Think Twice Before You Use Subs or 1099’s Who Can’t Speak English; Here’s 2 Simple Reasons Why

The government has recently been cracking down on improper classification of workers as subcontractors. Understanding the difference, at least in the eyes of the government, can help a remodeler avoid challenges as well as the fines and penalties that come with misclassification. I recently became aware of an additional consideration as a result of reading an article in Remodeling magazine titled “Se Habla Ingles + No = No Deal? Get Real!” After reading the article, but particularly the reader comments, that new consideration jumped out at me. Using subcontractors and or 1099 workers who do not speak English can put your remodeling business at risk in at least two costly ways.

The government has recently been cracking down on improper classification of workers as subcontractors. Understanding the difference, at least in the eyes of the government, can help a remodeler avoid challenges as well as the fines and penalties that come with misclassification. I recently became aware of an additional consideration as a result of reading an article in Remodeling magazine titled “Se Habla Ingles + No = No Deal? Get Real!” After reading the article, but particularly the reader comments, that new consideration jumped out at me. Using subcontractors and or 1099 workers who do not speak English can put your remodeling business at risk in at least two costly ways.

Two simple ways the language barrier can put your remodeling or construction business at risk

#1: Customer service can be compromised leading to loss of repeat work and referrals.

Let’s face facts here; if a worker cannot speak English there will definitely be communication challenges. This is clearly demonstrated by the comment left at the article I mentioned above. The comment was by Perry, an actual consumer who personally experienced the challenges and disappointments caused both by the workers who could not adequately understand English as well as the business that hired them:

“It's difficult to quantify or fully explain in this comment the magnitude of problems we've had on our current job, but approximately half the problems can be traced directly back to a communication problem with the workers at the site. I witnessed our job supervisor explaining what was needed (in as good a Spanish as he could muster), the worker acknowledging his understanding, and hours later when the completed work is inspected, it's clear the worker did not understand exactly what was needed. This has happened repeatedly, with some of the mistakes far more costly than others.”

When a customer experiences what Perry speaks to its not likely the contractor performing the work will ever get future business or referrals from the disappointed customer. Remember, quality is not just determined by the final outcome. Quality is also determined by the experience the consumer has as the product is being delivered.

When a customer experiences what Perry speaks to its not likely the contractor performing the work will ever get future business or referrals from the disappointed customer. Remember, quality is not just determined by the final outcome. Quality is also determined by the experience the consumer has as the product is being delivered.

#2: Risk of the government deciding they are employees

Contractors should be using fixed scope contracts with subcontractors. Subcontractor agreements should detail the work to be completed, the expected outcome, when it has to be completed and include a fixed price for the services performed. If a subcontractor and or his/her workers cannot read a written work order due to a language barrier someone outside the subcontractor’s business will have to explain what is to be done and how it is to be done to the subcontractor. And in the absence of the subcontractor at the jobsite someone will need to explain and direct that sub’s employees. This type of relationship with a sub and or the sub’s employees demonstrates control by the business that hired the subcontractor.

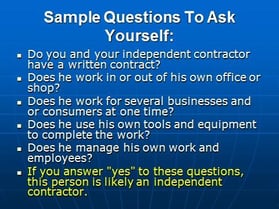

The IRS will consider a worker to be an employee unless independent contractor status is clearly indicated by the relationship between the worker and a remodeling business. The way the IRS sees it an employee is a worker who performs services at the direction of an employer. Subcontractors are considered to be in business for themselves and work under their own direction. So simply stated anyone who performs services for a remodeler is an employee if the remodeler can and or does control what will be done and how it will be done. Explaining things to a worker and orally directing how and in what order to perform their work therefore makes the worker an employee.

