Guest Blogger: Judith Miller has worked with remodelers nearly 30 years; she writes for Remodeling Magazine, facilitates for Remodelers Advantage and consults with remodelers around the country with particular focus on the importance of good financials! Visit her website at www.remodelservices.com

Two Ways To Predict and Measure Good Cash Flow

In his excellent blog post on cash flow, Shawn mentioned direct costs, overhead and net profit as all potentially contributing to good cash flow. And, as he so rightly pointed out, the potential for good cash flow begins with accurate pricing for the job. Shawn also mentioned the importance of working on ‘accrual’ accounting rather than cash. When you’ve got these important elements of good construction accounting in place, you can lay out a couple metrics which will be useful in understanding cash flow.

First, get all your costs in the right place on the Profit/Loss:

Income = revenue from construction projects

Direct Costs = expenses, including ALL labor (even that production manager who doesn’t keep a time card) AND associated labor burden, related to jobs for which you receive the income. Don’t include work on your own house or you Mom’s in this category because you’ll skew (and screw) the numbers.

Overhead = all costs it takes to run an office, including a construction office, but not related to jobs – those costs go into Direct. This includes marketing expenses, rent, office supplies, professional fees, owner and admin salaries and related burden, general insurance – not liability or workers comp which go into Direct.

(List of Typical Accounting Terms and Definitions)

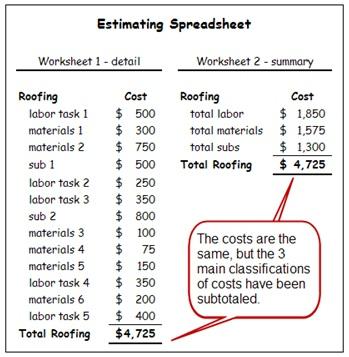

Second, establish a good system for job cost analysis

A good system for job cost analysis lays out the true estimated cost of the job – no SWAGs or ‘guesstimates’ – and allows you to post costs against the estimate as they are incurred. Remember that a cost is incurred WHEN THE WORK IS DONE not when the bill is received.

Third, reliable reports are accurate, complete and timely

Prior to calculating these metrics, be sure to review all reports for reliability.

Now you’re ready to develop these two useful metrics:

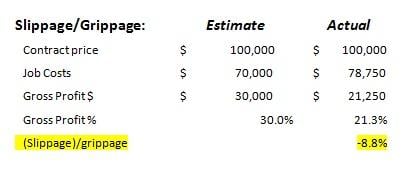

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit. Slippage is negative, grippage is positive. This is of critical importance because if you’ve got slippage either your estimating is wrong or your production is not working up to expected efficiency. And if you’ve got grippage, you might be leaving money on the table from estimating too high. Control of production allows for profits which can then be managed to ensure good cash flow.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit. Slippage is negative, grippage is positive. This is of critical importance because if you’ve got slippage either your estimating is wrong or your production is not working up to expected efficiency. And if you’ve got grippage, you might be leaving money on the table from estimating too high. Control of production allows for profits which can then be managed to ensure good cash flow.- The calculation is: Estimated gross profit margin MINUS Produced gross profit margin

- The goal should be no more than 2 percentage points slippage – or grippage.

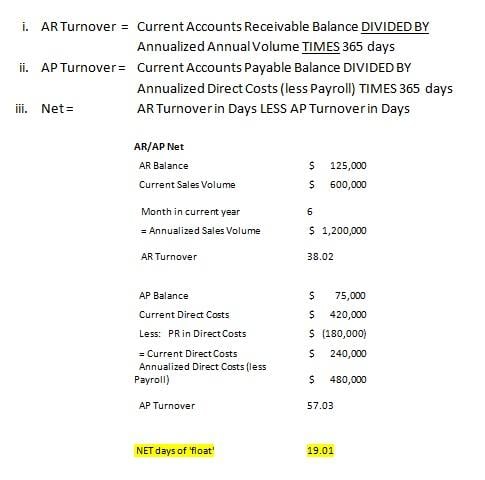

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover). If you receive money from your customers in 10 days and pay your expenses in 15, you’d have 5 days “float” – a good thing! However, if the reverse is true, you might have to borrow to pay the bills.

