Remodelers, Make Sure To Pay All The Taxes You Can This Year. Really?

The holiday season is now upon us. For small business owners, in addition to celebrating the holidays with family and friends, it’s also the time of year to start making plans and doing budgeting for next year. To increase your after taxes net profits next year you might want to consider paying more taxes this year. Here is why.

At the end of September I posted a blog about the impending Fiscal Cliff. In that blog I pointed out several ways the Fiscal Cliff decisions might affect remodeling businesses. I also pointed out that how our country’s leadership ultimately decides to deal with the pending changes would depend quite a bit on who won the presidential election. The election is over and President Obama will be our leader for the next four years. With that in mind I suggest small business owners re-read that blog post and look into the list of possible tax changes that are now more likely to occur with President Obama remaining in office.

(Click here for a pretty good Fiscal Cliff summary by NPR)

A Few Ways You Might Be Affected:

A Few Ways You Might Be Affected:

The House Committee on Small Business has offered a chart on its web site to show the potential changes and affects on small businesses if the current Bush Era Tax Cuts are not extended. Remodelers could be hit really hard because many of them are organized as “pass-through” entities, where their business gains or losses are reflected on their individual tax returns. Several that could really affect the after tax profitability for remodelers includes:

-

An increase in capital gains from 15% to 20% (33% increase!)

-

An increase in tax rates on business dividends received by individuals will be treated as ordinary income (higher rates) rather than as capital gains, currently 15%.

-

Tax rates in the top four brackets will be increased to (from current rate): 39.6% (35%), 36% (33%), 31% (28%), 28% (25%)

-

Small businesses with undistributed taxable income will no longer be taxed at the current rate on dividends (currently 15%), but rather will be taxed at the highest individual tax rate (up to 39.6%).

What To Do:

So, to limit your tax liability I suggest remodelers speak with their accountant ASAP to fully understand how the potential changes and ultimately any actual changes will affect you and your business. Remember, profits can be used to reinvest back into your business, but you must pay tax on those profits first, leaving only the remaining profit available to invest. The same holds true if you were planning to use business profits for other personal purposes such as paying for your children’s’ college education or buying a new home or RV. Back when I owned my remodeling business my accountant helped me strategize how to claim certain revenues and profits in one year versus the other depending on my effective tax rate for each respective year. By doing so in one year I saved over $20,000.00 the next year!

Make Sure You Have The Right Accountant:

There nothing worse than the feeling of working really hard to earn a profit only to find out that you could have reduced your total tax burden (and the amount of profit you get to keep) by taking advantage of simple and completely legal tax strategies. A big lesson for me when I owned my remodeling business was making sure I had the right accountant and financial advice. Saving money on an accountant’s fees might just cost you far more in taxes than the money you might save if you have chosen your accountant based on price rather than value, strategic advice and timely services.

There nothing worse than the feeling of working really hard to earn a profit only to find out that you could have reduced your total tax burden (and the amount of profit you get to keep) by taking advantage of simple and completely legal tax strategies. A big lesson for me when I owned my remodeling business was making sure I had the right accountant and financial advice. Saving money on an accountant’s fees might just cost you far more in taxes than the money you might save if you have chosen your accountant based on price rather than value, strategic advice and timely services.

My second accountant cost me twice as much as my first. It was well worth paying the difference because of the money I saved in taxes. It still is!

Help them get mentally prepared: Let them know what to expect they will live through while the construction is under way. Tell them about things that might affect them like the noise, the dust, shutting off their water, change orders and the decisions that come with final selections and unanticipated challenges. Just as a doctor would do with patients regarding medications, a good remodeler will warn clients that it is likely there might be side effects experienced during the remodeling process. By doing so clients can recognize the warning signs so they will be able to mentally and physically adjust. Also, my experience was that by discussing these realities in advance, the fatigue might not set in as early, or at least would not be as significant, as early, as it might be if my team had not warned them.

