the destination (answers to your questions), getting there is left to chance. You must identify what you want to find out.

If you’re setting out to just “drive around” you don’t need a destination. But if you need to get somewhere, it’s important to know where the destination is relative to where you are. So if I want to drive from New York to California, I should be heading west, not south. It’s the same with your financials. If you don’t have a clear view of the destination (answers to your questions), getting there is left to chance. You must identify what you want to find out. If you’re planning that trip from New York to California, the path you select will reflect your criteria, such as whether or not you are interested in the fastest route, the most scenic route, the cheapest route, etc. Accounting software varies in its user friendliness and flexibility. QuickBooks is highly flexible and very user friendly, which leads users to take inappropriate routes with a high degree of confidence! There are many ways to accomplish any given task. Making the right choice can be confusing, sort of like making the New York to California trip without the benefit of road signs (or GPS!). You must know the software.

If you’re planning that trip from New York to California, the path you select will reflect your criteria, such as whether or not you are interested in the fastest route, the most scenic route, the cheapest route, etc. Accounting software varies in its user friendliness and flexibility. QuickBooks is highly flexible and very user friendly, which leads users to take inappropriate routes with a high degree of confidence! There are many ways to accomplish any given task. Making the right choice can be confusing, sort of like making the New York to California trip without the benefit of road signs (or GPS!). You must know the software. Can you turn right on a red light in Iowa? Is the maximum speed limit in Kansas the same as that in Missouri? Is it mandatory to wear seat belts in Nevada? Do you have to turn on your lights if it’s raining in California? Just as you can get yourself into trouble while driving if you don’t know the law, you can get yourself in trouble in accounting if you don’t know the correct way to classify transactions. You must understand the basics of construction accounting.

Can you turn right on a red light in Iowa? Is the maximum speed limit in Kansas the same as that in Missouri? Is it mandatory to wear seat belts in Nevada? Do you have to turn on your lights if it’s raining in California? Just as you can get yourself into trouble while driving if you don’t know the law, you can get yourself in trouble in accounting if you don’t know the correct way to classify transactions. You must understand the basics of construction accounting. Help is available! There are good, experienced, qualified resources out there who can either start you out right or help you adjust your course. The key is to look for consultants and trainers with experience in your industry and in your software of choice. Find out how many businesses similar to yours they have worked with. A construction expert who has only worked with development companies with revenue in excess of $20M may not be appropriate for a startup remodeling company with forecast revenue of $600K. Get references. Request a no obligation 15 minute phone call to get a feel for whether they will be a good fit for your business and you.

Help is available! There are good, experienced, qualified resources out there who can either start you out right or help you adjust your course. The key is to look for consultants and trainers with experience in your industry and in your software of choice. Find out how many businesses similar to yours they have worked with. A construction expert who has only worked with development companies with revenue in excess of $20M may not be appropriate for a startup remodeling company with forecast revenue of $600K. Get references. Request a no obligation 15 minute phone call to get a feel for whether they will be a good fit for your business and you. Final Word

Final Word I work with many companies in transition. The steps from being a “guy and a truck” to having an office and a bookkeeper and field employees are frequently challenging, but the milestones are pretty easy to identify. Ray the Remodeler used to work out of his house, but now he’s got an office. Bill the Builder used to pound nails, but now he does sales and supervises a crew. A less easily-measured but potentially even more important milestone is when the owner is able to recognize and maintain separation between himself (his personality, his idiosyncrasies, his strengths and weaknesses, his preferences, and his habits) from the company for the sake of the business.

I work with many companies in transition. The steps from being a “guy and a truck” to having an office and a bookkeeper and field employees are frequently challenging, but the milestones are pretty easy to identify. Ray the Remodeler used to work out of his house, but now he’s got an office. Bill the Builder used to pound nails, but now he does sales and supervises a crew. A less easily-measured but potentially even more important milestone is when the owner is able to recognize and maintain separation between himself (his personality, his idiosyncrasies, his strengths and weaknesses, his preferences, and his habits) from the company for the sake of the business. Adding the trappings of a business (office, staff) without shifting attitudes about the business has held many owners back and limited the potential growth of their companies. As long as they see themselves as remodelers, rather than owners of businesses that deliver the service of remodeling, they risk seeing their businesses as extensions of themselves, reflecting their own strengths and weaknesses. They also tend to see their companies as being so unique that they can’t be run using best business practices.