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover). If you receive money from your customers in 10 days and pay your expenses in 15, you’d have 5 days “float” – a good thing! However, if the reverse is true, you might have to borrow to pay the bills.

The calculation is three part:

Once your accounting system is set up correctly, information is entered accurately, timely and consistently, you’ll be able to see where the money comes from, where it goes and how to control the all important cash flow! This is a set of gears which all work together to produce profits and protects cash!

There are many reason construction businesses fail. A read of a 2007 report by the Joint Center for Housing Studies at Harvard University titled

There are many reason construction businesses fail. A read of a 2007 report by the Joint Center for Housing Studies at Harvard University titled  First, if you don’t put efficient business systems in place as a small business your likelihood of failure will be very high even if your business remains small in size. Also, even with modest growth, unless you put systems in place your business is more likely to fail. Also consider, without efficient systems, it will be you the business owner who will have to work harder and longer to get things done due to the lack of those systems. If that is the case then burn out and or the typical resulting health problems might lead to failure. But remember, that burnout happened because of a lack of systems.

First, if you don’t put efficient business systems in place as a small business your likelihood of failure will be very high even if your business remains small in size. Also, even with modest growth, unless you put systems in place your business is more likely to fail. Also consider, without efficient systems, it will be you the business owner who will have to work harder and longer to get things done due to the lack of those systems. If that is the case then burn out and or the typical resulting health problems might lead to failure. But remember, that burnout happened because of a lack of systems. First, unless you can determine the cost of being in business you won’t know what to charge for your services over and above the direct job costs of labor and materials. If you don’t know what to charge you literally won’t know whether you are buying or selling jobs. Plus, every contractor I have helped do a budget goes forward with confidence and success selling at the price they now know they need to get to be profitable.

First, unless you can determine the cost of being in business you won’t know what to charge for your services over and above the direct job costs of labor and materials. If you don’t know what to charge you literally won’t know whether you are buying or selling jobs. Plus, every contractor I have helped do a budget goes forward with confidence and success selling at the price they now know they need to get to be profitable.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due. Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems: Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

For these individuals, ignoring this fact so far during their careers is the reason they are lacking adequate funds to retire and my prediction is that they will continue to ignore this fact. However, remodelers are not alone. Most Americans are in this same predicament. When they reach retirement what will their lives be like and who is going to pay for their living and medical expenses? One answer; the next generation of working tax payers, assuming they have jobs. With such a financial burden on the next generation, they too may be destine for the same harsh reality.

For these individuals, ignoring this fact so far during their careers is the reason they are lacking adequate funds to retire and my prediction is that they will continue to ignore this fact. However, remodelers are not alone. Most Americans are in this same predicament. When they reach retirement what will their lives be like and who is going to pay for their living and medical expenses? One answer; the next generation of working tax payers, assuming they have jobs. With such a financial burden on the next generation, they too may be destine for the same harsh reality. Business owners are obviously too busy running jobs to even think retirement. Employees are often living and thinking day-to-day, often working for cash. This is a huge mistake. While you may love what you do, your body may not allow you to do it forever. Consider the day when you will no longer be physically able to work in the field and or your declining physical abilities will result in lower productivity and therefore reduced compensation.

Business owners are obviously too busy running jobs to even think retirement. Employees are often living and thinking day-to-day, often working for cash. This is a huge mistake. While you may love what you do, your body may not allow you to do it forever. Consider the day when you will no longer be physically able to work in the field and or your declining physical abilities will result in lower productivity and therefore reduced compensation.  According to a study by the Transamerica Center for Retirement Studies 54 percent of workers in their 60s said they haven’t saved enough to sustain themselves for the rest of their life.

According to a study by the Transamerica Center for Retirement Studies 54 percent of workers in their 60s said they haven’t saved enough to sustain themselves for the rest of their life.

Are you confident in your abilities to earn enough for your own retirement?

Are you confident in your abilities to earn enough for your own retirement?

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above.