Help them get mentally prepared: Let them know what to expect they will live through while the construction is under way. Tell them about things that might affect them like the noise, the dust, shutting off their water, change orders and the decisions that come with final selections and unanticipated challenges. Just as a doctor would do with patients regarding medications, a good remodeler will warn clients that it is likely there might be side effects experienced during the remodeling process. By doing so clients can recognize the warning signs so they will be able to mentally and physically adjust. Also, my experience was that by discussing these realities in advance, the fatigue might not set in as early, or at least would not be as significant, as early, as it might be if my team had not warned them. Help them get physically prepared: Living through the remodeling process can be much easier with some preparation. For example, remind customers they will not be able to cook while you remodel their kitchen. Suggest they consider cooking and freezing easy to microwave meals and or collect take out menus before you start their kitchen renovation. Some remodelers have told me they actually provide their clients recipe books and or a collection of local restaurant menus to help with this. If you are renovating their only bathroom as part of a project, ask how they plan to deal without a toilet for a few days or more. They may not have even thought about such realities. Maybe you or they can even set up temporary spaces to tide them over until they get their homes and their lives back.

Help them get physically prepared: Living through the remodeling process can be much easier with some preparation. For example, remind customers they will not be able to cook while you remodel their kitchen. Suggest they consider cooking and freezing easy to microwave meals and or collect take out menus before you start their kitchen renovation. Some remodelers have told me they actually provide their clients recipe books and or a collection of local restaurant menus to help with this. If you are renovating their only bathroom as part of a project, ask how they plan to deal without a toilet for a few days or more. They may not have even thought about such realities. Maybe you or they can even set up temporary spaces to tide them over until they get their homes and their lives back.

Unfortunately in addition to a bad economy we also have a lot of uncertainty about what the government will or will not do. I think the problem, at least for those who keep an eye on the economy and the political arena, is having any confidence in making long term investments and decisions. The fiscal cliff could really challenge the economy if across the board cuts are made as planned. And because the current administration has not clarified or committed to what will be cut, we don’t know how or in what market areas the economy will be affected most. Unfortunately, true discussion about all this by our elected leaders won’t even get started until after the elections.

Unfortunately in addition to a bad economy we also have a lot of uncertainty about what the government will or will not do. I think the problem, at least for those who keep an eye on the economy and the political arena, is having any confidence in making long term investments and decisions. The fiscal cliff could really challenge the economy if across the board cuts are made as planned. And because the current administration has not clarified or committed to what will be cut, we don’t know how or in what market areas the economy will be affected most. Unfortunately, true discussion about all this by our elected leaders won’t even get started until after the elections. In my opinion, as long as they are selling work at a price that meets their overhead costs, remodelers must decide if they will use the gross profit to hire office and management staff and reduce their workload, hours and or stress; or work all those hours and keep the gross profit as their own compensation. On the other hand if they are not selling at prices high enough to support the overhead, hiring more staff or buying more assets are not sound financial options. I suggest waiting to see what happens with the elections and the cliff before making any long term business investments. If you have money you are willing to invest, I suggest using it to improve your marketing and sales skills. Those are investments that can help a business regardless of the economy and can even give you an advantage over your competition when it comes to capturing the limited amount of work available during a down economy.

In my opinion, as long as they are selling work at a price that meets their overhead costs, remodelers must decide if they will use the gross profit to hire office and management staff and reduce their workload, hours and or stress; or work all those hours and keep the gross profit as their own compensation. On the other hand if they are not selling at prices high enough to support the overhead, hiring more staff or buying more assets are not sound financial options. I suggest waiting to see what happens with the elections and the cliff before making any long term business investments. If you have money you are willing to invest, I suggest using it to improve your marketing and sales skills. Those are investments that can help a business regardless of the economy and can even give you an advantage over your competition when it comes to capturing the limited amount of work available during a down economy.

Hydroelectric energy is one of the most developed forms of green energy across the country. For generations, American engineers have been developing dams for many of our nation’s rivers. Once a river has been dammed, engineers can control how much water passes through at any given time. As that water flows, it rotates a series of turbines thus creating energy.

Hydroelectric energy is one of the most developed forms of green energy across the country. For generations, American engineers have been developing dams for many of our nation’s rivers. Once a river has been dammed, engineers can control how much water passes through at any given time. As that water flows, it rotates a series of turbines thus creating energy. In order to turn wind into electricity, a new type of windmill has been developed. Often these windmills are installed in large groups referred to as wind farms. All throughout West Texas, there are thousands of new windmills that have been built over the past decade, and wind-generated power is becoming an increasingly substantial source of energy for the Texas grid.