The fines and penalties for misclassification can ruin your business

As I pointed out in a previous blog post the determination by the government of misclassification of workers can be caused by many reasons. Plus when it happens the government assumes you to be guilty until you prove your innocence. If you cannot create a written subcontractor agreement, in the  language of the subs you work with which details the scope of work they are to perform independently, you and or your business will be forced to orally direct the work of the subs. Once you do that the government no longer classifies them as subs, but rather as employees. That is therefore misclassification. According to an article at workcompcentral, in Tennessee a company by the name of Aguilar Carpentry was caught misclassifying workers and was fined $73,000. In another article posted to WTNH.com a CT contractor was fined $20,240 for misclassification. Those fine amounts would put most remodelers out of business.

language of the subs you work with which details the scope of work they are to perform independently, you and or your business will be forced to orally direct the work of the subs. Once you do that the government no longer classifies them as subs, but rather as employees. That is therefore misclassification. According to an article at workcompcentral, in Tennessee a company by the name of Aguilar Carpentry was caught misclassifying workers and was fined $73,000. In another article posted to WTNH.com a CT contractor was fined $20,240 for misclassification. Those fine amounts would put most remodelers out of business.

Still unsure about your relationship with sub? Here are three possible options

For a quick answer perhaps just take the quiz Remodeling Magazine recently offered titled: "Take the Quiz: Are You Misclassifying Your Subcontractor?" Answer the questions honestly and then see if the government would call them subs or employees.

If you want help from the IRS and you have a lot of time to wait you can use IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. The completed form can be filed with the IRS by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status. Unfortunately it can take at least six months to get a determination. Additionally, often times because determining factors used by the government are not always objective, the determination may not binding.

If you want help from the IRS and you have a lot of time to wait you can use IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. The completed form can be filed with the IRS by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status. Unfortunately it can take at least six months to get a determination. Additionally, often times because determining factors used by the government are not always objective, the determination may not binding.

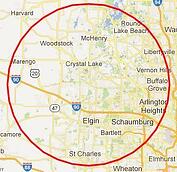

Many contractors are using what are refer to as 1099 workers to avoid employee and payroll related administrative responsibilities and financial costs. Some use this tactic to reduce their costs to help win bids and or make more money. If you never get caught you may feel or believe it was worth it. On the other hand if you get caught, whether you knew what you were doing was illegal or you really believed what you were doing was OK, the financial and litigation related costs can kill your business. The chance of this happening has dramatically increased in certain areas of the country because Washington is offering money to states to help them do so. Read on to find out about what is already happening in Virginia.

Many contractors are using what are refer to as 1099 workers to avoid employee and payroll related administrative responsibilities and financial costs. Some use this tactic to reduce their costs to help win bids and or make more money. If you never get caught you may feel or believe it was worth it. On the other hand if you get caught, whether you knew what you were doing was illegal or you really believed what you were doing was OK, the financial and litigation related costs can kill your business. The chance of this happening has dramatically increased in certain areas of the country because Washington is offering money to states to help them do so. Read on to find out about what is already happening in Virginia. That means you have to pay up on any fines, at their full rate (anywhere from $7K to 70K per violation) right away. Then you have to decide if you are willing to wait for your legal case to make it through a legal system sponsored by the same entity that is accusing your business.

That means you have to pay up on any fines, at their full rate (anywhere from $7K to 70K per violation) right away. Then you have to decide if you are willing to wait for your legal case to make it through a legal system sponsored by the same entity that is accusing your business.

As a contractor, you know that building a custom home or doing a major remodel is not a one-person job. You need to work with an architect, an interior designer, one or more sub-contractors and any number of laborers—and, of course, the homeowner. Getting everyone on the same page can be the difference between an amazing house and a patchwork disaster.

As a contractor, you know that building a custom home or doing a major remodel is not a one-person job. You need to work with an architect, an interior designer, one or more sub-contractors and any number of laborers—and, of course, the homeowner. Getting everyone on the same page can be the difference between an amazing house and a patchwork disaster. In a

In a  Most contractors do not have a licensed person on their team who can handle all the components of a construction job. For roofing, foundations, plumbing and electrical, they will usually subcontract to a licensed professional and or expert. In many cases, the interior designer may be a subcontractor of the lead contractor, making him the designer’s de facto boss. Whichever way you structure the construction process, you have some

Most contractors do not have a licensed person on their team who can handle all the components of a construction job. For roofing, foundations, plumbing and electrical, they will usually subcontract to a licensed professional and or expert. In many cases, the interior designer may be a subcontractor of the lead contractor, making him the designer’s de facto boss. Whichever way you structure the construction process, you have some

Upon a little reflection I’ve realized there are a lot of ways to organize a contracting business, none of which are the “gold standard” and all of which either purposely or inadvertently express the personality of the owner. At your inner core are you a manager or a craftsman? Are you a little of both? Are you neither? Generally, I’ve noticed successful people have figured out who they are and how they add value to the equation. Then they’ve set up a business system to capitalize on their strengths.