So, when you determine the burdened hourly rate to use in your estimates and for job costing you can't be guessing. To get the accurate rate you must divide the total annual cost to compensate and support each employee by the number of hours he or she will be working producing income. For the example above, you must collect enough money in 1940 hours of productive time so you will have enough money to pay the employee for 2080 hours. Non-productive time and other labor related expenses are easily calculated into a burdened labor rate using a spreadsheet like the one shown above. A long time ago a remodeler in my NARI Chapter who was just starting his business asked me for advice about how he too could have a successful and profitable business. Seeking to keep my response simple and to the point I came up with a list of nine steps. When I was explaining my list to him he asked where he would find the time to do all these things. He said he was already straight out trying to sell and complete work. That’s when I added step number one to the ten step list below.

A long time ago a remodeler in my NARI Chapter who was just starting his business asked me for advice about how he too could have a successful and profitable business. Seeking to keep my response simple and to the point I came up with a list of nine steps. When I was explaining my list to him he asked where he would find the time to do all these things. He said he was already straight out trying to sell and complete work. That’s when I added step number one to the ten step list below.  Recharge Your Batteries!

Recharge Your Batteries!

That learning experience and the difference it made for me sticks with me even today. For example, every time I start working with a new remodeler or design/builder as their business consultant or coach I make it a first priority to be sure my client knows the difference between margin and markup. Many a remodeler has made the mistake of figuring out the margin they need to cover overhead and profit only to assume they can then use that same number as the markup for establishing their project selling prices. When I explain the difference the light bulb goes off; shedding light as to why they are not achieving their required gross profit margin and therefore have no or even negative net profit.

That learning experience and the difference it made for me sticks with me even today. For example, every time I start working with a new remodeler or design/builder as their business consultant or coach I make it a first priority to be sure my client knows the difference between margin and markup. Many a remodeler has made the mistake of figuring out the margin they need to cover overhead and profit only to assume they can then use that same number as the markup for establishing their project selling prices. When I explain the difference the light bulb goes off; shedding light as to why they are not achieving their required gross profit margin and therefore have no or even negative net profit.

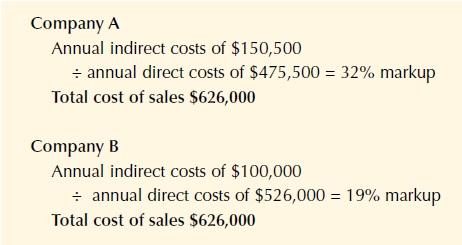

Markup on anything you sell needs to be based on projected overhead costs and net profit requirements for producing a specified volume of work. Be careful using someone else's markup suggestions particularly if they have not done the math to figure it out.

Markup on anything you sell needs to be based on projected overhead costs and net profit requirements for producing a specified volume of work. Be careful using someone else's markup suggestions particularly if they have not done the math to figure it out. Also, many magazine articles advise contractors to apply a “professional markup” to their bids. But what, exactly, is a professional markup? Does a 50% markup make you a professional, or should you apply 67% to qualify? The simple answer is, if you don’t know what markup your company needs to use, you’re not a professional, and therefore you’re not using a professional markup. But if you know the formulas for determining margin and markup, you have a working financial tool, rather than a magic number suggested by some remodeling guru or pulled out of a hat by another remodeler.

Also, many magazine articles advise contractors to apply a “professional markup” to their bids. But what, exactly, is a professional markup? Does a 50% markup make you a professional, or should you apply 67% to qualify? The simple answer is, if you don’t know what markup your company needs to use, you’re not a professional, and therefore you’re not using a professional markup. But if you know the formulas for determining margin and markup, you have a working financial tool, rather than a magic number suggested by some remodeling guru or pulled out of a hat by another remodeler.

Financial success doesn't happen by accident. Knowing your real costs can give you the confidence to estimate and sell at the right price.

Financial success doesn't happen by accident. Knowing your real costs can give you the confidence to estimate and sell at the right price.

Many expect Workers Compensation rates to increase significantly this year. The MA Workers Comp Rating and Inspection Bureau has recently applied for an average rate increase of 19.3%. According to the Insurance Journal, Commissioner Joseph Murphy will be holding a public meeting on March 30th on this request.

Many expect Workers Compensation rates to increase significantly this year. The MA Workers Comp Rating and Inspection Bureau has recently applied for an average rate increase of 19.3%. According to the Insurance Journal, Commissioner Joseph Murphy will be holding a public meeting on March 30th on this request.