Guest Blogger: Thomas Messier, CIC. Tom is Vice President of Construction Industry Services at Mason and Mason Insurance Agency, Inc. in Whitman MA. He speaks frequently to construction industry groups about insurance related topics. Tom is a Certified Insurance Counselor, and is a graduate of St. Michael’s College.

Does Your Construction Liability Insurance Policy Have the Right ‘Coverage Trigger’?

What Is An Insurance "Coverage Trigger"?

A “coverage trigger” is an event that causes your Liability policy to pay a claim. There are two basic types of “triggers”: occurrence and claims made.

What is an Occurrence Trigger?

An “occurrence” trigger means that the policy will cover any injury or damage during the policy period. For example, if a roof that you installed four years ago collapsed last week, injuring five people, the occurrence trigger will apply and the policy will pay. It doesn’t matter when the roof was built or when the claim was filed – only when the actual injury took place.

What is a Claims Made Trigger?

A “claims-made” trigger, as the name suggests, focuses on the date the actual claim is made. Underwriting and rating provisions might limit how far into your past the policy provides coverage. However, the key question is: “did the claim come in during the policy period?” If so, a “claims-made” Liability policy will pay. Using the example of the collapsing roof, it doesn’t matter when the roof was built or when the event took place, the trigger won’t apply until the claim is filed.

If this claim is made during the current policy period, your insurance company will pay it. However, suppose the claim isn’t made for several weeks, and by the time it arrives, your current coverage has expired and you’re into a new policy period? In this case, the “claims-made” policy will pay the claim, since it was made during the new period.

If this claim is made during the current policy period, your insurance company will pay it. However, suppose the claim isn’t made for several weeks, and by the time it arrives, your current coverage has expired and you’re into a new policy period? In this case, the “claims-made” policy will pay the claim, since it was made during the new period.

Maintaining Coverage Is Key

One type of trigger isn’t necessarily better than the other. However, it’s almost always wise to keep the current type in order to provide relatively seamless coverage.

Make Sure Your Insurance Agent Is Able To Offer The Right Advice

Questions to ask your insurance provider if your a contractor:

- What is Claims Made Liability Insurance Coverage?

- What is Occurrence Liability Insurance Coverage?

- Which one is right for my business and why?

If you’re offered a Liability policy that offers broader coverage or more attractive pricing – but has a different trigger than your current insurance – consult with a construction insurance specialist before you make a decision. The only way to be sure you get the protection you need at a fair price is to consider all possible underwriting considerations and how the change in coverage trigger might affect your liability needs.

Watch for Tom's next guest blog where he'll discuss what a "Triple Trigger" is and why you should care about what it is.

I’m sure this story is true for many remodelers. If you’re one of them and you’re tired of never ending sales cycles, having to sell on price, working for people you’d rather say no to and you can’t seem to generate enough volume and or gross profit to have a healthy business; it’s time to decide who you want to target for prospects and start strategically marketing so they can find you and so you can convert them into customers.

I’m sure this story is true for many remodelers. If you’re one of them and you’re tired of never ending sales cycles, having to sell on price, working for people you’d rather say no to and you can’t seem to generate enough volume and or gross profit to have a healthy business; it’s time to decide who you want to target for prospects and start strategically marketing so they can find you and so you can convert them into customers.

One resource remodelers can take advantage of for help with better targeting is their vendors. Vendors who carry well known product brands know which demographic of customers buy different products based on their quality, benefits and related cost. They also typically get support in this area from the product manufacturers and distributors they do business with. If you establish a relationship with a good vendor who offers marketing help and support, it can be like having a whole team of marketing experts working on helping you find more and better customers. The great part about it is that helping the remodeler helps the vendor, the distributor and the manufacturer all at the same time. When something gets sold everyone one wins!

One resource remodelers can take advantage of for help with better targeting is their vendors. Vendors who carry well known product brands know which demographic of customers buy different products based on their quality, benefits and related cost. They also typically get support in this area from the product manufacturers and distributors they do business with. If you establish a relationship with a good vendor who offers marketing help and support, it can be like having a whole team of marketing experts working on helping you find more and better customers. The great part about it is that helping the remodeler helps the vendor, the distributor and the manufacturer all at the same time. When something gets sold everyone one wins! Ready for the new normal?

Ready for the new normal?