Adding the trappings of a business (office, staff) without shifting attitudes about the business has held many owners back and limited the potential growth of their companies. As long as they see themselves as remodelers, rather than owners of businesses that deliver the service of remodeling, they risk seeing their businesses as extensions of themselves, reflecting their own strengths and weaknesses. They also tend to see their companies as being so unique that they can’t be run using best business practices. Chase profit, not dollars. When owners start talking about how much their sales have increased, I remain unimpressed. Sales are nothing. Profit is where it’s at. Let’s say your volume is $600,000 in year 1 and $900,000 in year 2. A 50% increase, right? Wonderful, right? Maybe yes, and maybe no. If in order to sell and produce 50% more you had to hire a production manager, an estimator, and a salesperson and that caused a significant increase in your overhead, you could wind up with a lower net margin at the end of year 2. You might even end up with fewer actual dollars of profit to say nothing of the added stress of running more or bigger jobs. Know what numbers to watch, how to interpret them, and what to do to improve them.

Chase profit, not dollars. When owners start talking about how much their sales have increased, I remain unimpressed. Sales are nothing. Profit is where it’s at. Let’s say your volume is $600,000 in year 1 and $900,000 in year 2. A 50% increase, right? Wonderful, right? Maybe yes, and maybe no. If in order to sell and produce 50% more you had to hire a production manager, an estimator, and a salesperson and that caused a significant increase in your overhead, you could wind up with a lower net margin at the end of year 2. You might even end up with fewer actual dollars of profit to say nothing of the added stress of running more or bigger jobs. Know what numbers to watch, how to interpret them, and what to do to improve them. Stop trying to do everything yourself. If you haven’t already figured this stuff out on your own, hire somebody who has helped hundreds of contractors understand their numbers, replace habits with systems, and achieve a healthier relationship with their business. Comments from my clients reveal that many contractors struggle with the business side of things. Would you like to move “…from being clueless & frustrated to confident and comfortable….”? Would you find it “…refreshing to speak with someone who actually knew what they were doing, understood what (you were) trying to accomplish, and just made it happen.”? Are you sick of being “…lost in a sea of numbers…”?

Stop trying to do everything yourself. If you haven’t already figured this stuff out on your own, hire somebody who has helped hundreds of contractors understand their numbers, replace habits with systems, and achieve a healthier relationship with their business. Comments from my clients reveal that many contractors struggle with the business side of things. Would you like to move “…from being clueless & frustrated to confident and comfortable….”? Would you find it “…refreshing to speak with someone who actually knew what they were doing, understood what (you were) trying to accomplish, and just made it happen.”? Are you sick of being “…lost in a sea of numbers…”? Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate?

Pricing your work without knowing the true cost of being in business is referred to as using the "WAG" method, or “Wild Ass Guess” method. Unless a business knows what markup to use to determine the right selling price it puts itself at risk of actually buying jobs instead of selling them. Unless you know your minimum required markup to cover overhead, how do you know how low you can go when the prospect wants to negotiate? This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell.

This is like a Super-Sized WAG! Unless you use a single across the board markup on all estimated costs, you will need to be very accurate when anticipating how much you will sell of, and how much you will markup, each category of costs your business includes in estimates throughout the course of the year. Most contractors who do this have no idea how to do so. Keep in mind that if you do drop the markup on one item you will need to increase the markup on another to make up for the drop in gross profit dollars on the first one. One contractor I know said he believed contractors who use this method have what he called “Head Trash” about money. He went on to say they should “get over it” and should learn how to sell. First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use

First, this assumes the contractor even does job costing, most don’t. As one example I estimate that fewer than 10% of contractors can job cost their labor costs the same way they estimate them. If you use a burdened labor rate to estimate the dollar cost of task hours, your total labor cost will include things like workers comp insurance, non-productive time and employee benefits. If you use QuickBooks for job costing, and you enter employee time card information into QuickBooks, typically only the employees wage and employer paid payroll taxes are expensed against the job budget in job cost reports. This will falsely make the actual labor cost appear much lower than the labor budget from your estimate. To solve this, use  If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.

If you sell work that you won’t be starting for some time, in your estimates you will needed to include the actual costs you will incur at the time you produce the work. If you don’t do so the extra costs will eat away at your planned net profit until it’s gone. If the extra costs exceed your anticipated net profit you will need to use your own money to finish that customer’s job. Keep in mind that some reports anticipate many construction materials will increase in cost as much as 25% this year.