Question:

What with all this water damage this week, it occurs to me to wonder about the intersection between flood damage restoration (with insurance coverage) and the EPA's lead rule set to take effect in a couple three weeks.

Insurance companies use detailed estimating programs to set the rates they will reimburse for repairs. When we go trying to fix up people's soggy basements and flooded first stories after this big wet one, can we assume that we are disturbing lead? And if so, are they going to want us to put up plastic and stuff amid all that soggy mess? And if so (which I doubt), are the insurance companies ready to pay the added cost of this?

Insurance companies use detailed estimating programs to set the rates they will reimburse for repairs. When we go trying to fix up people's soggy basements and flooded first stories after this big wet one, can we assume that we are disturbing lead? And if so, are they going to want us to put up plastic and stuff amid all that soggy mess? And if so (which I doubt), are the insurance companies ready to pay the added cost of this?

I leave aside the absurdity of supposedly vacuuming for paint in a basement full of raw sewage. For now.

But seriously -- has anyone thought about how this EPA BS fits into the insurance industry's rate paradigm? Have you?

Regards,Ted

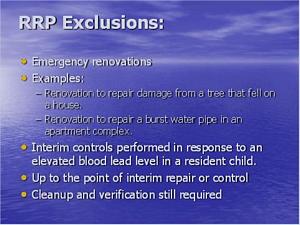

This came up for me in two places. First with one of my clients who is a water remediation contractor. Second, at a full day RRP Class for business owners that I presented. I have no idea what the insurance industry has or will do regarding unit costs for EPA RRP related work. There is an exclusion in the EPA RRP rule for emergency work.

Basically, you can deal with the emergency up until the point it is no longer an emergency. I suggest that would include removing damaged components so as to prevent and or limit additional damages (including mold) and health risks. Clean up and cleaning verification is not excluded. Also, you must switch over to the work practice requirements once you reach the point of interim control. I hope this helps. I am not an EPA lawyer, nor have I qualified this with the EPA. I am answering based on my understanding of the EPA RRP rule.

Looking for accurate information about the EPA RRP rule?

Looking for accurate information about the EPA RRP rule?