Take this self quiz to see if a properly set up financial system would benefit you and your business:

Take this self quiz to see if a properly set up financial system would benefit you and your business:

The books in the list I offer below fall into the top five books I think remodelers should read if they want to grow a successful business and reduce the total time it takes to do so. More importantly, these books can help remodelers avoid the frustrations, wasted time and wasted money that come with the trial and error approach of going it alone as a business owner. Even if you still can’t build the business you want on your own after reading these books, you will definitely know what help you will need to get there

The books in the list I offer below fall into the top five books I think remodelers should read if they want to grow a successful business and reduce the total time it takes to do so. More importantly, these books can help remodelers avoid the frustrations, wasted time and wasted money that come with the trial and error approach of going it alone as a business owner. Even if you still can’t build the business you want on your own after reading these books, you will definitely know what help you will need to get there

A Few Ways You Might Be Affected:

A Few Ways You Might Be Affected: There nothing worse than the feeling of working really hard to earn a profit only to find out that you could have reduced your total tax burden (and the amount of profit you get to keep) by taking advantage of simple and completely legal tax strategies. A big lesson for me when I owned my remodeling business was making sure I had the right accountant and financial advice. Saving money on an accountant’s fees might just cost you far more in taxes than the money you might save if you have chosen your accountant based on price rather than value, strategic advice and timely services.

There nothing worse than the feeling of working really hard to earn a profit only to find out that you could have reduced your total tax burden (and the amount of profit you get to keep) by taking advantage of simple and completely legal tax strategies. A big lesson for me when I owned my remodeling business was making sure I had the right accountant and financial advice. Saving money on an accountant’s fees might just cost you far more in taxes than the money you might save if you have chosen your accountant based on price rather than value, strategic advice and timely services.

Unfortunately in addition to a bad economy we also have a lot of uncertainty about what the government will or will not do. I think the problem, at least for those who keep an eye on the economy and the political arena, is having any confidence in making long term investments and decisions. The fiscal cliff could really challenge the economy if across the board cuts are made as planned. And because the current administration has not clarified or committed to what will be cut, we don’t know how or in what market areas the economy will be affected most. Unfortunately, true discussion about all this by our elected leaders won’t even get started until after the elections.

Unfortunately in addition to a bad economy we also have a lot of uncertainty about what the government will or will not do. I think the problem, at least for those who keep an eye on the economy and the political arena, is having any confidence in making long term investments and decisions. The fiscal cliff could really challenge the economy if across the board cuts are made as planned. And because the current administration has not clarified or committed to what will be cut, we don’t know how or in what market areas the economy will be affected most. Unfortunately, true discussion about all this by our elected leaders won’t even get started until after the elections. In my opinion, as long as they are selling work at a price that meets their overhead costs, remodelers must decide if they will use the gross profit to hire office and management staff and reduce their workload, hours and or stress; or work all those hours and keep the gross profit as their own compensation. On the other hand if they are not selling at prices high enough to support the overhead, hiring more staff or buying more assets are not sound financial options. I suggest waiting to see what happens with the elections and the cliff before making any long term business investments. If you have money you are willing to invest, I suggest using it to improve your marketing and sales skills. Those are investments that can help a business regardless of the economy and can even give you an advantage over your competition when it comes to capturing the limited amount of work available during a down economy.

In my opinion, as long as they are selling work at a price that meets their overhead costs, remodelers must decide if they will use the gross profit to hire office and management staff and reduce their workload, hours and or stress; or work all those hours and keep the gross profit as their own compensation. On the other hand if they are not selling at prices high enough to support the overhead, hiring more staff or buying more assets are not sound financial options. I suggest waiting to see what happens with the elections and the cliff before making any long term business investments. If you have money you are willing to invest, I suggest using it to improve your marketing and sales skills. Those are investments that can help a business regardless of the economy and can even give you an advantage over your competition when it comes to capturing the limited amount of work available during a down economy.

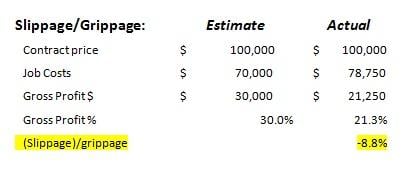

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

1: Slippage/Grippage: this metric calculates the difference between your estimated gross profit and the produced gross profit.

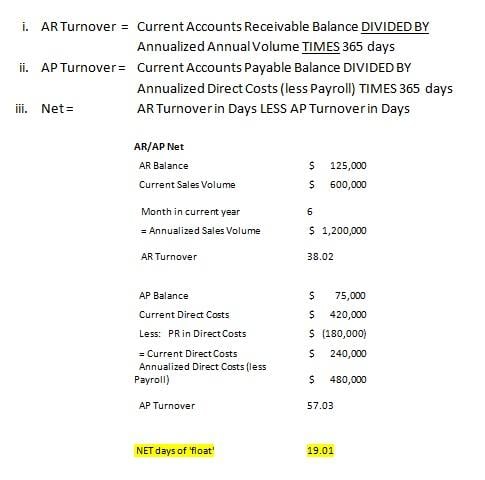

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

2: AR/AP Turnover Net: this metric calculates the difference between the number of days it takes to RECEIVE your cash from customer’s invoices (AR Turnover) and to PAY your customer’s expenses (AP Turnover).