Upon a little reflection I’ve realized there are a lot of ways to organize a contracting business, none of which are the “gold standard” and all of which either purposely or inadvertently express the personality of the owner. At your inner core are you a manager or a craftsman? Are you a little of both? Are you neither? Generally, I’ve noticed successful people have figured out who they are and how they add value to the equation. Then they’ve set up a business system to capitalize on their strengths.  If you are excited about putting a team of specialized professional craftsmen together to construct a series of varied job types where organization & management are key elements of production & profitability, you’re a good fit for a general contractor operation. A GC set up is generally best for larger jobs like a custom home, a larger addition, or a whole house remodel job. Sometimes smaller jobs that require a higher level of craftsmanship like a special faux finish on walls, or custom built in cabinetry, or precision stone work are best left to the specialist sub contractor. Higher end bath remodels are also a good fit for a GC with a loyal team of trade contractors. You absolutely must develop a team that you work with regularly so you can be assured of consistent quality and integration between trades.

If you are excited about putting a team of specialized professional craftsmen together to construct a series of varied job types where organization & management are key elements of production & profitability, you’re a good fit for a general contractor operation. A GC set up is generally best for larger jobs like a custom home, a larger addition, or a whole house remodel job. Sometimes smaller jobs that require a higher level of craftsmanship like a special faux finish on walls, or custom built in cabinetry, or precision stone work are best left to the specialist sub contractor. Higher end bath remodels are also a good fit for a GC with a loyal team of trade contractors. You absolutely must develop a team that you work with regularly so you can be assured of consistent quality and integration between trades.

One employee was found using a table saw without using safety glasses. This offense came with a $1200 fine. The inspector noted the violation was corrected during inspection.

One employee was found using a table saw without using safety glasses. This offense came with a $1200 fine. The inspector noted the violation was corrected during inspection. Mark shared that his first experience with OSHA was back in 1979 when working as a project supervisor. An OSHA inspector showed up at the job site with three books under his arm. Mark said the inspector greeted him with; “You’re going to get a fine today. I’ve got three books here and I’m sure I can find something in one of them”.

Mark shared that his first experience with OSHA was back in 1979 when working as a project supervisor. An OSHA inspector showed up at the job site with three books under his arm. Mark said the inspector greeted him with; “You’re going to get a fine today. I’ve got three books here and I’m sure I can find something in one of them”.

Then, in a

Then, in a

The details: He uses his own tools and performs services in the order designated by the corporation and according to its specifications. The corporation supplies all materials, makes frequent inspections of his work, pays him on a piecework basis, and carries workers' compensation insurance on him. He does not have a place of business or hold himself out to perform similar services for others. Either party can end the services at any time.

The details: He uses his own tools and performs services in the order designated by the corporation and according to its specifications. The corporation supplies all materials, makes frequent inspections of his work, pays him on a piecework basis, and carries workers' compensation insurance on him. He does not have a place of business or hold himself out to perform similar services for others. Either party can end the services at any time. The details: A signed contract established a flat amount for the services rendered by Bill Plum. Bill is a licensed roofer and carries workers' compensation and liability insurance under the business name, Plum Roofing. He hires his own roofers who are treated as employees for federal employment tax purposes. If there is a problem with the roofing work, Plum Roofing is responsible for paying for any repairs.

The details: A signed contract established a flat amount for the services rendered by Bill Plum. Bill is a licensed roofer and carries workers' compensation and liability insurance under the business name, Plum Roofing. He hires his own roofers who are treated as employees for federal employment tax purposes. If there is a problem with the roofing work, Plum Roofing is responsible for paying for any repairs.

The press release alleges that the violations occurred while James J. Welch & Co., Inc. was acting as the general contractor performing renovations on a project at the former Frisbee School in Kittery, Maine. At the time of the renovation the Kittery site was a child-occupied facility and therefore was subject to Renovation, Repair and Painting (RRP) Rule.