In order to turn wind into electricity, a new type of windmill has been developed. Often these windmills are installed in large groups referred to as wind farms. All throughout West Texas, there are thousands of new windmills that have been built over the past decade, and wind-generated power is becoming an increasingly substantial source of energy for the Texas grid. Harnessing the energy of the sun’s rays requires the use of solar panel technology. While solar panels were once extremely pricey, prices have come down as technology has advanced. Now, many people in sunny regions, including many areas of Texas, are installing their own personal solar arrays in order to capitalize on the most abundant energy resource in our solar system.

Harnessing the energy of the sun’s rays requires the use of solar panel technology. While solar panels were once extremely pricey, prices have come down as technology has advanced. Now, many people in sunny regions, including many areas of Texas, are installing their own personal solar arrays in order to capitalize on the most abundant energy resource in our solar system.

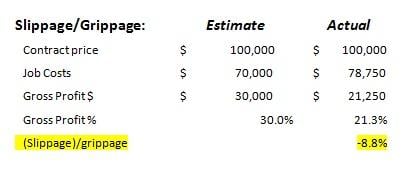

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

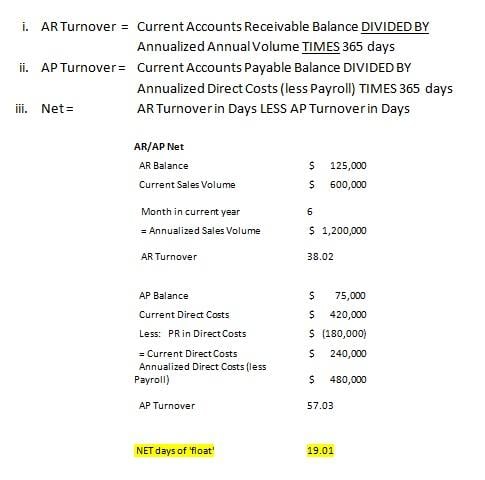

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

There are many reason construction businesses fail. A read of a 2007 report by the Joint Center for Housing Studies at Harvard University titled

There are many reason construction businesses fail. A read of a 2007 report by the Joint Center for Housing Studies at Harvard University titled  First, if you don’t put efficient business systems in place as a small business your likelihood of failure will be very high even if your business remains small in size. Also, even with modest growth, unless you put systems in place your business is more likely to fail. Also consider, without efficient systems, it will be you the business owner who will have to work harder and longer to get things done due to the lack of those systems. If that is the case then burn out and or the typical resulting health problems might lead to failure. But remember, that burnout happened because of a lack of systems.

First, if you don’t put efficient business systems in place as a small business your likelihood of failure will be very high even if your business remains small in size. Also, even with modest growth, unless you put systems in place your business is more likely to fail. Also consider, without efficient systems, it will be you the business owner who will have to work harder and longer to get things done due to the lack of those systems. If that is the case then burn out and or the typical resulting health problems might lead to failure. But remember, that burnout happened because of a lack of systems. First, unless you can determine the cost of being in business you won’t know what to charge for your services over and above the direct job costs of labor and materials. If you don’t know what to charge you literally won’t know whether you are buying or selling jobs. Plus, every contractor I have helped do a budget goes forward with confidence and success selling at the price they now know they need to get to be profitable.

First, unless you can determine the cost of being in business you won’t know what to charge for your services over and above the direct job costs of labor and materials. If you don’t know what to charge you literally won’t know whether you are buying or selling jobs. Plus, every contractor I have helped do a budget goes forward with confidence and success selling at the price they now know they need to get to be profitable.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due.

If the business’ financial system includes the ability to predict income and expenses on a monthly basis, the cash flow needs for that month can be easily determined in advance. Any excess of cash that would normally remain in the account could also be anticipated and create an opportunity to earn additional profits. In order to actually qualify what is excess cash over and above monthly expenses, the accounting system should be run on an accrual basis, not a cash basis. By using the accrual method of accounting, expenses are recognized as they occur, even if the expense has not yet been paid for. Income is recognized when the customer is billed, even if payment has not yet been received. Income and expenses are then tracked by the exact day they are to be collected or are due respectively. By tracking the income and expenses in this way, one can easily predict the money that will be owed at a certain given time as well as how much money will be available to pay for those expenses at the time the expenses become due. Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

Before you consider using any of my suggestions, be sure they make sense for you and you understand the legal and or tax implications for you and your business. I suggest that you always be sure to consult with your accountant, tax adviser and or other appropriate counsel before trying any new strategies, including those described in this blog.