This should be your first consideration. Be honest with yourself. Do you really want to be a business owner running and growing a business where your role is to develop your business so it creates the opportunity for employees and subs to perform the work, or is your love for the tools and craftsmanship what motivates you to go to work each day? Either one can be a good choice, but the business you build will be dramatically different depending on your choice. If you choose the craftsman route be sure to consider your age and health; now and in the future. Will your body be able to handle the work type your business sells as you get closer to retirement age? Also, as you age, will you be able to maintain the productivity required to earn the money you need to live and eventually retire?

This should be your first consideration. Be honest with yourself. Do you really want to be a business owner running and growing a business where your role is to develop your business so it creates the opportunity for employees and subs to perform the work, or is your love for the tools and craftsmanship what motivates you to go to work each day? Either one can be a good choice, but the business you build will be dramatically different depending on your choice. If you choose the craftsman route be sure to consider your age and health; now and in the future. Will your body be able to handle the work type your business sells as you get closer to retirement age? Also, as you age, will you be able to maintain the productivity required to earn the money you need to live and eventually retire? Regardless of your choice to the consideration above, few business owners can know and or do everything needed to run a profitable business and still have a life outside work. When seeking to add new employees, consider how you chose your previous employees. Did you hire people who required constant supervision and instruction, or did you hire people who added skills and knowledge to your business that you didn’t have yourself? Who you hire going forward will make a big difference in regards to what you will have to do yourself and how much of your time will be spent where.

Regardless of your choice to the consideration above, few business owners can know and or do everything needed to run a profitable business and still have a life outside work. When seeking to add new employees, consider how you chose your previous employees. Did you hire people who required constant supervision and instruction, or did you hire people who added skills and knowledge to your business that you didn’t have yourself? Who you hire going forward will make a big difference in regards to what you will have to do yourself and how much of your time will be spent where.

For these individuals, ignoring this fact so far during their careers is the reason they are lacking adequate funds to retire and my prediction is that they will continue to ignore this fact. However, remodelers are not alone. Most Americans are in this same predicament. When they reach retirement what will their lives be like and who is going to pay for their living and medical expenses? One answer; the next generation of working tax payers, assuming they have jobs. With such a financial burden on the next generation, they too may be destine for the same harsh reality.

For these individuals, ignoring this fact so far during their careers is the reason they are lacking adequate funds to retire and my prediction is that they will continue to ignore this fact. However, remodelers are not alone. Most Americans are in this same predicament. When they reach retirement what will their lives be like and who is going to pay for their living and medical expenses? One answer; the next generation of working tax payers, assuming they have jobs. With such a financial burden on the next generation, they too may be destine for the same harsh reality. Business owners are obviously too busy running jobs to even think retirement. Employees are often living and thinking day-to-day, often working for cash. This is a huge mistake. While you may love what you do, your body may not allow you to do it forever. Consider the day when you will no longer be physically able to work in the field and or your declining physical abilities will result in lower productivity and therefore reduced compensation.

Business owners are obviously too busy running jobs to even think retirement. Employees are often living and thinking day-to-day, often working for cash. This is a huge mistake. While you may love what you do, your body may not allow you to do it forever. Consider the day when you will no longer be physically able to work in the field and or your declining physical abilities will result in lower productivity and therefore reduced compensation.  According to a study by the Transamerica Center for Retirement Studies 54 percent of workers in their 60s said they haven’t saved enough to sustain themselves for the rest of their life.

According to a study by the Transamerica Center for Retirement Studies 54 percent of workers in their 60s said they haven’t saved enough to sustain themselves for the rest of their life.

Are you confident in your abilities to earn enough for your own retirement?

Are you confident in your abilities to earn enough for your own retirement? An experienced Management Team that has created and follows a strategic and sustainable business plan, implements industry best practices and continuously identifies and mentors strong leadership within the team in each department.

An experienced Management Team that has created and follows a strategic and sustainable business plan, implements industry best practices and continuously identifies and mentors strong leadership within the team in each department. A

A

A Design System that properly identifies and documents the information needed by the client as well as the Design/Builder's project team and serves as a communication tool to make sure the design and final project serve the client's purposes within the agreed budget and timeline

A Design System that properly identifies and documents the information needed by the client as well as the Design/Builder's project team and serves as a communication tool to make sure the design and final project serve the client's purposes within the agreed budget and timeline A

A