The press release alleges that the violations occurred while James J. Welch & Co., Inc. was acting as the general contractor performing renovations on a project at the former Frisbee School in Kittery, Maine. At the time of the renovation the Kittery site was a child-occupied facility and therefore was subject to Renovation, Repair and Painting (RRP) Rule.  In Feb. 2012, after receiving the anonymous tip, the EPA and the Maine Department of Environmental Protection performed an inspection of the site. Based on the inspection, EPA determined that the general contractor did not ensure that a company hired as a subcontractor to replace windows at the school, New Hampshire Glass, was complying with the required work practices required under the RRP Rule.

In Feb. 2012, after receiving the anonymous tip, the EPA and the Maine Department of Environmental Protection performed an inspection of the site. Based on the inspection, EPA determined that the general contractor did not ensure that a company hired as a subcontractor to replace windows at the school, New Hampshire Glass, was complying with the required work practices required under the RRP Rule.  The nightmare both of these businesses are going through should serve as a warning for other business owners. Both general contractors and sub contractors need to know each other’s responsibilities when it comes to compliance with the RRP Rule. By understanding the rule the GC and the sub can then come to an agreement about who will do what and when they will do it to make sure that both of them are in compliance while doing the work, as well as creating and maintaining all required paperwork and documentation. If you do not already have these things under control at your business I suggest you read my September 3, 2010 RRPedia blog titled:

The nightmare both of these businesses are going through should serve as a warning for other business owners. Both general contractors and sub contractors need to know each other’s responsibilities when it comes to compliance with the RRP Rule. By understanding the rule the GC and the sub can then come to an agreement about who will do what and when they will do it to make sure that both of them are in compliance while doing the work, as well as creating and maintaining all required paperwork and documentation. If you do not already have these things under control at your business I suggest you read my September 3, 2010 RRPedia blog titled:

Several years ago I helped one of my remodeler coaching clients plan out how to offer and perform snow removal services. He called me because he realized there were a lot of things he should consider before just sending his guys out with there with shovels and axes. Below is a list of considerations from my coaching session notes created during my discussions with him. By sharing my notes my hope is that you will find them helpful, you will price the work for profit, you and your employees will be safer while performing the work, you can use the opportunity to create new customers and you will generate future work from those that hire you.

Several years ago I helped one of my remodeler coaching clients plan out how to offer and perform snow removal services. He called me because he realized there were a lot of things he should consider before just sending his guys out with there with shovels and axes. Below is a list of considerations from my coaching session notes created during my discussions with him. By sharing my notes my hope is that you will find them helpful, you will price the work for profit, you and your employees will be safer while performing the work, you can use the opportunity to create new customers and you will generate future work from those that hire you. Discussed properly equipping his employees to avoid risk and health problems. Confirmed he has fall protection equipment needed to meet OSHA requirements and employees know how to use it. Should try to do as much of the work as they can from the ground.

Discussed properly equipping his employees to avoid risk and health problems. Confirmed he has fall protection equipment needed to meet OSHA requirements and employees know how to use it. Should try to do as much of the work as they can from the ground. Look at the work as a good way to meet new clients. Because there might be more demand than he can service, be selective about who he will work for, make sure they fit within his target customer/location niche.

Look at the work as a good way to meet new clients. Because there might be more demand than he can service, be selective about who he will work for, make sure they fit within his target customer/location niche. Discourage use of Red Bull, maybe even coffee. Suggested hot chocolate and donuts.

Discourage use of Red Bull, maybe even coffee. Suggested hot chocolate and donuts. Recently there has been a lot of buzz around the remodeling and home improvement industries regarding OSHA enforcement.

Recently there has been a lot of buzz around the remodeling and home improvement industries regarding OSHA enforcement. OSHA requirements do not apply if you are the business owner and only work alone.

OSHA requirements do not apply if you are the business owner and only work alone. Below is short a list of things contractors should consider if they want to be ready when an OSHA Inspector drives by and or stops in to check out your job site.

Below is short a list of things contractors should consider if they want to be ready when an OSHA Inspector drives by and or stops in to check out your job site.