This should be your first consideration. Be honest with yourself. Do you really want to be a business owner running and growing a business where your role is to develop your business so it creates the opportunity for employees and subs to perform the work, or is your love for the tools and craftsmanship what motivates you to go to work each day? Either one can be a good choice, but the business you build will be dramatically different depending on your choice. If you choose the craftsman route be sure to consider your age and health; now and in the future. Will your body be able to handle the work type your business sells as you get closer to retirement age? Also, as you age, will you be able to maintain the productivity required to earn the money you need to live and eventually retire?

This should be your first consideration. Be honest with yourself. Do you really want to be a business owner running and growing a business where your role is to develop your business so it creates the opportunity for employees and subs to perform the work, or is your love for the tools and craftsmanship what motivates you to go to work each day? Either one can be a good choice, but the business you build will be dramatically different depending on your choice. If you choose the craftsman route be sure to consider your age and health; now and in the future. Will your body be able to handle the work type your business sells as you get closer to retirement age? Also, as you age, will you be able to maintain the productivity required to earn the money you need to live and eventually retire? Regardless of your choice to the consideration above, few business owners can know and or do everything needed to run a profitable business and still have a life outside work. When seeking to add new employees, consider how you chose your previous employees. Did you hire people who required constant supervision and instruction, or did you hire people who added skills and knowledge to your business that you didn’t have yourself? Who you hire going forward will make a big difference in regards to what you will have to do yourself and how much of your time will be spent where.

Regardless of your choice to the consideration above, few business owners can know and or do everything needed to run a profitable business and still have a life outside work. When seeking to add new employees, consider how you chose your previous employees. Did you hire people who required constant supervision and instruction, or did you hire people who added skills and knowledge to your business that you didn’t have yourself? Who you hire going forward will make a big difference in regards to what you will have to do yourself and how much of your time will be spent where.

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems:

Contractors who try to job cost inside QuickBooks at the level of 2x6’s and specific products (Kohler faucet K-13490-CP) produce three problems: Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

Contractors who continually add job-specific line items in QuickBooks invoices (ex: “repair Jones front porch step”, “Replace damaged shower tile”, “Add backsplash”) produce these two problems:

For these individuals, ignoring this fact so far during their careers is the reason they are lacking adequate funds to retire and my prediction is that they will continue to ignore this fact. However, remodelers are not alone. Most Americans are in this same predicament. When they reach retirement what will their lives be like and who is going to pay for their living and medical expenses? One answer; the next generation of working tax payers, assuming they have jobs. With such a financial burden on the next generation, they too may be destine for the same harsh reality.

For these individuals, ignoring this fact so far during their careers is the reason they are lacking adequate funds to retire and my prediction is that they will continue to ignore this fact. However, remodelers are not alone. Most Americans are in this same predicament. When they reach retirement what will their lives be like and who is going to pay for their living and medical expenses? One answer; the next generation of working tax payers, assuming they have jobs. With such a financial burden on the next generation, they too may be destine for the same harsh reality. Business owners are obviously too busy running jobs to even think retirement. Employees are often living and thinking day-to-day, often working for cash. This is a huge mistake. While you may love what you do, your body may not allow you to do it forever. Consider the day when you will no longer be physically able to work in the field and or your declining physical abilities will result in lower productivity and therefore reduced compensation.

Business owners are obviously too busy running jobs to even think retirement. Employees are often living and thinking day-to-day, often working for cash. This is a huge mistake. While you may love what you do, your body may not allow you to do it forever. Consider the day when you will no longer be physically able to work in the field and or your declining physical abilities will result in lower productivity and therefore reduced compensation.  According to a study by the Transamerica Center for Retirement Studies 54 percent of workers in their 60s said they haven’t saved enough to sustain themselves for the rest of their life.

According to a study by the Transamerica Center for Retirement Studies 54 percent of workers in their 60s said they haven’t saved enough to sustain themselves for the rest of their life.

Are you confident in your abilities to earn enough for your own retirement?

Are you confident in your abilities to earn enough for your own retirement?